Nvidia Soars Past Apple: A New Era for Semiconductor Dominance

Nvidia (NASDAQ: NVDA) has recently surpassed Apple to claim the title of the world’s largest company in market capitalization. This monumental shift comes as Nvidia continues to showcase remarkable growth, driven largely by surging demand for its chip systems that are essential in the evolution of artificial intelligence (AI).

At present, Nvidia boasts a market cap of approximately $3.6 trillion. Analysts anticipate that the company’s momentum will persist, forecasting a staggering 57% annual growth in earnings over the next five years. This raises the question: Can Nvidia sustain this impressive trajectory and achieve a $5 trillion valuation by 2028?

Nvidia’s Pricing Advantage Fuels Its Growth

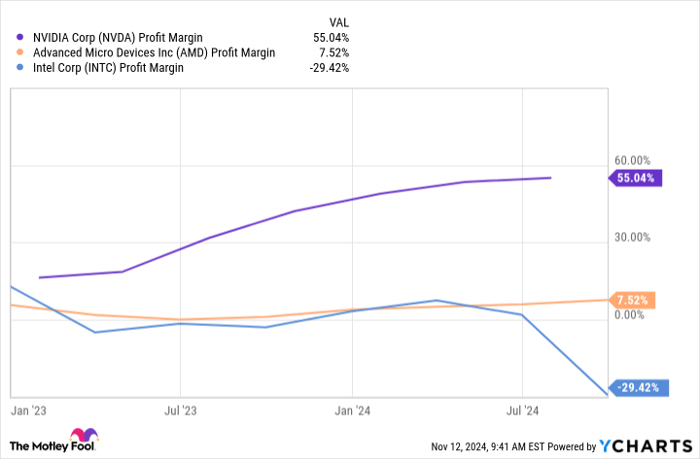

Nvidia may be categorized as a hardware manufacturer, but its profit margins have seen remarkable enhancement since 2023. Comparatively, Nvidia’s profit margins significantly outperform those of competitors such as Advanced Micro Devices and Intel.

NVDA Profit Margin data by YCharts

The increase in Nvidia’s profitability largely stems from its strong pricing power in the AI graphics processing unit (GPU) market, where it holds a commanding market share of roughly 95%. A recent report from Citi disclosed that Nvidia’s popular H100 AI GPUs are priced at four times that of its competitor AMD’s MI300X AI accelerator.

To be more precise, Nvidia prices its H100 GPUs between $30,000 and $40,000, while AMD’s equivalent model ranges from $10,000 to $15,000. This substantial premium can be attributed to the intense demand for the H100, with waiting periods that once extended to eight to eleven months before easing to three to four months this year.

The shortening of wait times is linked to enhancements in advanced chip packaging capacity from Nvidia’s foundry partner, Taiwan Semiconductor Manufacturing (TSMC). TrendForce reported that Nvidia accounts for 40% to 50% of TSMC’s advanced packaging capabilities.

Moreover, Nvidia’s control over the supply chain is likely to expand, as the company reported $26.3 billion in data center revenue in the last quarter (Q2 of fiscal year 2025, ending July 28, 2024). In stark contrast, AMD only made $3.5 billion in its data center segment for Q3 of 2024. This disparity implies that TSMC might be offering more production capacity to Nvidia than previously estimated.

Furthermore, AMD’s guidance for data center GPU revenues for 2024 pales compared to Nvidia’s potential. This dynamic positioning enables Nvidia to maintain higher prices and generate substantial data center revenues, driven by consumer willingness to pay for superior performance.

For instance, Nvidia’s new Hopper flagship processor, the H200, reportedly surpasses AMD’s MI300X by over 40% in AI inference capabilities. Such performance advantages justify Nvidia’s premium pricing over rivals like AMD.

Looking ahead, Nvidia is poised to further push performance boundaries with its Blackwell series of AI GPUs, anticipated to be four times faster than Hopper chips. Market speculation suggests Nvidia will price its Blackwell GB200 superchips between $50,000 and $70,000, according to insights from Japanese investment bank Mizuho.

This impressive pricing power positions Nvidia to sustain exceptional earnings growth in the upcoming years. But is this sufficient for the company to reach a $5 trillion market cap?

Charting a Course to a $5 Trillion Valuation

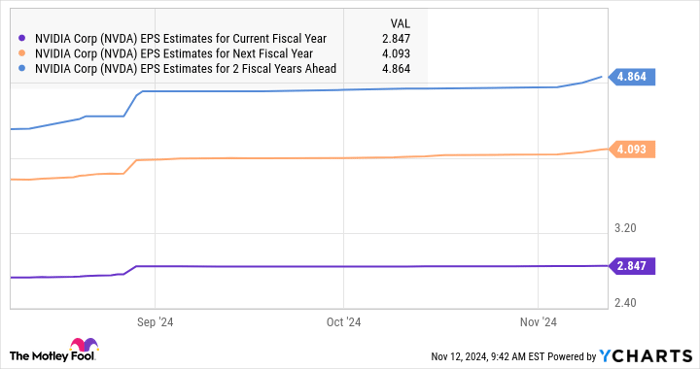

Nvidia concluded fiscal 2024 with earnings of $1.19 per share. Current projections indicate that earnings per share (EPS) could climb to $4.84 by fiscal 2027, marking a nearly 60% compound annual growth rate (CAGR) over this period.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

If we consider a conservative earnings growth rate of 20% for fiscal years 2028 and 2029, EPS could potentially reach $6.97 four years from now. Notably, Nvidia’s fiscal 2029 will overlap with eleven months of calendar year 2028. Should the company meet the $6.97 per share target and trade at 30.7 times forward earnings (mirroring the tech-heavy Nasdaq-100 index), its stock price might rise to $214.

This would represent a 48% increase from current levels, sufficient to elevate Nvidia’s market cap to $5 trillion based on its existing valuation. Additionally, Nvidia could achieve this target sooner if it continues to deliver rapid earnings growth, an outcome that remains possible given its strong market presence and the bright future of the AI chip sector.

A Timely Investment Opportunity Awaits

Do you think you missed the chance to invest in top-performing stocks? If so, you’ll find this news interesting.

Occasionally, our team of expert analysts identifies a special “Double Down” stock recommendation for companies poised for a significant rise. If you worry you’ve missed your chance, now is the perfect time to buy before it’s too late. The numbers tell a compelling story:

- Amazon: $1,000 invested back in 2010 would now be worth $24,113!*

- Apple: a $1,000 investment in 2008 has grown to $42,634!*

- Netflix: if you had put in $1,000 in 2004, you would currently hold $447,865!*

Presently, we are issuing “Double Down” alerts for three remarkable companies, and this opportunity may not come again soon.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Citigroup is an advertising partner of Motley Fool Money. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.