H1: Cathie Wood: Shifting Strategies in the Tech Investment Landscape

Cathie Wood has become a prominent figure on Wall Street, known for her unique approach to investing.

Rather than relying on traditional investment models, Wood’s firm, Ark Invest, focuses primarily on emerging technologies through various exchange-traded funds (ETFs). While she embraces innovative businesses, her portfolio also includes established companies, including several of the “Magnificent Seven.” These larger companies are currently at the forefront of advances in artificial intelligence (AI).

Recently, Wood made headlines by selling shares of Tesla (NASDAQ: TSLA) while increasing her investment in Amazon (NASDAQ: AMZN). These moves suggest a strategic reevaluation of her holdings.

Understanding Wood’s Decision to Reduce Tesla Holdings

Typically, portfolio managers keep the specifics of their trades private. They may discuss strategies during media interviews, but this often occurs after significant actions have been taken.

However, Ark Invest operates differently. Each day, they send out an email detailing trades for that day. Wood also frequently appears on networks like CNBC and Yahoo! Finance, where she openly shares her investment thoughts.

In recent weeks, Wood has steadily decreased her stake in Tesla.

| Category | Oct. 24 | Oct. 28 | Oct. 29 | Oct. 30 | Nov. 1 | Nov. 4 | Nov. 5 | Nov. 7 |

|---|---|---|---|---|---|---|---|---|

| Shares of Tesla sold | 85,500 | 120,000 | 13,900 | 62,200 | 30,600 | 9,900 | 2,300 | 85,000 |

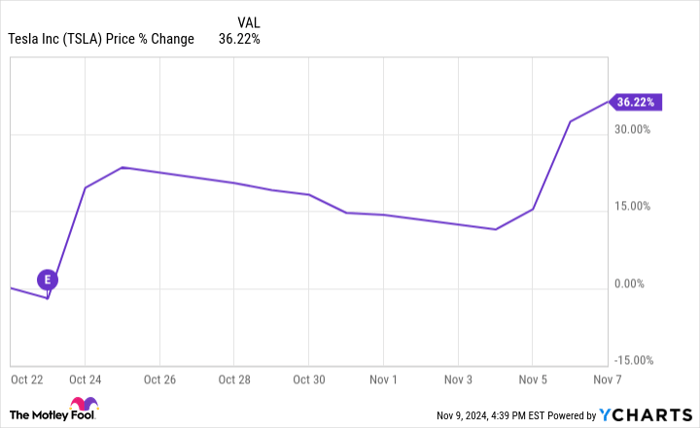

Despite these sales, which might suggest panic, the context is crucial. Following Tesla’s third-quarter earnings report on October 23, its stock rose by over 30%.

TSLA data by YCharts.

During a segment on Yahoo! Finance, Wood indicated that it was an opportune moment to take profits and rebalance Ark Invest’s portfolio. Given Tesla’s stock volatility, this strategic sell-off could help safeguard gains.

The Appeal of Investing in Amazon

Throughout October, Wood sold Tesla shares and redirected those funds into Amazon. Ark Invest acquired over 395,000 shares of Amazon between October 8 and November 7.

Amazon’s extensive operations—including e-commerce, cloud computing, and subscription services—position it as a strong investment choice, regardless of market conditions.

The recent partnership with Anthropic allows Amazon to integrate AI across its business, enhancing customer engagement and growth opportunities.

Amazon’s financial health supports this strategy, boasting $48 billion in trailing-12-month free cash flow and $88 billion in cash and equivalents, positioning it well for continued investment in AI initiatives.

Image Source: Getty Images

Conclusion

Investors should note that Wood remains optimistic about Tesla’s long-term potential, even as she takes profits. Ark Invest previously set a five-year price target of $2,600 for Tesla. The company continues to play a significant role in Ark’s portfolio, and it’s likely Wood will maintain a vested interest moving forward.

Investing in Amazon seems well-timed. Its shares are relatively inexpensive based on free cash flow, and as the company integrates AI, additional purchases could follow.

Considering a $1,000 Investment in Amazon?

Before diving into Amazon stock, here’s an important point:

The Motley Fool Stock Advisor analysts recently identified the 10 best stocks to buy right now—with Amazon missing from that list. These picks boast strong potential for returns in the coming years.

For instance, a $1,000 investment in Nvidia, which was recommended on April 15, 2005, would now be worth around $908,737!

Stock Advisor offers an easy-to-follow strategy for success, including portfolio-building advice and two stock recommendations every month. The Stock Advisor service has returned more than four times the S&P 500’s return since 2002.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.