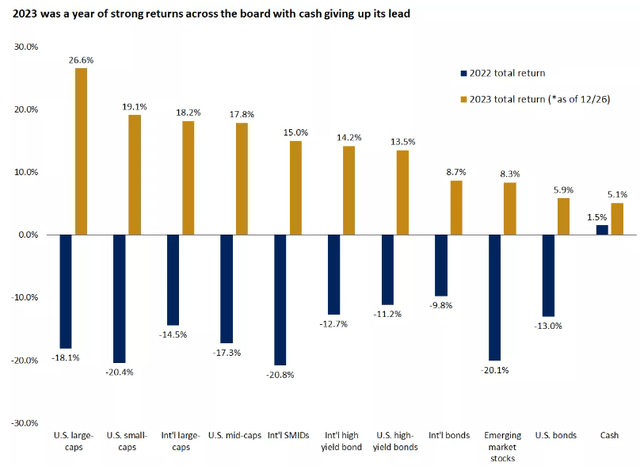

Approximately 12 months ago, the assertion was made that a bleak outlook and a widespread fixation on recession were obscuring the fact that the current expansion was robust, rooted firmly in a foundation constructed from the grassroots. It was also projected that the rates of change in incoming economic data would continue to show improvement across the board, with inflation rates falling faster than anticipated, ultimately leading to a pivot by the Fed in its policy stance during the initial quarter of 2023. Subsequently, the anticipation was for the birth of a new bull market, proven prophetic by significant gains witnessed across the board during the year.

Regrettably, one’s latest forecast dictates their standing, and therein lies the 2024 prediction. Amidst the lack of absolute clarity about the economic landscape and the absence of extremely low sentiment as a tailwind for forward market returns, confidence persists that the ongoing economic expansion will endure, and that the bull market born last year still has further room for advancement.

Futile Preoccupation with Recession

For the cohort relentless in forecasting a recession in 2023 and now pinning hopes on it materializing in 2024, the takeaway is to refrain from fixating on individual indicators to reach a conclusive stance. It is imperative to consider the entirety of the data within the current context, which encompasses a once-in-a-lifetime pandemic.

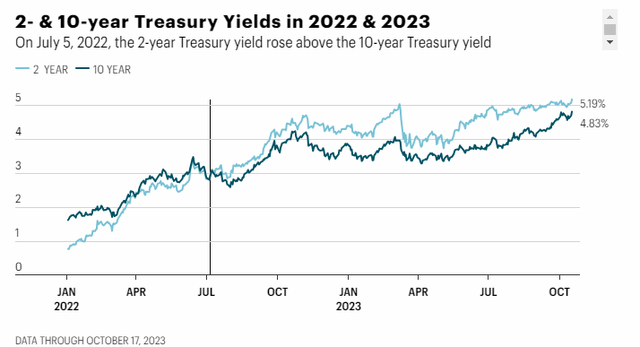

At the onset of 2023, several historically reliable indicators hinted at a highly probable recession. The most pivotal indicator was the inversion of the yield curve, persisting for 18 months, yet failing to usher in a recession. Other concerning indicators included the ongoing deterioration in the housing market, the prolonged contraction in the manufacturing sector, and the sharp decline in the Conference Board’s Leading Economic Index (LEI). Despite minimal improvement on these fronts, a recession remains absent.

Unprecedented swings in high-frequency economic data post-pandemic had disrupted previously reliable models for forecasting the business cycle. We spent much of the last year rectifying imbalances between supply and demand, such as the emphasis on services spending over goods, which depressed the manufacturing sector and heavily influenced the LEI. This is why most on Wall Street underestimated its strength. Main Street remains the linchpin for the continuation of the expansion in 2024 and is crucial for the ongoing bull market.

