Market Trends and Historical Insights

After an abysmal 2022, the S&P 500 Index and the Nasdaq Composite regained their footing in grand fashion in 2023. The S&P 500 Index ETF (SPY) gained 26.19%, while the Nasdaq 100 ETF (QQQ) soared 54%. Bold analyst estimates often dominate market discourse, but these are frequently constructed on gut feel rather than thorough data-based analysis. To cut through the noise and provide clarity, investors can look to three key data-backed indicators.

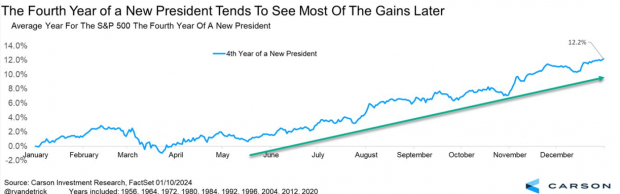

Understanding Election Year Seasonality

Election year seasonality on Wall Street pertains to the historical patterns and fluctuations that financial markets experience during major political elections. The uncertainties and investor sentiment surrounding the electoral process often influence distinct market trends. In 2023, election cycle seasonality unfolded dramatically, revealing the value of studying such trends. A back test conducted by Ryan Detrick of Carson Research showed that election years tend to be weak early in the year (January-April) but rally from April into year-end.

Image Source: Ryan Detrick, Carson Research

Scrutinizing Market Sentiment

CNN’s Fear and Greed Index measures market sentiment by analyzing various indicators, providing a numerical score that reflects the level of fear and greed in the stock market. Last year, whenever the index reached “Extreme Greed” levels, it marked a multi-week, intermediate correction. In late December and early January, the index once again flashed these levels.

Image Source: Zacks Investment Research

Examining Market Digestion

Moving averages serve as valuable tools for investors. By observing an index and assessing how far prices typically deviate from a moving average before retracting, investors can gain insight. For instance, a pattern emerges as each time the QQQ exceeded ~7% from the 50-day moving average, a pullback occurred. Visualize the 50-day moving average as a rubber band – each time the price stretches, it tends to snap back or correct.

Image Source: TradingView

Investing in Choppy Markets

Stocks with liquidity and beta offer stability in volatile markets. For instance, International Business Machines (IBM) has a beta of below 1, indicating lower volatility compared to the S&P 500 Index. Other low beta examples are Costco (COST) with a beta of 0.76 and Nike (NKE) with a beta of 1.12.

The Final Word

While many Wall Street “experts” rely on gut feelings, making forecasts based on data can provide a clearer outlook. The data presented in this piece indicates a potentially choppy first half for the market.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

NIKE, Inc. (NKE) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

To read this article on Zacks.com click here.