Tesla’s Ambitious Robotaxi Plans Spark Skepticism Among Investors

Tesla’s (NASDAQ:TSLA) recent reveal of its Robotaxi plans was filled with excitement but lacked substantial details. This uncertainty has led to a notable 15% decline in Tesla’s stock for the month of October. Many investors are questioning whether the company’s promised self-driving Cybercab and the newly introduced Cybervan, along with the Optimus robot that Elon Musk described as “the biggest product ever,” will truly change the transportation landscape.

Interestingly, a report from Bloomberg highlighted that during the reveal event, Tesla had humans remotely controlling some functions of the Optimus robot prototypes.

Given these circumstances, it is easy to see why some may harbor doubts about Musk’s grand ambitions.

Even analysts who typically support Tesla, like Canaccord’s George Gianarikas, acknowledged the event’s shortcomings.

“Let’s be critical for a moment,” Gianarikas noted. “We understand the skepticism. The details were minimal, and we question the timeline. We are skeptical about the Robotaxi launching by 2026 and are not fully convinced that Tesla’s camera-only approach will prove effective anytime soon.”

Despite his concerns, Gianarikas remains optimistic about Tesla’s overall strategy. He urges investors to keep faith, referring to recent achievements by SpaceX as a sign of the company’s potential.

He emphasizes that Tesla is focused on long-term growth across four key markets: electric vehicles, artificial intelligence and autonomy, robotics, and energy storage. Each sector has substantial total addressable markets (TAM) where Tesla aims to be a dominant player.

“The event may have seemed lacking, yet it served as a modern introduction to Tesla’s future in robotics, signaling its ongoing developments to the world,” Gianarikas reassured. “Investors should look beyond the flashy presentation to understand the company’s true potential.”

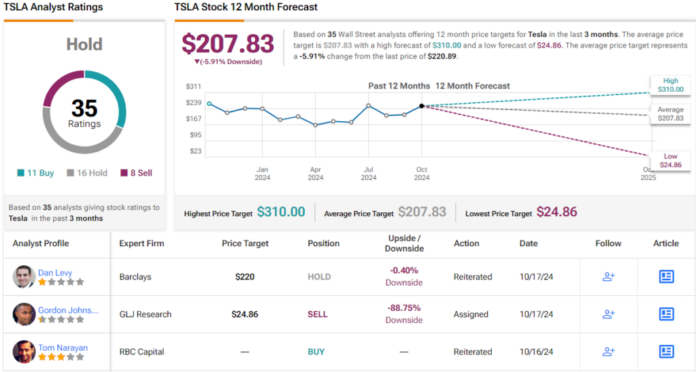

In light of this, Gianarikas maintains a Buy rating on Tesla shares, with a price target of $254. This suggests a potential upside of 15% from current stock levels. (To view Gianarikas’s performance record, click here.)

Looking at the broader market, 10 other analysts also view TSLA positively, although they are balanced by 16 Hold ratings and 8 Sell ratings, resulting in a consensus Hold rating. The average price target for Tesla currently sits at $207.83, indicating a potential decline of about 6%. (See Tesla stock forecast)

For investors seeking favorable stock opportunities at attractive valuations, TipRanks’ Best Stocks to Buy tool combines comprehensive equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended for informational purposes only. It is crucial to conduct your own analysis before making any investment decisions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.