Prospects for Ongoing Expansion

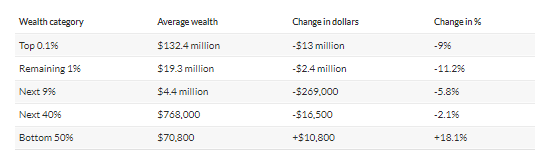

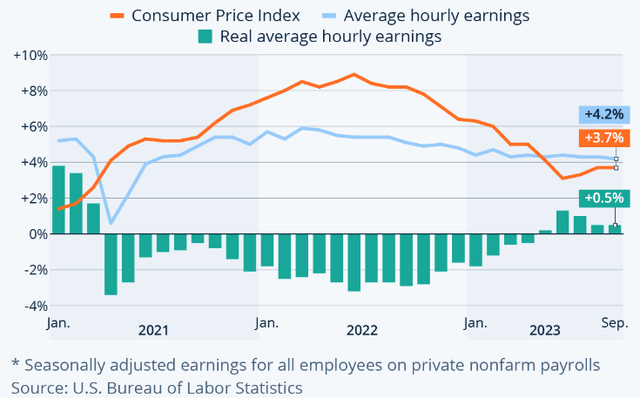

For 18 months, a soft landing has been predicted on the basis that post-pandemic fiscal stimulus significantly favored the bottom 50% of households in terms of income and wealth, a unique occurrence. Additionally, the lowest-income workers experienced the highest percentage wage increase, allowing most consumers to counter the surge in costs for goods and services in 2023.

The reduction in savings and a decelerating wage growth trigger concerns about a recession. However, what is overlooked is the offsetting effect of real wage growth and the fall in inflation rates, reinstating the purchasing power of consumer incomes.

Investor Insights: Gauging Economic Health and Market Expectations for 2024

The Consumer’s Financial Stability

The amount of debt in the average household has managed to shock a few pencil pushers, but it’s not as crucial as the ability of consumers to handle it. Surprisingly, consumer debt service payments relative to disposable income are just beginning to rise to pre-pandemic levels, which still sit substantially low compared to historical standards. Therefore, the elevated debt levels have not quite put a damper on consumer spending as pessimistic pundits predicted. We need to reassess the focal point for clarity.

Consumer Spending as the Catalyst

Opposing popular belief, the labor market thrives due to consumer spending rather than the other way around. It’s when consumers begin to tighten their purse strings that businesses slow down recruitment or let go of workers – forming a negative cycle that diminishes spending capacity. Hence, the foremost indicator for steering this expansion is not the latest jobs report but the trajectory of real consumer spending growth on a year-over-year basis. This is the pivotal metric to determine any future vulnerabilities in this expansion.

The Influence of the Federal Reserve

In the year 2023, I suggested that it is wiser for investors to focus on the Federal Reserve’s actions, while disregarding the predominantly hawkish discourse delivered by the Fed officials, including Chairman Powell. The Fed’s moves often differ from their verbal cues, and that stance remains unaltered for 2024. Although officials have predicted three 25-basis-point rate cuts for this year, I anticipate six, aligning with the consensus of investors as indicated by the CME Fed Funds futures market.

Market Dependency on Fed’s Monetary Policy

Currently, investors anticipate weaker economic data to endorse lower inflation rates, enabling the Fed to commence rate reductions by March. The focus is likely to shift to concerns regarding the sustainability of growth as the Fed’s inflation goal becomes tangible later in the year. The pivotal factor influencing market and economic performance this year will be the pace at which the Fed adjusts its benchmark rate closer to a neutral level, which I forecast at approximately 3-3.5%. The onus is on the Fed not to constrict monetary policy too severely for a prolonged period, risking the stability of the soft landing and the bull market.

Prioritizing Rates of Change

Instead of fixating on absolute figures, concentrating on the rates of change is the superior method for predicting market trends. This approach played a crucial role for investors in the previous year, underscoring the consistent prevalence of the disinflationary trend and the vigorously sustained expansion. For the past year, the most pivotal figure has been the inflation rate, which has persistently decelerated since its peak 18 months ago. As per the Cleveland Fed’s Inflation Nowcasting model, the core personal consumption expenditures (PCE) price index is projected to decline from 3% in December to 2.8% in January, marking significant progress towards the Fed’s target.

