Investing

Figuring out how to invest your money to generate consistent returns can seem daunting, especially if you don’t have extensive financial knowledge. Our investing section provides novice investors with the key strategies and tips for how to invest money wisely. We deliver actionable advice to help you build wealth steadily over time.

Simply put, investing as a beginner can look confusing initially. But sticking to proven, time-tested investing principles can help you avoid costly mistakes and accumulate real returns. We believe successful investing doesn’t require taking excessive risk. By learning how to assess risk vs reward and allocating capital prudently, regular investors can steadily build wealth over the long run.

From setting investment goals and building a diversified portfolio to rebalancing and maximizing returns, we cover the essential investing basics. You’ll learn timeless wisdom from legendary investors like Warren Buffett and Peter Lynch that can guide your own investment decisions. We explain key terms and concepts clearly, so you can grasp investing fundamentals quickly.

While investing always involves some degree of risk, going in with the right knowledge helps tilt the odds in your favor. We believe the average individual has the ability to invest successfully on their own and grow significant wealth over time. By teaching you how to invest money wisely, we aim to empower our readers to take control of their financial futures.

Ready to start growing your money? Browse our investing for beginners articles covering stocks, mutual funds, ETFs, real estate, and alternative assets. Learn how to open a brokerage account, build a portfolio, and invest with a long-term mindset. Sign up for our free investing newsletter to get simple money tips delivered to your inbox daily.

TreeHouse Foods Q4 Earnings Report and Sales Decline

TreeHouse Foods (THS) Q4 Earnings Report and Sales Decline

Against a backdrop of challenging consumer trends within the food and beverage space, TreeHouse Foods, Inc. (THS) released its fourth-quarter results for 2023. Unfortunately, ...

Marathon Oil Corporation (MRO) Set to Release Q4 Earnings

Marathon Oil Corporation (MRO) Set to Release Q4 Earnings

Marathon Oil Corporation MRO is scheduled to release financial results for the fourth quarter on Feb 21, with the current Zacks Consensus Estimate projecting ...

Eastman (EMN) Partners Nord Pal Plast for Feedstock in France

Eastman Chemical Company’s Bold Recycling Partnership Reshapes Sustainable Future

The Eastman Chemical Company (EMN) has sealed a game-changing, long-term pact with Nord Pal Plast SA, a pivotal player within the Dentis Group. This ...

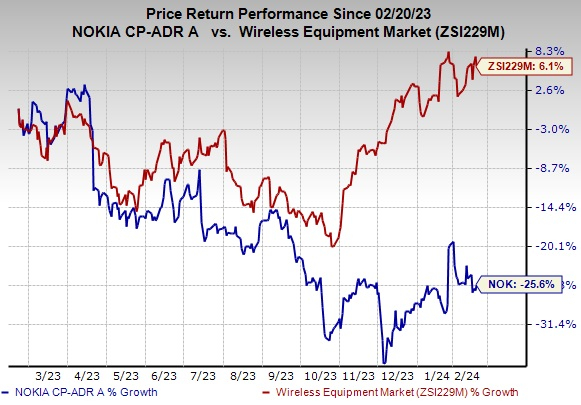

Nokia and Dell’s Game-Changing Partnership

Nokia and Dell’s Game-Changing Partnership

Nokia Corporation NOK and Dell Technologies Inc. DELL have cemented their partnership to revolutionize open network architectures within the telecom industry. The collaboration aims ...

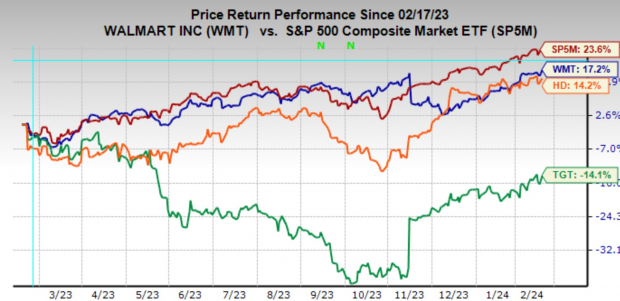

Retail Industry Outlook: Finding Balance Among the Numbers

Retail Industry Outlook: Finding Balance Among the Numbers

Walmart WMT shares took a hit in response to the latest quarterly release on November 16th when the company offered guidance that fell slightly ...

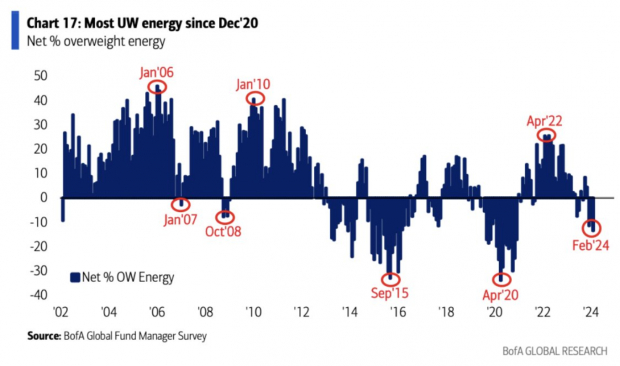

The Case for Investing in the Lagging Energy Sector

The Case for Investing in the Lagging Energy Sector

“If everyone’s thinking alike, then somebody isn’t thinking.” ~ George S. Patton Exhibit A: Despite Super Micro Computer’s (SMCI) roller-coaster ride in the stock ...

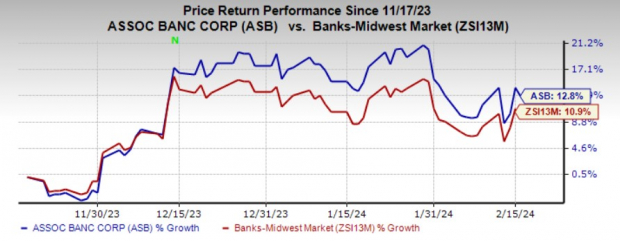

Associated Banc-Corp: Navigating Strategic Growth Amid Rising Costs

Associated Banc-Corp: Navigating Strategic Growth Amid Rising Costs

Associated Banc-Corp (ASB) ventures forth with an ambitious strategic plan, geared towards fortifying its loan and deposit balances and improving fee income. Evidently, the ...

PPL Corporation’s Strong Q4 Earnings and Expanded Capital Expenditure Projection

PPL Corporation has pulled off a financial coup with a remarkable performance in its fourth-quarter 2023 operating earnings. The company’s earnings per share (EPS) ...

MRC Global Inc: A Financial Review

MRC Global Inc: A Financial Review

MRC Global Inc. MRC has been thriving due to its diversified presence across multiple end markets, including upstream production, midstream pipelines, gas utilities, and ...