Investing

Figuring out how to invest your money to generate consistent returns can seem daunting, especially if you don’t have extensive financial knowledge. Our investing section provides novice investors with the key strategies and tips for how to invest money wisely. We deliver actionable advice to help you build wealth steadily over time.

Simply put, investing as a beginner can look confusing initially. But sticking to proven, time-tested investing principles can help you avoid costly mistakes and accumulate real returns. We believe successful investing doesn’t require taking excessive risk. By learning how to assess risk vs reward and allocating capital prudently, regular investors can steadily build wealth over the long run.

From setting investment goals and building a diversified portfolio to rebalancing and maximizing returns, we cover the essential investing basics. You’ll learn timeless wisdom from legendary investors like Warren Buffett and Peter Lynch that can guide your own investment decisions. We explain key terms and concepts clearly, so you can grasp investing fundamentals quickly.

While investing always involves some degree of risk, going in with the right knowledge helps tilt the odds in your favor. We believe the average individual has the ability to invest successfully on their own and grow significant wealth over time. By teaching you how to invest money wisely, we aim to empower our readers to take control of their financial futures.

Ready to start growing your money? Browse our investing for beginners articles covering stocks, mutual funds, ETFs, real estate, and alternative assets. Learn how to open a brokerage account, build a portfolio, and invest with a long-term mindset. Sign up for our free investing newsletter to get simple money tips delivered to your inbox daily.

QIAGEN’s Sustainability Milestones

QIAGEN Earns Notable Recognitions in Sustainability

Sustainability is no longer the road less traveled, and QIAGEN N.V. (QGEN) is showcasing leadership in this arena with two significant achievements. My Green ...

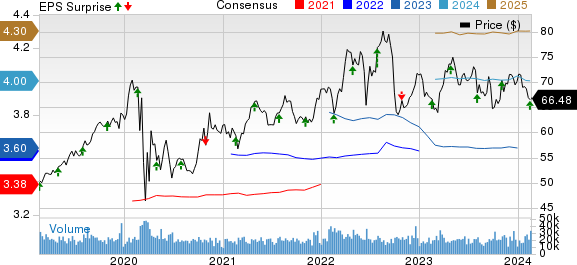

Why CNA Financial (CNA) Stock is a Must-Hold

Why CNA Financial (CNA) Stock is a Must-Hold

CNA Financial Corporation is poised to gain on the back of new businesses, improved non-catastrophe current accident year underwriting results, higher net earned premiums, ...

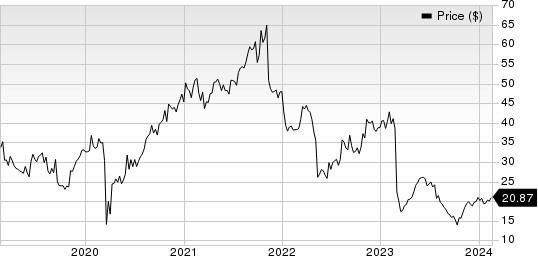

National Vision’s Struggles Amidst Closure and Economic Challenges

National Vision, a leading player in the optical retail industry, faces significant challenges with the imminent termination of its Legacy business and the impact ...

Lantheus Holdings, Inc. Q4 Earnings Preview

Lantheus Holdings, Inc. Q4 Earnings Preview

Lantheus Holdings, Inc. (LNTH) is scheduled to release fourth-quarter 2023 results on Feb 22, before the opening bell. In the last reported quarter, Lantheus ...

CSX Corporation Increases Quarterly Dividend by 9.1%

CSX Corporation Rewards Shareholders with 9.1% Dividend Increase

In a move to prioritize its shareholders, CSX Corporation has made an investor-friendly revelation, heightening the percentage of its dividend pay-out. The board of ...

Can Rigel Pharmaceuticals (RIGL) Exceed Q4 Earnings Expectations?

Can Rigel Pharmaceuticals (RIGL) Exceed Q4 Earnings Expectations?

We anticipate Rigel Pharmaceuticals RIGL to surpass expectations when it reports fourth-quarter and full-year 2023 results later this month or early next month. In ...

Gibraltar Industries Q4 Earnings Preview

Gibraltar Industries (ROCK) to Report Q4 Earnings: Here’s What Investors Should Anticipate

Gibraltar Industries, Inc. (ROCK) is slated to release its fourth-quarter 2023 results on Feb 21, before the opening bell. In the previous quarter, the ...

ANSYS Set to Unveil Q4 Financial Results: Brace for Impact

ANSYS Inc ANSS is set to report its financial results for the fourth quarter of 2023 on Feb 21st. The company anticipates non-GAAP earnings ...

TC Energy’s Q4 Earnings and Revenue Exceed Expectations

TC Energy (TRP) Q4 Earnings and Revenues Surpass Estimates

TC Energy Corporation TRP left investors awe-struck, shattering expectations with its Q4 2023 performance. The energy infrastructure provider reported adjusted earnings of 99 cents ...

Southern Co.: Q4 Earnings Surpass, but Sales Falter

Southern Co.: Q4 Earnings Surpass, but Sales Falter

The Southern Company (SO) has stunned investors with fourth-quarter 2023 earnings per share of 64 cents, surpassing the Zacks Consensus Estimate of 59 cents. ...