Market Expectations for 2024

The robustness of the prevalent bull market was purely due to the upsurge in valuations, with the anticipated S&P 500 earnings growing by less than 1% in 2023 against a sales growth of merely 2.3%. The progression in valuations was invariably a result of plummeting long-term interest rates and a steadfastly declining inflation rate, circumstances which are unlikely to continue in 2024. Hence, to catalyze the bull market this year, earnings will need to take the lead, with the consensus projecting a growth of 11.5% in 2024 on a revenue growth of 5.5%.

Key Catalysts for S&P 500 in 2024

Despite these seemingly ambitious figures for a soft landing scenario, the rate-cut cycle executed by central banks globally is expected to bolster sales sourced from international markets. Furthermore, an enhancement in productivity is anticipated to sustain profit margins at their current levels. The prospect of achieving new all-time highs for the S&P 500 this year seems highly probable, with the potential to exceed 5,400 before the year concludes.

The impetus for the S&P 500’s bull market in 2024 will be propelled by the redistribution of roughly $6 trillion in money market assets by investors. Even a fraction, say $1-2 trillion, transitioning towards stocks and fixed-income securities offering superior yields than the dwindling money market rates, will exert a substantial influence.

The 2024 Financial Landscape: Cautious Optimism Amidst Volatility

As we delve into the prospects and intricacies of the investment arena for 2024, it’s important to heed the words of famed investor Warren Buffett, “Be fearful when others are greedy, and greedy when others are fearful.” This adage holds particular relevance given the current financial backdrop.

The Spectacular Rally

Entering 2024, the economy and markets radiate astonishing vigor, akin to a triumphant athlete basking in the glory of their unprecedented successes. The S&P 500 concluded 2023 with an awe-inspiring, parabolic surge, illuminating a feat not witnessed since 2004 – a nine-week continuous ascent. Simultaneously, the bond market staged a phenomenal rally, with the 10-year Treasury yield hurtling from the brink of 5% to a remarkable low of 3.79% over a mere 10-week span. These monumental numbers led to over 90% of the stocks in the S&P 1500 trading above their 50-day moving averages, dispelling the lack of market breadth that stirred disquietude in the bear camp throughout the preceding summer.

The present potency reverberating in the market holds profound promise for forthcoming market performance over the next 6-12 months, seemingly painting an optimistic canvas for investors.

Navigating Overbought Terrain

Despite the resplendent rally, the financial landscape bears the mark of an exceedingly overbought condition, embarking on a process of reconciliation. The path to resolution may involve a period of treading water for a few weeks, or more likely, a continued spell of profit-taking following the astounding rally. However, amid this apparent turbulence, where balance sheets teeter precariously, rests the potential for a gracious buying opportunity, providing economic and market fundamentals remain resolute and rates of change continue their upward trajectory.

Thus, a prudent posture is prudent, setting the stage for a cautious optimism entrenched in the resolve to seize potential windows of opportunity presented by any impending pullback.

The Shroud of Uncertainty

Looking forward, the specter of the forthcoming election in November casts a shadow of uncertainty, manifesting as a potential catalyst for augmented market volatility. Should the impending election mirror its tumultuous precursor from four years ago, a surge in volatility leading up to the event, as well as an aftermath fraught with uncertainty, appears inevitable. However, despite the looming political tempest, the investment strategy remains undeterred, steadfastly anchored in the quest for an astute, profitable outcome. As the year unfolds, navigating this dichotomy of offense and defense in investment strategy will be paramount, particularly as November draws near.

Approaching the second half of the year, the mounting unknowns and the looming election metamorphose into the focal point, casting a shadow of doubt on the trajectory of the market’s unfolding narrative, juxtaposed against the resolute confidence in the prospects for the first half of 2024, albeit punctuated by an anticipated pullback.

The shifting tides of the financial waters demand astute navigation, akin to steering a ship through tempestuous seas, encompassing both offense and defense in the investment strategy, invoking a delicate balance reminiscent of a tightrope walker poised on the precipice of uncertainty.