CarMax Surpasses Earnings Expectations in Q3 of Fiscal 2025

CarMax Inc. (KMX) reported its adjusted earnings per share for the third quarter of fiscal 2025, which concluded on November 30, 2024. The company achieved earnings of 81 cents per share, exceeding the Zacks Consensus Estimate of 62 cents. This figure also marked an increase from last year’s 52 cents per share. CarMax’s total revenues for the quarter reached $6.22 billion, surpassing the Zacks Consensus Estimate of $5.99 billion and reflecting a year-over-year growth of 1.2%.

Stay updated with quarterly releases: Check the Zacks Earnings Calendar.

Insights on Financial Performance

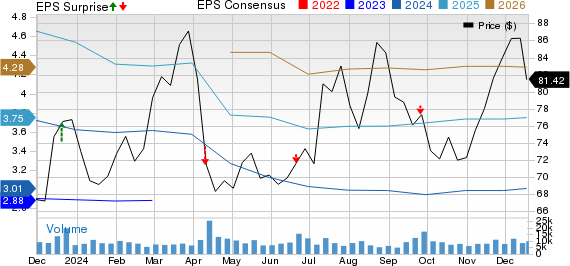

CarMax, Inc. price-consensus-eps-surprise-chart | CarMax, Inc. Quote

Exploring Segment Performance

In the reported quarter, CarMax’s used-vehicle net sales reached $4.89 billion, marking a 1.2% increase compared to the previous year. This growth was driven by a 5.4% rise in unit sales, totaling 184,243 vehicles, which surpassed our forecast of 172,504 units. However, the average selling price (ASP) of used vehicles decreased by 3.9% from last year, settling at $26,153 and missing our projection of $26,788. Despite these challenges, the revenues from this segment exceeded our expectation of $4.62 billion.

Comparable store used-vehicle units rose by 4.3%, with revenues increasing by 0.5% year over year. The used-vehicle gross profit per unit (GPU) reached $2,306, slightly higher than the previous year’s $2,277, aligning with our estimate.

Wholesale vehicle revenues increased by 0.3% year on year, totaling $1,168.6 million, though it fell short of our projection of $1,171.5 million due to lower unit sales and ASPs. Units sold in this category went up by 6.3% to 136,013, compared to our estimate of 137,506. However, the ASP dropped by 5.7% to $8,177, below our estimate of $8,520. The wholesale vehicle GPU was reported at $1,015, an increase from $961 last year but below our projected figure of $1,028.3.

Other sales and revenues saw a significant rise of 9.7% year over year to $165.9 million, surpassing our anticipated $162.6 million. Additionally, CarMax Auto Finance income grew by 7.6% year over year, amounting to $159.9 million at the end of the fiscal third quarter.

Selling, general, and administrative expenses rose by 2.8% from last year, totaling $575.8 million. As of November 30, 2024, CarMax reported cash and cash equivalents of $271.9 million alongside long-term debt of $1.59 billion.

During the fiscal third quarter, CarMax repurchased shares valued at $114.8 million. As of the same date, the company has $2.04 billion remaining under its share repurchase authorization.

CarMax’s Market Position and Comparisons

Currently, KMX holds a Zacks Rank of #2 (Buy).

Notable competitors in the auto sector include Dorman Products, Inc. (DORM), Tesla, Inc. (TSLA), and Blue Bird Corporation (BLBD), each carrying a Zacks Rank of #1 (Strong Buy) at this time. The Zacks Consensus Estimate indicates that DORM’s sales and earnings for 2024 will experience year-over-year growth of 3.66% and 51.98%, respectively. Additionally, EPS estimates have improved by 75 cents and 88 cents for 2024 and 2025, respectively, over the last 60 days.

Similarly, TSLA’s 2024 sales are expected to grow by 3.36%, with EPS estimates increasing by 22 cents in the same timeframe. For BLBD, the consensus estimates for fiscal 2025 suggest robust growth of 10.97% for sales and 12.14% for earnings, with EPS estimates improving by 18 cents in the last 30 days.

Zacks Identifies Top Stocks for 2025

Interested in early access to Zacks’ top 10 stock picks for 2025?

Recent history shows promising performance. Since 2012, when Sheraz Mian took charge of the portfolio, Zacks’ Top 10 Stocks have increased by +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 companies to select the top 10 stocks to buy and hold in 2025. Make sure to look for the release on January 2.

Be the first to discover the Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

CarMax, Inc. (KMX): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Blue Bird Corporation (BLBD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.