Comparing Investment Potential: Palantir vs. NVIDIA in 2025

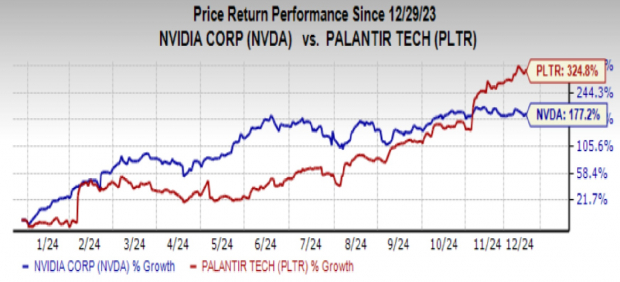

With the rise of artificial intelligence (AI), investors have shown keen interest in both Palantir Technologies Inc. (PLTR) and NVIDIA Corporation (NVDA). This year, Palantir’s stock has outperformed NVIDIA’s significantly, gaining +324.8% compared to NVIDIA’s +177.2%.

Image Source: Zacks Investment Research

But does this performance mean Palantir is the superior choice moving into the new year? Let’s explore further.

The Advantages of Investing in Palantir (PLTR)

Palantir has launched an innovative Artificial Intelligence Platform (AIP), which allows companies to incorporate large language models into their operations, boosting profitability.

As a result of AIP, Palantir’s customer base grew by 39% year-over-year in the third quarter of 2024. Additionally, contracts exceeding $1 million increased by 30%, showing a rise in deal sizes.

The earnings report for the third quarter reflects the momentum from AIP, with the net-dollar retention rate rising to 118%, up from 107% a year earlier. Palantir’s remaining deal value hit $4.5 billion, increasing by 22% from the previous year. The company anticipates revenues of $2.8 billion in 2024, a 25% increase from $2.23 billion in 2023, while the Zacks Consensus Estimate for earnings per share stands at $0.38, marking a 31% increase from the prior year.

Image Source: Zacks Investment Research

The Strength of NVIDIA (NVDA) Stock

NVIDIA remains a strong contender in the graphics processing unit (GPU) market, with CEO Jensen Huang confirming sustained demand for the Hopper architecture, even as new Blackwell chips approach launch.

This demand indicates confidence in NVIDIA’s existing and forthcoming products, particularly when compared to competitors like Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC).

The anticipation for the Blackwell chips, which process substantial data more efficiently, is palpable. For instance, the GB200 NVL72 system is expected to execute AI inferences 30 times quicker than its predecessor, the H100. Major companies, including Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Oracle Corporation (ORCL), are already purchasing these advanced chips.

NVIDIA shipped 13,000 Blackwell chips in the last reported quarter. Analysts at Morgan Stanley (MS) project shipments could soar to 300,000 units in Q4 of 2024 and 800,000 units in Q1 of 2025. This growing demand is expected to propel NVIDIA’s profits, with a Zacks Consensus Estimate for earnings per share at $2.93, a 47.2% increase from the previous year.

Image Source: Zacks Investment Research

Why NVIDIA Might be the Better Choice in 2025

Although both Palantir’s AI enhancements and NVIDIA’s new chips may drive stock growth in 2025, NVIDIA is positioned as the stronger investment option.

Palantir could face challenges if companies cut down on AI investments due to unprofitable endeavors. Conversely, NVIDIA’s established standing in the AI sector offers it pricing power and greater profit potential.

Additionally, NVIDIA has a track record of consistent profits, reflected in its return on equity (ROE) of 120.4%, compared to Palantir’s 21% ROE.

Image Source: Zacks Investment Research

NVIDIA also maintains a robust business model by paying dividends, with a dividend payout ratio of 2% and a 5.4% increase in payouts over the past five years, indicating effective reinvestment into research and development.

Image Source: Zacks Investment Research

Furthermore, NVIDIA presents a more financially attractive option, trading at a price/earnings ratio of 46.8X forward earnings, while Palantir trades at a significantly higher 190.7X forward earnings.

Image Source: Zacks Investment Research

Find out more about today’s top investment opportunities in our Zacks #1 (Strong Buy) Rank stocks list.

Zacks Announces Top 10 Stock Picks for 2025

Looking for early insights on our 10 best stock picks for 2025? Historical performance suggests these stocks could excel.

Since 2012, the Zacks Top 10 Stocks portfolio has achieved an impressive +2,112.6% return, significantly outpacing the S&P 500’s +475.6%. Our Director of Research, Sheraz Mian, is reviewing over 4,400 companies to find the best 10 stocks for the upcoming year. Don’t miss your opportunity to discover these stocks when they are announced on January 2.

Want the latest stock suggestions from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

Intel Corporation (INTC): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

This article’s views and opinions belong solely to the author and do not necessarily reflect those of Nasdaq, Inc.