Blockchain

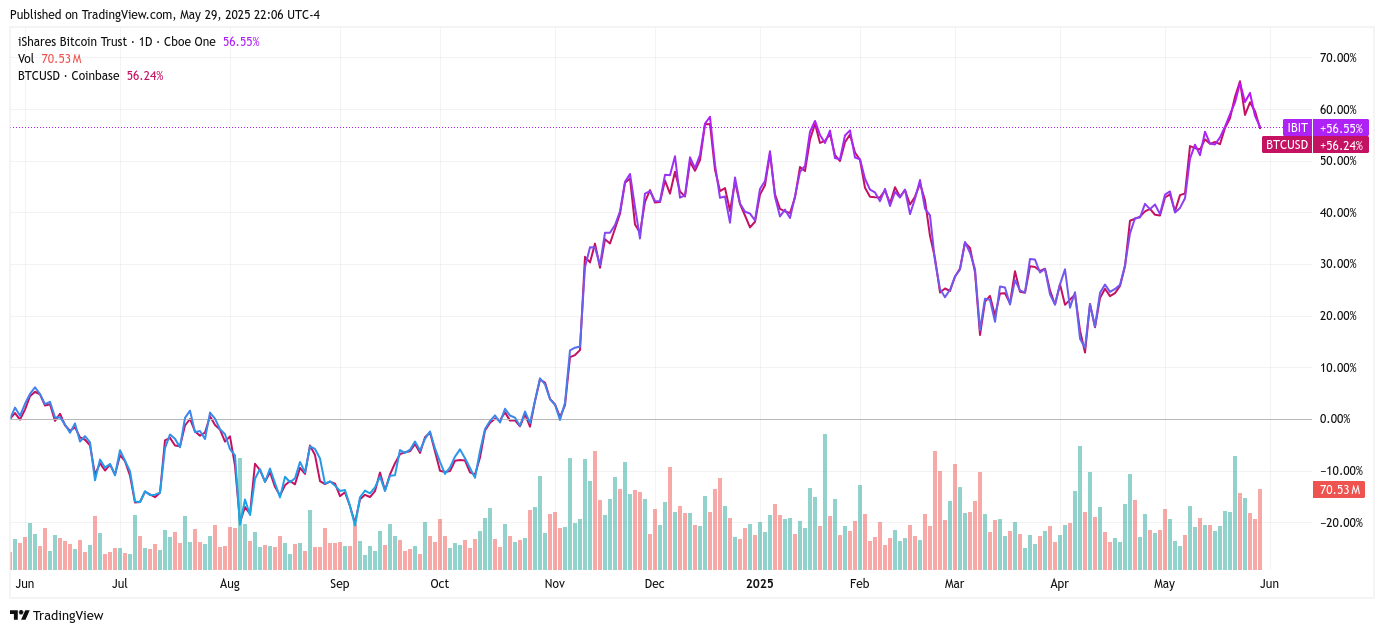

Stocks to Steer Clear of Amid Decreasing Crypto Enthusiasm

As of October 2025, the cryptocurrency market is experiencing significant downturns, with Bitcoin poised for its worst annual performance since 2022. After peaking at ...

