Citigroup Adjusts Outlook for Ross Stores Amid Shifts in Fund Ownership

Citigroup Changes Course on Ross Stores

On November 12, 2024, Citigroup shifted its rating for Ross Stores (WBAG:ROST) from Buy to Neutral.

Current Fund Sentiment

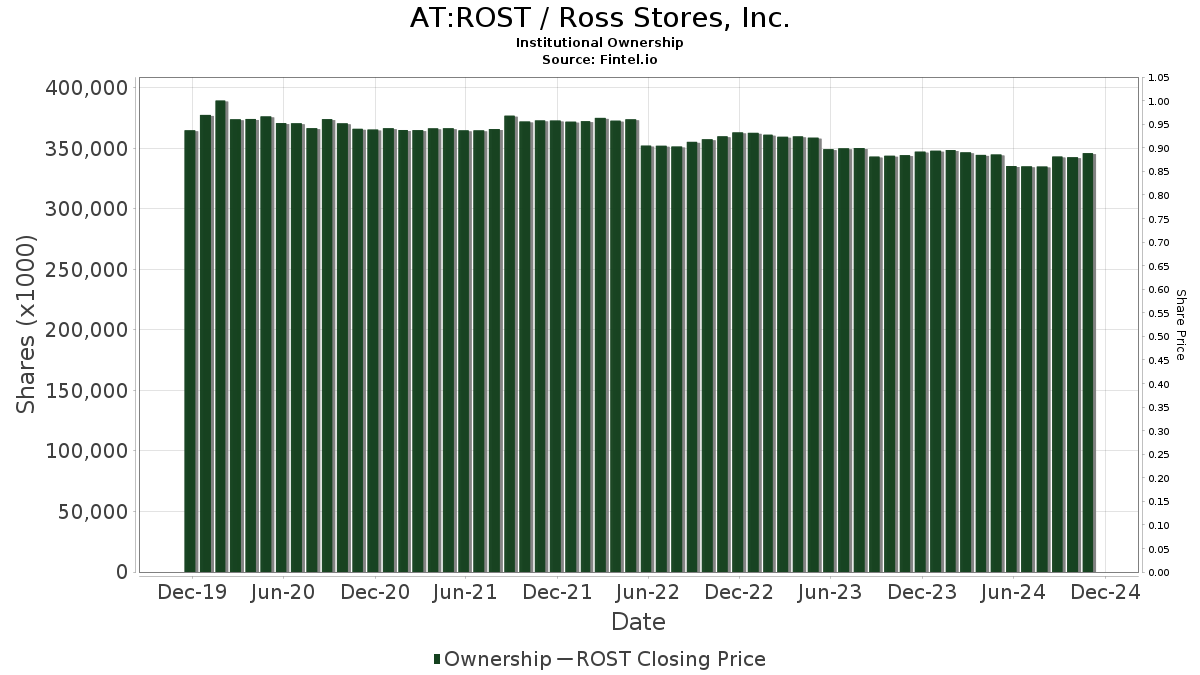

Currently, there are 2,064 funds or institutions holding positions in Ross Stores. This figure marks an increase of 9 owners, or 0.44%, in the past quarter. The average portfolio weight of all funds invested in ROST stands at 0.37%, up by 2.12%. Over the last three months, total shares owned by institutions rose by 3.14%, reaching 343,869K shares.

Changes Among Major Shareholders

Price T Rowe Associates now holds 15,904K shares, equating to a 4.79% stake in Ross Stores. This represents a notable drop from their previous ownership of 17,920K shares, a decrease of 12.68%. During the last quarter, the firm also reduced its portfolio allocation in ROST by 14.20%.

In contrast, J.P. Morgan Chase has increased its holdings, now owning 14,109K shares, which accounts for 4.25% of the total. This is an increase from their last report of 10,165K shares, reflecting a rise of 27.95%. They also boosted their portfolio allocation in ROST by 33.38% during the past quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 10,582K shares, representing 3.19% ownership. After reporting 10,597K shares previously, this shows a slight decrease of 0.14%. Their allocation in ROST also fell by 3.84% over the last three months.

Meanwhile, Primecap Management now holds 10,536K shares or 3.18%. Previously, they reported an ownership of 10,651K shares, indicating a decrease of 1.09%, while increasing their portfolio allocation by 4.05% in ROST.

Lastly, the Vanguard 500 Index Fund Investor Shares (VFINX) currently owns 8,606K shares, amounting to 2.59% ownership. This is a rise from their earlier report of 8,484K shares, which is an increase of 1.42%. However, they still reduced their overall allocation in ROST by 4.92% last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our expansive data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and much more. We also offer exclusive stock picks powered by advanced, backtested quantitative models designed to improve profitability.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.