“`html

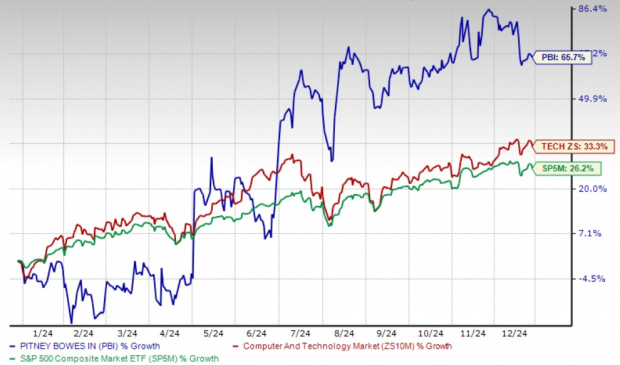

Pitney Bowes (PBI) shares have skyrocketed by 65.7% this year, outperforming both the Zacks Computer and Technology sector’s 33.3% increase and the S&P 500’s 26.2% gain. With such impressive results, investors are left pondering whether to invest further in PBI or to exercise caution.

PBI Price Trends: A Year of Growth

Image Source: Zacks Investment Research

Pitney Bowes Takes Action: Selling Off Global Ecommerce

For some time, Pitney Bowes faced challenges with the underperformance of its Global Ecommerce (GEC) segment. Despite significant investments, including acquiring Borderfree in 2015 and Newgistics in 2017, the GEC business thrived during the COVID pandemic but struggled afterward due to lower package volumes and stiff competition.

Seeing GEC as a liability, the company has opted to divest this segment. The sale to Hilco Global, expected to conclude in early 2025, could add $136 million to annual earnings. This strategic move will allow Pitney Bowes to focus on more profitable ventures and streamline operations.

Pitney Bowes Shows Financial Strength

Pitney Bowes is actively addressing its long-term debt and improving liquidity. Recently, the company brought back $117 million from overseas operations, resulting in over $100 million in excess cash, which will aid in debt reduction and boost financial flexibility.

Meanwhile, cost-cutting efforts have yielded significant results, with $90 million in annualized savings already achieved from its SendTech and Presort divisions since early 2024. Management remains optimistic about achieving total cost savings between $150 million and $170 million this year, reflecting a commitment to operational efficiency.

In terms of recovery, the company projects earnings before interest and tax (EBIT) for 2024 to fall between $355 million and $360 million, suggesting improved profitability. Moreover, the Zacks Consensus Estimate shows year-over-year earnings growth of 850% for 2024 and 184% for 2025.

Image Source: Zacks Investment Research

Additionally, the consensus estimate for 2024 earnings has increased by three cents to 38 cents per share over the past two months, while the 2025 estimate rose by three cents to $1.08 just recently.

Strong Partnerships Enhance PBI’s Growth Potential

Pitney Bowes boasts an extensive customer roster, serving over 90% of Fortune 500 companies. Its partnerships with major players like Amazon (AMZN), eBay (EBAY), Shopify, and Salesforce (CRM) reinforce its stature in the logistics and technology industries.

For instance, Pitney Bowes assists eBay with cross-border e-commerce logistics in both the U.S. and U.K. markets. Their long-standing collaboration with Amazon Web Services (AWS) and membership in the AWS Solution Provider Network signify a strong ability to use advanced technologies.

Moreover, Pitney Bowes and Salesforce are connected through the latter’s Shipping API Partner Program. These affiliations not only diversify revenue streams but also support long-term growth aspirations.

Pitney Bowes Offers an Attractive Valuation

Currently, Pitney Bowes trades at a forward 12-month price-to-sales (P/S) ratio of 0.67X, significantly lower than the tech sector average of 6.47X. This indicates that the stock is trading at a substantial discount, creating a favorable opportunity for value-oriented investors.

Image Source: Zacks Investment Research

Final Thoughts: Consider Buying PBI Now

Pitney Bowes stands at a crucial turning point. With strategic realignments and ongoing cost-cutting measures, the company looks poised for sustained growth. The sale of its GEC segment, alongside financial discipline and strong partnerships, sets the foundation for long-term profitability.

Given its impressive financial recovery, attractive stock price, and optimistic growth outlook, Pitney Bowes presents a strong investment opportunity. Investors keen on benefiting from this transformation might want to consider adding PBI to their portfolios. Currently, PBI holds a Zacks Rank #1 (Strong Buy). You can check out the complete list of today’s Zacks #1 Rank stocks here.

Zacks Names Top 10 Stocks for 2025

Interested in getting early access to our 10 top picks for 2025?

Historical performance shows they could deliver outstanding results.

Since 2012, when our Director of Research Sheraz Mian took over this portfolio, the Zacks Top 10 Stocks generated gains of +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Now, Sheraz is reviewing 4,400 companies to select the best 10 stocks to buy and hold for 2025. Don’t miss the chance to get these stocks when they are announced on January 2.

Be the first to know about the new Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Pitney Bowes Inc. (PBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`