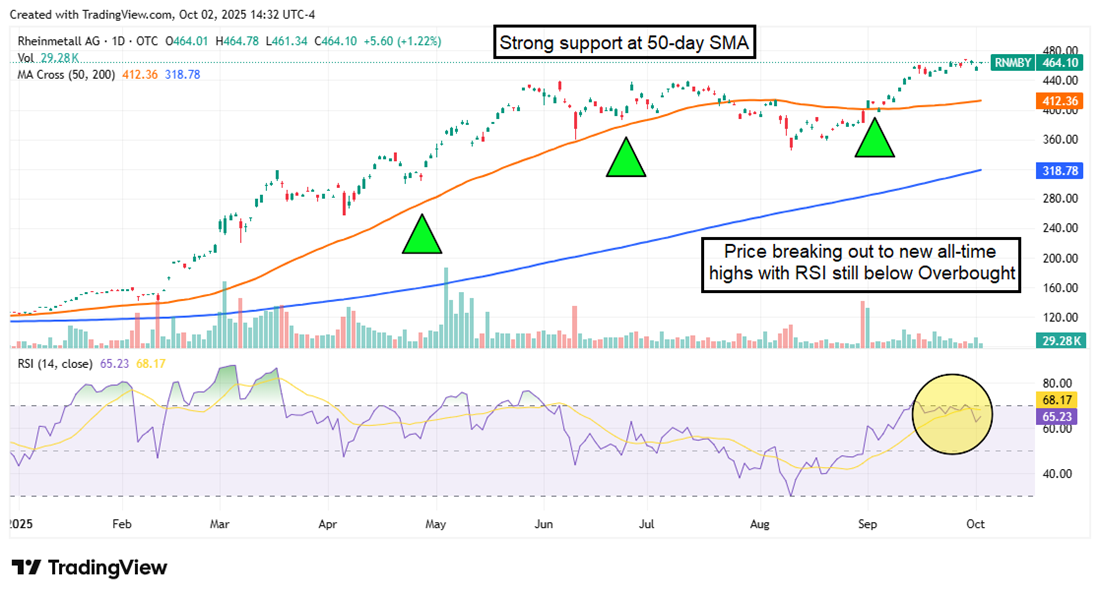

Top Defense Stocks to Watch Amid Escalating Ukraine Conflict

“`html European defense stocks are experiencing significant growth as the war in Ukraine approaches its fourth anniversary. Notably, Rheinmetall AG has seen its shares ...

August 2025: Insights and Future Perspectives

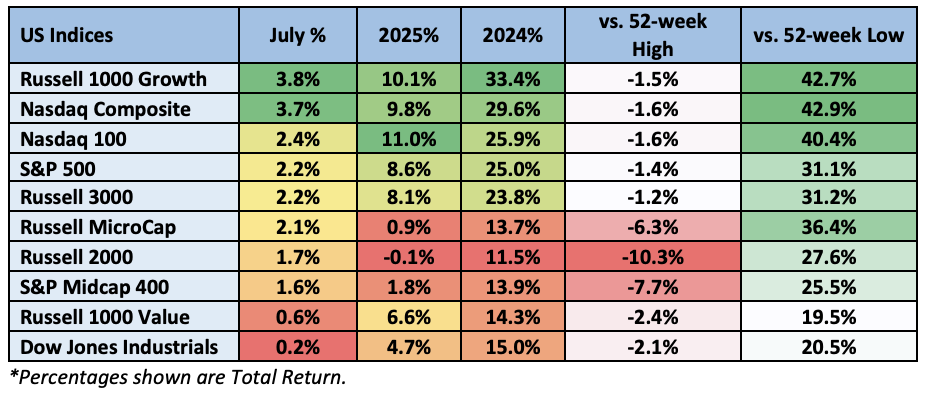

Core News Summary: The U.S. stock market experienced significant gains in July, with both the S&P 500 and Nasdaq reaching new highs, fueled by ...

Mid-Year Review and Future Projections for 2025

“`html Market Overview In July, the S&P 500 and Nasdaq reached new record highs, buoyed by easing trade tensions, a strong earnings season, and ...

Mid-Year Analysis and Future Projections for 2025

“`html Executive Summary The S&P 500 and Nasdaq 100 recorded new all-time highs at the end of Q2 2025, signifying a robust economic landscape. ...

Exploring Capital Efficiency in Crypto Derivatives: Insights from QCP’s CEO on Nasdaq’s Blockchain Innovation

Nasdaq announced a new blockchain-integrated margin and collateral management solution on October 3, 2023, developed with QCP, Primrose Capital Management, and Digital Asset Holdings. ...

Three Intelligent Strategies to Capitalize on the Crypto Surge Without Buying Coins

Bitcoin recently surpassed $110,000 for the first time, with regulatory optimism suggesting a potential crypto rally in 2025. Investors can engage with this market ...

Unveiling the Financial Benefits of Taskrabbit for Retirees

Unveiling the Financial Benefits of Taskrabbit for Retirees

Dan W. felt the itch to keep himself occupied in retirement, all while padding his pockets. In 2021, the retired individual turned to Taskrabbit, ...

Crypto Taxes in 2024: Exploring Tax Implications of Cryptocurrency

Crypto Taxation Unveiled: The Intricacies of Taxing Digital Currencies

Cryptocurrency, the modern-day treasure hunt in the investment arena, remains as unpredictable as tumbleweeds in a desert storm. Its intangibility coupled with sky-high volatility ...

Exploring Mark Cuban’s Top Passive Income Ventures

Exploring Mark Cuban’s Top Passive Income Ventures

Mark Cuban is renowned for his candid opinions on various subjects, spanning from political landscapes to financial realms. The self-made billionaire is not one ...