CICC Rates Estée Lauder Companies: Market Perform Recommendation

On December 27, 2024, CICC began its coverage of Estée Lauder Companies (LSE:0JTM) by issuing a Market Perform recommendation.

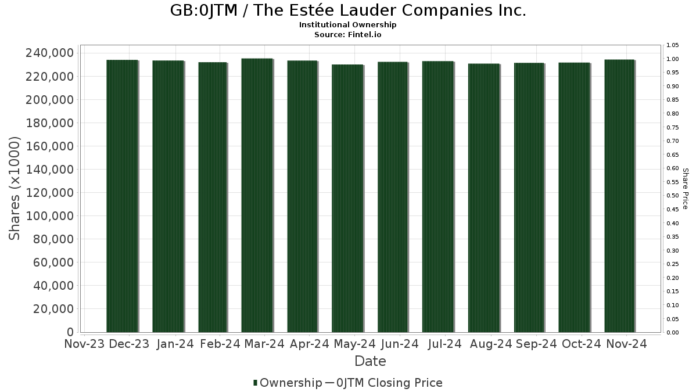

Institutional Fund Sentiment: A Shift in Ownership

A total of 1,674 funds or institutions currently hold positions in Estée Lauder Companies. This marks a decline of 60 funds, or 3.46%, in the past quarter. The average portfolio weight of all funds invested in 0JTM stands at 0.13%, reflecting a significant increase of 33.18%. However, the total shares owned by institutions dipped by 1.26% over the last three months, totaling 230,653K shares.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 7,006K shares, which is 3.00% of the company’s total ownership. This is an increase from the previous report, which listed 6,977K shares, amounting to a 0.42% rise. However, the fund has reduced its overall portfolio allocation in 0JTM by 11.63% during the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) owns 6,103K shares, representing 2.61% ownership of Estée Lauder. This is up from 5,982K shares previously, indicating a 1.98% increase. Nevertheless, VFINX has also decreased its portfolio allocation in 0JTM by 12.03% in the past quarter.

Massachusetts Financial Services owns 5,724K shares, accounting for 2.45% ownership. They reported an increase from 3,191K shares, making for a substantial increase of 44.25%. Still, they reduced their allocation in 0JTM significantly by 74.79% over the last quarter.

Independent Franchise Partners LLP holds 5,400K shares, which is 2.31% of the company. Previously, they owned 3,466K shares, revealing a 35.81% increase, along with a 39.82% rise in their portfolio allocation for 0JTM.

The Goldman Sachs Group possesses 4,741K shares, or 2.03% ownership. Their previous holdings were 5,267K shares, showing a decrease of 11.08%. Likewise, they reduced their portfolio allocation in 0JTM by 19.69% over the last quarter.

Fintel continues to be a leading investment research platform for individual investors, traders, financial advisors, and smaller hedge funds.

Featuring a global array of data—including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and insider trading—Fintel aims to provide actionable insights. Advanced, backtested quantitative models support exclusive stock picks to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.