Sarepta Therapeutics Gets a Boost from Cantor Fitzgerald Upgrade

Analyst Predicts Significant Price Growth

On November 7, 2024, Cantor Fitzgerald raised its rating for Sarepta Therapeutics (NasdaqGS:SRPT) from Neutral to Overweight. This upgrade is rooted in optimism about the company’s financial potential.

Price Target Indicates 61.83% Upside Potential

As of October 22, 2024, analysts estimate a one-year price target for Sarepta Therapeutics at $194.88 per share. These predictions fluctuate between a low of $148.59 and a high of $231.00. This average represents a potential increase of 61.83% from the company’s latest closing price of $120.42 per share.

Check out our leaderboard for companies with the highest price target upside.

Sarepta’s projected annual revenue is $2,022 million, showing a significant rise of 23.27%. The anticipated annual non-GAAP earnings per share (EPS) is $2.68.

Insight into Fund Sentiment

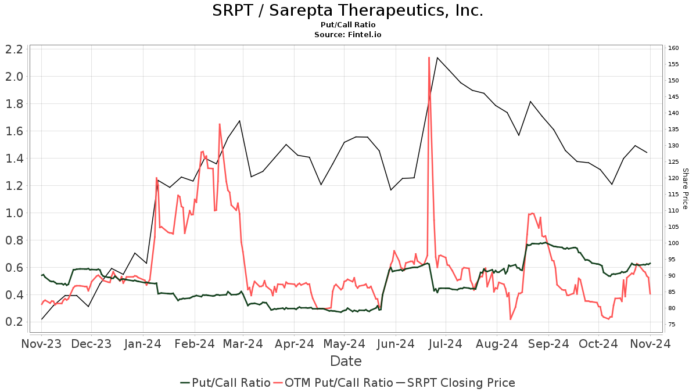

A total of 1,028 funds and institutions hold positions in Sarepta Therapeutics, marking an increase of 119 owners or 13.09% in the last quarter. The average portfolio weight of funds allocated to SRPT is 0.34%, up by 10.11%. Over the last three months, the total shares owned by institutions grew by 8.17%, amounting to 105,473,000 shares.  The put/call ratio for SRPT stands at 0.63, which indicates a bullish sentiment among investors.

The put/call ratio for SRPT stands at 0.63, which indicates a bullish sentiment among investors.

Activity of Other Shareholders

Capital International Investors owns 4,321,000 shares, representing 4.53% of the company. Previously, they held 4,818,000 shares, which shows a decrease of 11.50%. However, they increased their allocation in Sarepta by 11.30% over the last quarter.

Janus Henderson Group, with 3,815,000 shares, holds a 4.00% interest. Their previous filing revealed ownership of 4,891,000 shares, indicating a decline of 28.20%, and they cut their share allocation in SRPT by 63.07% recently.

Avoro Capital Advisors has decreased its ownership from 4,344,000 shares to 3,000,000 shares, a drop of 44.81%, while also lowering its portfolio allocation by 3.77% last quarter. Additionally, the IJH – iShares Core S&P Mid-Cap ETF holds 2,940,000 shares (3.08%), and the VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 2,851,000 shares, showing a slight increase of 1.93% from their last report.

Background on Sarepta Therapeutics

(Company-provided description)

Sarepta Therapeutics Inc. is committed to advancing precision genetic medicine. The company focuses on developing treatments for rare diseases, particularly Duchenne muscular dystrophy (DMD), with over 40 programs underway in areas including gene therapies for limb-girdle muscular dystrophies and other disorders. Their research and programs span various therapeutic methods such as RNA, gene therapy, and gene editing.

Fintel offers a robust investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

The platform encompasses comprehensive data including fundamentals, analyst insights, ownership details, fund sentiment, options trends, and much more. Fintel’s stock picks are driven by advanced, backtested quantitative models designed to enhance investor profits.

Click to Learn More

This article first appeared on Fintel.

The views expressed here are those of the author alone and do not necessarily represent those of Nasdaq, Inc.