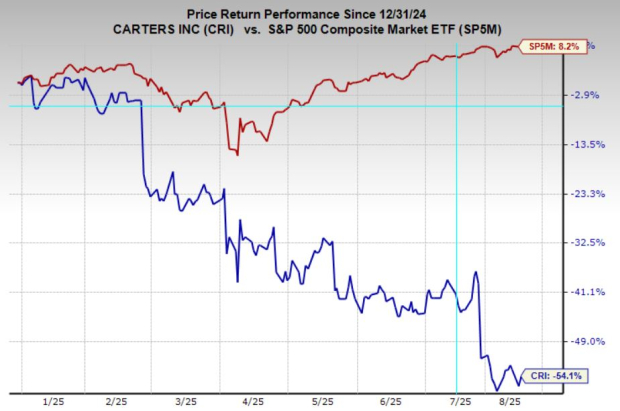

Carter’s, Inc. (CRI) is facing significant financial challenges, with first-quarter 2025 sales down 4.8% year-over-year due to declines in its U.S. Retail, U.S. Wholesale, and International segments. Declining consumer confidence, high inflation, and tariff uncertainties are further impacting the company’s operations. Analysts have cut earnings estimates for the current quarter by 13.3% and for full-year 2025 by 4.2%, resulting in a Zacks Rank of #5 (Strong Sell).

Moreover, sales projections indicate a further 1.7% decline in 2025, followed by a modest 0.9% rebound in 2026. With continued macroeconomic pressures and diminishing margins—gross margin down 140 basis points and operating income down 35.7%—Carter’s appears to be struggling to regain investor confidence.

Investors are advised to exercise caution, as the outlook remains sluggish and signs of recovery are limited, suggesting that CRI is likely to face ongoing financial pressure.