Gold’s Decline: Short-Term Setbacks Amid Long-Term Promises

Understand the realities as government spending rises and debt surges globally.

Gold prices are facing immediate challenges but may rebound in the future.

Let’s break this down beginning with the current decline.

Gold Hits New Highs Only to Drop Nearly 7%

Gold recently reached an all-time high at the end of October, but it has since plummeted almost 7% shortly after President Trump’s reelection. This decline stems from shifts in the market tied to expectations that Trump’s policies will lead to heightened inflation and greater government spending.

During his campaign, Trump emphasized plans like reducing corporate taxes from 21% to 15% and cutting regulations that have slowed market growth. While these may improve business conditions, they also increase concerns about inflation.

Adding to this worry, Trump aims to impose new tariffs on imports from China and Europe. These tariffs are designed to protect American businesses but will raise prices on imported goods, which could fuel inflation for consumers in the U.S.

Consequently, the market anticipates that as business activity ramps up due to tax cuts and deregulation, inflation will inevitably rise. Investors have responded by selling bonds, which lowers bond prices and increases yields, while also bolstering the U.S. dollar’s value.

Gold, which does not yield any income, sees diminished appeal in this scenario. Higher treasury yields and a stronger dollar create significant obstacles for gold’s value.

Global Economic Trends Favor Gold

Now shifting to the global landscape, investors should look at the ramifications of domestic policies. As mentioned, Trump’s proposed tax reductions would considerably decrease government revenue. At the same time, plans to deport millions could incur heavy costs.

The Committee for a Responsible Federal Budget estimates that Trump’s agenda could increase the federal deficit by $7.75 trillion over the next decade. This situation emerges when the government is already in a precarious position, with a fiscal deficit hitting $1.83 trillion in fiscal year 2024, a historic high.

What are the probable consequences?

Rising Debt Levels Highlight Future Concerns

With expenses outweighing income due to tax cuts, the government is likely to increase debt to cover its financial shortfalls.

This borrowing could be sourced from public institutions or increased money supply through open market operations, which have caused inflationary pressure for years. More money in circulation typically lowers the purchasing power of the currency.

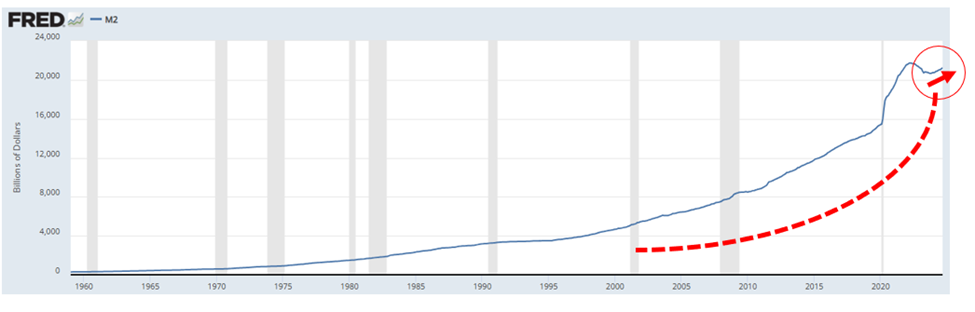

The chart below illustrates the growth of the M2 money stock since 1960, indicating an exponential trend that raises concerns about savings power:

Source: Federal Reserve data

This trend is troubling for the future value of savings, making gold a potentially vital asset for preservation against inflation.

