“`html

Hims & Hers Health: A Telehealth Stock with Ups and Downs

The telehealth stock Hims & Hers Health (NYSE: HIMS) has experienced significant fluctuations in 2024. Currently, the stock has fallen over 25% from its peak; however, it still boasts an impressive nearly 200% increase over the past year. The company has gained attention for offering compounded versions of GLP-1 agonists, the trending diabetes and weight loss medications addressing the obesity epidemic.

On one side, the company’s outstanding performance can lead investors to consider its potential for high returns. On the other side, uncertainty surrounds Hims & Hers Health due to ongoing debates about GLP-1 drugs, competition, and fluctuating share prices.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

So, is Hims & Hers Health a future millionaire maker, or will its 2024 success fade? Here’s what you need to know.

Beyond GLP-1 Agonists

Hims & Hers Health operates as a direct-to-consumer telehealth platform. Customers can engage in digital consultations with healthcare professionals for a variety of conditions, receive prescriptions, and have products delivered without insurance. The company has broadened its services from sexual health and hair loss to include mental health, weight loss, skincare, and beyond. Hims & Hers is also distinguishing its offerings with separate brands for men and women.

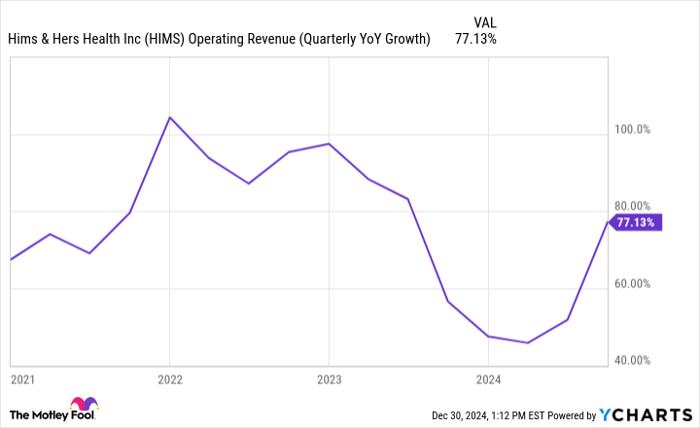

It’s noteworthy that Hims & Hers was growing successfully even before introducing GLP-1 agonists. The company has reported strong revenue growth, achieving a 45% year-over-year increase during its least productive quarter. The introduction of compounded GLP-1 products began in late May 2024, and though this has contributed to revenue growth, it’s important to highlight that subscriptions rose by 40% year over year in Q3 2024 without GLP-1s.

HIMS Operating Revenue (Quarterly YoY Growth) data by YCharts

Challenges Facing Hims & Hers

The volatility of the stock can be attributed to certain concerns. Here are the three main criticisms often mentioned:

1. There is a possibility that the FDA may restrict companies like Hims & Hers from selling compounded GLP-1 agonists. The current market opportunity arose due to a shortage, allowing for compounded alternatives when patented products are unavailable. Hims & Hers offers compounded semaglutide (Ozempic/Wegovy). Recent actions have suggested that semaglutide may soon be removed from the shortage list, similar to the removal of tirzepatide (Mounjaro/Zepbound).

2. Amazon has emerged as a formidable competitor after redesigning its online telehealth services earlier this year. With its vast resources and market presence, Amazon poses a significant challenge to Hims & Hers.

3. Some investors believe Hims & Hers lacks a competitive edge as it mainly prescribes generic medications. If cheaper options are available elsewhere, customers may leave the platform.

These criticisms are valid, but counterarguments do exist:

1. While GLP-1s are an important part of Hims & Hers, the company has established a robust business beyond these products, continuing to offer non-GLP-1 treatments for weight loss.

2. Amazon’s expansion in the healthcare sector isn’t new; its telehealth platform was launched in 2022, and it hasn’t yet hindered Hims & Hers. Overall, the healthcare market is vast and could potentially accommodate multiple successful companies.

3. Hims & Hers is personalizing medication by customizing dosages and combining products. This tailored approach may help retain patients, even if the base medications are generic. As of Q3 2024, more than half of their subscribers have transitioned to personalized treatments.

Positive Numbers Support Long-Term Potential

The data tells an encouraging story: Hims & Hers continues to grow rapidly and became profitable according to GAAP standards this year.

HIMS Revenue (TTM) data by YCharts

Growth may slow if regulators limit compounded GLP-1 offerings, but it’s crucial to focus on the overall picture. Even without GLP-1 agonists, Hims & Hers expanded its subscriber base by 40% in Q3, reaching 2 million subscribers. With approximately 258 million adults in the U.S., subscriber growth and variety in products could significantly drive revenue in the future.

Astoundingly, the company’s market cap sits below $6 billion, with a price-to-sales ratio of 4.6. In contrast, tech stock Palantir trades at an impressive 70 times sales. While Hims & Hers may not warrant that level of valuation, this discrepancy indicates a tough reception on Wall Street compared to other stocks.

However, if Hims & Hers Health continues delivering strong results, it may have significant upside potential.

Is Investing $1,000 in Hims & Hers Health a Good Idea Right Now?

Before making any investment in Hims & Hers Health, you should consider this:

The Motley Fool Stock Advisor analyst team has determined their top 10 best stocks for investors to buy right now, and Hims & Hers Health did not make the list. The stocks selected present promising potential for growth in the coming years.

For instance, Nvidia was added to this list on April 15, 2005. If you invested $1,000 at that recommendation, you’d now have $842,611!*

Stock Advisor offers investors clear guidance on building a successful portfolio, providing regular analyst updates and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has positions in Hims & Hers Health. The Motley Fool has positions in and recommends Amazon and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`