Is Reinflation the New Challenge for Stock Market Growth?

After two years of declining inflation, rates are now on the rise, posing potential risks to the stock market’s recovery.

The U.S. economy has faced numerous challenges since early 2020, ranging from the disruptions caused by the pandemic to significant inflation increases. Despite these obstacles, the stock market has rebounded, driven by falling inflation rates and the rapid advancements in AI technology.

Since the market hit rock bottom in late 2022, our optimistic outlook has remained unchanged.

However, what once seemed like an unstoppable recovery is now threatened by a growing concern: reinflation. While it has not yet escalated into a crisis, there are unmistakable signs that warrant attention.

Currently, we maintain a positive outlook on stocks. Factors such as supportive government policies, potential interest rate cuts, and sustained growth in the AI sector suggest strong stock performance in 2025.

Nevertheless, we are becoming increasingly cautious about the possibility that reinflation, though currently contained, could emerge in 2025 or 2026 and disrupt the market’s progress.

Shift from Disinflation to Rising Inflation

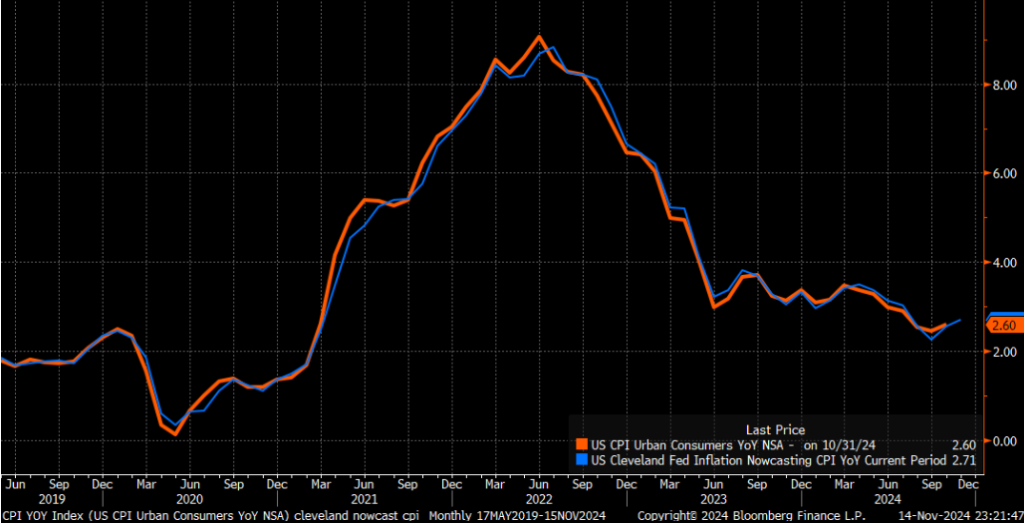

From summer 2022 to summer 2024, the U.S. inflation rate consistently dropped from approximately 9.1% to 2.4%, returning to more typical levels.

Now, however, inflation is beginning to rise again.

Recent Consumer Price Index (CPI) reports indicate inflation increased from 2.4% in September to 2.6% in October, with projections suggesting a rise to 2.7% in November.

To put it simply, inflation that was falling is now climbing.

In isolation, rising inflation isn’t entirely negative. Keeping inflation between 2% to 3% is still relatively low. A modest increase might not drastically affect the economy.

However, this rise in inflation coincides with what may be the introduction of new inflationary economic policies under a future presidential administration.

Watch for Policy Changes in the Economy

President-elect Donald Trump has openly discussed implementing tariffs, tax cuts, deregulation, and mass deportations. These measures are likely to stimulate economic growth but may also lead to increased inflation.

Tariffs will raise the costs of imports, subsequently increasing production expenses for U.S. companies, which may result in consumers experiencing higher prices.

Additionally, tax cuts typically promote both business and consumer spending, leading to higher overall economic demand and likely inflation. A similar influence can be expected from deregulation. Moreover, decreasing the labor supply through mass deportations likely raises labor costs and contributes to inflation.

Thus, these proposed policies are poised to trigger reinflation. The critical question remains: To what extent will reinflation occur?

If these policies result in minimal reinflation, the impact could be manageable. Inflation might rise a few points, and while businesses and consumers might feel the pinch, the economy could keep functioning smoothly.

Conversely, if these measures push inflation high, the effects could be severe. A significant spike in inflation would burden U.S. businesses and consumers with elevated costs, compounded by a Federal Reserve unable to reduce interest rates in response. Consequently, the economy could struggle.

Final Thoughts on Inflation Concerns

How much reinflation can we anticipate in the coming years?

Honestly, we cannot say for sure.

At this moment, the specifics of the policies to be enacted, their timing, and their effects are uncertain. We can only acknowledge that the risk of reinflation is real.

Inflation has transitioned from a downward trend to an upward one. During Trump’s first term, inflation increased by 1.3 percentage points, climbing from 1.6% in summer 2017 to 2.9% by late summer 2019, just before trade wars and the onset of the COVID-19 pandemic. Should a similar situation arise, inflation could reach around 4% within the next one to two years, creating challenges for the U.S. economy.

Currently, though, this situation is not urgent. The risks of reinflation aren’t significant enough to derail the bull market.

Still, it’s essential to stay aware of these developments. We will continue to monitor this situation closely.

For now, the bull market persists, and we anticipate it will thrive as long as inflation remains manageable.

Explore some of the stocks we are following to benefit from today’s bullish market conditions.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article.

P.S. Stay updated with Luke’s market insights by checking out our Daily Notes! Discover the latest issue on your Innovation Investor or Early Stage Investor subscriber site.