A Historical Perspective on Gold’s Purchasing Power

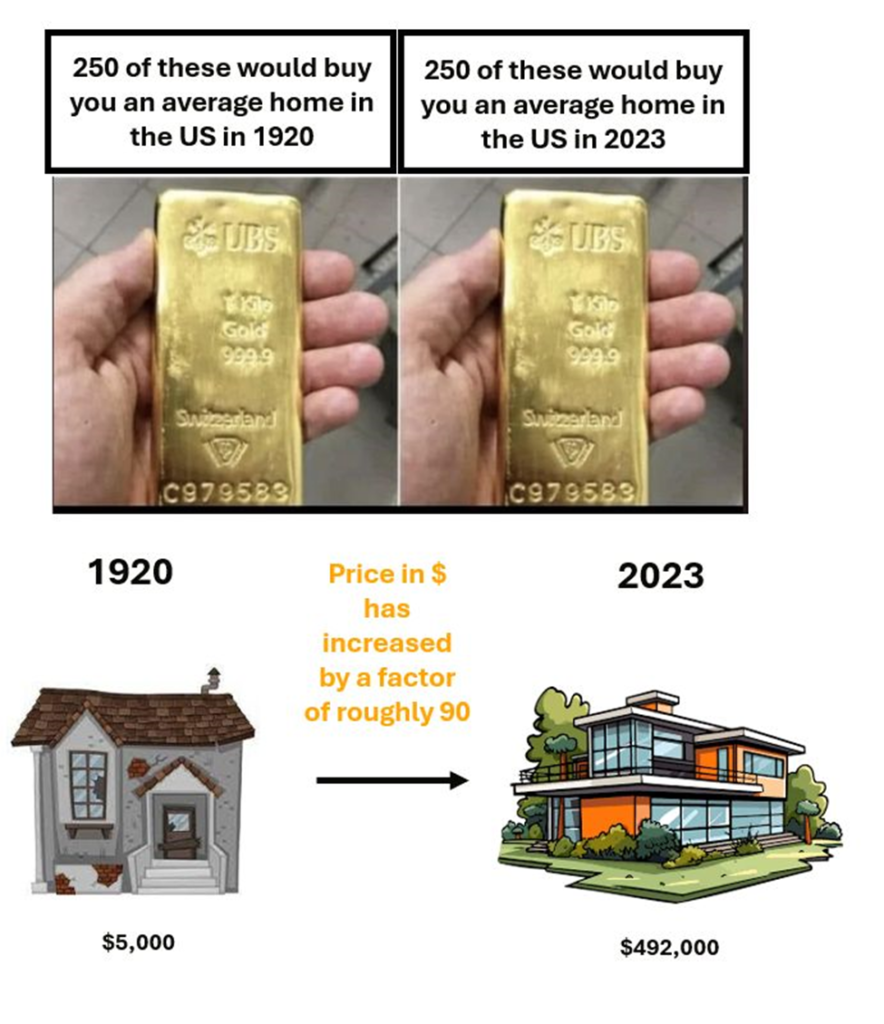

The rising cost of homes has rendered them unaffordable for many aspiring buyers. However, when assessing value through the lens of gold, the narrative shifts.

In our previous discussions, we showcased how gold has historically safeguarded purchasing power compared to real estate. Although the specific figures may have changed, the core message remains clear.

For instance, back in March, gold averaged $20.68 per ounce in 1920 and is now worth about $2,100 per ounce—a massive increase. By contrast, the average home price in the U.S. was between $5,000 and $6,000 in 1920, compared to around $492,000 today, both equating to roughly an 80x to 100x increase.

Gold Remains Steadfast Amid Global Debt Crisis

Understanding the Value of Gold in Today’s Economy

Source: Charles-Henry Monchau

Isn’t it interesting how gold has maintained its purchasing power over the years? A comparison over the decades shows that where gold could purchase a house in 1920, it can still do so today. This rich history highlights gold’s enduring value.

However, the dollar tells a different story. To match the purchasing power of $100 in 1920, you would now need $1,576.50. That is a remarkable 94% decline in the dollar’s strength over 104 years.

A Broader View of Global Debt

The United States is not alone in facing significant fiscal challenges. According to a recent report from the International Monetary Fund, global public debt is projected to exceed $100 trillion by year’s end. This accounts for roughly 93% of the global gross domestic product (GDP) and is forecasted to approach 100% of GDP by 2030. This is a substantial increase from the levels seen in 2019, prior to the pandemic.

Significantly, these debt forecasts could fall short, highlighting a historical trend where actual debt levels five years out may exceed estimates by 10 percentage points on average.

These rising debt levels have prompted central banks worldwide to increase their gold reserves. In 2022, central banks collectively purchased a record 1,082 tonnes of gold and nearly matched that in 2023 with 1,037 tonnes. Expectations for 2024 suggest a new all-time high in gold purchases is on the horizon.

MarketWatch noted the impact of these purchases on gold prices with insights from Torsten Slok, the chief economist at Apollo Global Management. He explained that central banks are diversifying their reserves away from U.S. Treasurys due to concerns about the U.S. fiscal outlook. Joe Cavatoni, a senior strategist at the World Gold Council, added that central banks are the leading story in the gold market over the past two years.

In summary, the global financial landscape is heavily burdened by debt. Central banks are responding by increasing their gold reserves while simultaneously facing the challenges of rampant money printing.

Looking Ahead: What This Means for Gold

In the near term, gold may experience some challenges. Rising treasury yields and a strong dollar have led investors to favor riskier assets, which has resulted in significant outflows from gold. Investors should brace for a period of adjustment.

Nevertheless, the financial outlook remains bleak both nationally and internationally. With increased debt spending and continued currency debasement, the potential for geopolitical conflicts could emerge—factors that typically support gold prices.

Therefore, while it is essential to explore opportunities in top technology sectors such as AI and quantum computing, do not underestimate gold’s significance. It serves as a safeguard for your savings in an era of substantial debt, inflation, and currency challenges. Watch for potential sell-offs in gold as prospects for buying may arise.

Best wishes,

Jeff Remsburg