As the new administration takes shape, investors are keenly adjusting their strategies—in particular, seizing opportunities in bond markets, including a standout 8.8% payer discussed below.

Brace for Economic Changes: “Bond Vigilantes” May Make a Return

You might be wondering, “Are we really buying bonds now?” Many analysts predict rising inflation and interest rates under the new administration. This raises valid concerns.

Typically, when interest rates rise, the value of bonds falls. This dynamic holds true for bond markets. A wave of tariffs, potential mass deportations, and a current federal deficit of $2 trillion suggest inflation pressures are building. Clearly, politicians are unlikely to address these economic hurdles quickly.

Due to these factors, many experts expect a resurgence of the “Bond Vigilantes”—investors prepared to sell Treasuries in protest against governmental policies, leading to higher yields on 10-year Treasury notes, along with increased interest obligations for the government.

Historically, the influence of bond markets has instilled fear in governments. As James Carville, known as the “Ragin’ Cajun,” aptly expressed:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

This sentiment explains the current disdain for bonds—and why contrarian investors are taking note.

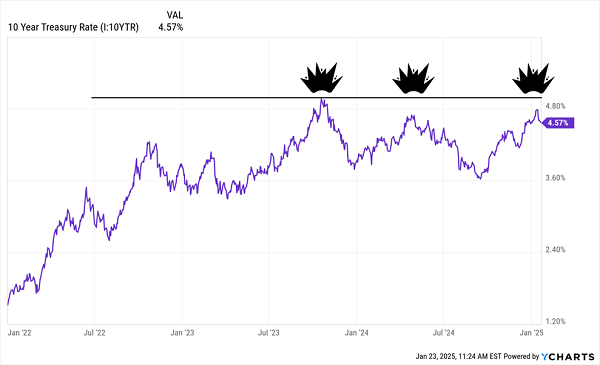

Is There a 5% Ceiling on Interest Rates?

While it’s possible that interest rates may rise, experts like myself believe the idea of soaring Treasury rates is premature.

Currently, I see a solid 5% “ceiling” on 10-year Treasury rates. The reasoning connects back to Federal Reserve Chair Jay Powell, who recently reduced interest rates by a quarter-point and revised forecasts for future cuts from four to just two in 2025.

Interestingly, even as the Fed cut rates, yields on 10-year Treasuries spiked, sending a clear message that inflation concerns remain unresolved.

It appears Powell is beginning to heed this warning. As a result, this might effectively cap the 10-year yield. Such a scenario would take Wall Street by surprise.

The Fed’s recent pause can help reinforce the 5% ceiling on rates, suggesting a potential decline in inflation trends. Consequently, current long-term yields might be more than adequate. I doubt we will see a dramatic breaking of this ceiling, contrary to prevailing market sentiment.

Bonds: A Promising Investment Opportunity

As more investors recognize this potential, opportunities in the bond market will increase.

A compelling choice is a high-yield closed-end fund (CEF), specifically the DoubleLine Yield Opportunities Fund (DLY), which I recommend in my Contrarian Income Report.

Highlighting an 8.8% Dividend Yield

DLY benefits from the expertise of its lead manager, Jeffrey Gundlach, often referred to as the “Bond God,” whose predictions have proven accurate over time.

Historically, Gundlach accurately anticipated the 2008/2009 financial crisis, Trump’s surprise victory in 2016, and the market tumult in 2022.

His strategy involves a portfolio comprising over 72% below-investment-grade and unrated bonds. This approach may seem risky, but these areas often provide the best opportunities. Institutional investors can’t own these lower-rated securities, creating more opportunities for individual investors.

Furthermore, Gundlach’s extensive industry connections provide an edge in accessing promising new issues, which is crucial in the bond market.

Moreover, we advocate for investing in CEFs rather than ETFs. Algorithm-driven ETFs are simply unable to capitalize on unique opportunities like those offered by DLY, which has significantly outperformed the SPDR Bloomberg High Yield Bond ETF (JNK) over the past year:

Gundlach’s Performance Outshines Algorithms

DLY also offers consistent monthly payouts, having started distributions in early 2020. Despite the challenging timing, this allowed Gundlach to acquire high-quality assets at lower prices.

Additionally, the fund awarded two special distributions at the end of both 2023 and 2024:

Reliable Monthly Payments Plus Bonuses

Source: Income Calendar

With an average bond duration of 3.2 years, DLY can benefit from ongoing high yields even after the Fed begins cutting rates. This duration also provides flexibility for Gundlach to adapt if rates increase unexpectedly. Currently, the fund employs 17.5% leverage, effectively balancing risks and enhancing returns.

Lastly, DLY is trading at a modest premium of less than 1%. While purchasing funds at a premium is generally not advisable, the excessive anxiety surrounding rates might lead to increased investor interest, ultimately widening this premium.

Maximize Your Income with an 11% Dividend Payer

DLY presents a strong contrarian opportunity amid inflation fears, boasting an 8.8% yield.

However, investors can amplify their returns by pairing DLY with another bond CEF, currently yielding an impressive 11%. This fund offers monthly payouts, making your financial strategy even more robust.

Every $100,000 invested eases into $11,000 in annual dividends—doubling that amount yields $22,000. Invest $500,000, and you could secure a significant $55,000 in yearly payouts, edging closer to financial independence.

With monthly distributions, the next payout is always around the corner.

Thus, I strongly encourage all investors to explore this remarkable 11% dividend payer now. Delaying could mean missing out on substantial income opportunities.

Click here to discover this high-yield investment and access a free Special Report unveiling more details.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.