Citigroup Initiates Coverage of Super Micro Computer with Neutral Rating

Fintel reports that on April 25, 2025, Citigroup initiated coverage of Super Micro Computer (XTRA:MS51) with a Neutral recommendation.

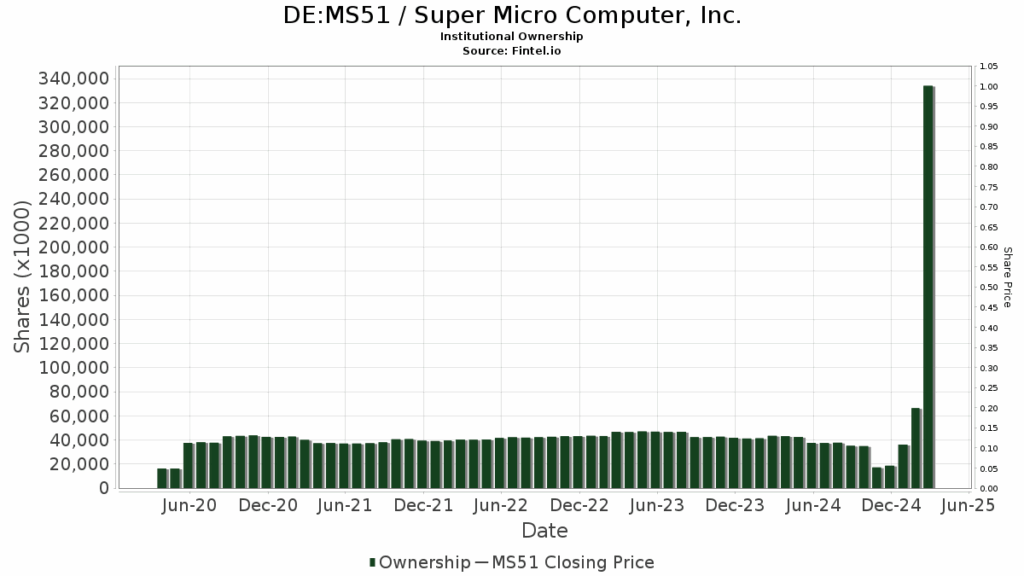

Fund Sentiment Overview

Currently, 1,300 funds and institutions have reported their positions in Super Micro Computer. This figure shows a significant increase of 406 owners, or 45.41%, in the last quarter. The average portfolio weight of all funds invested in MS51 has grown to 0.13%, marking an increase of 61.31%. Furthermore, total shares owned by institutions rose dramatically over the past three months, climbing 708.10% to reach 332,301K shares.

Insights from Other Shareholders

The Vanguard Total Stock Market Index Fund (VTSMX) currently holds 15,538K shares, equating to 2.62% ownership of Super Micro. In its previous filing, VTSMX reported 1,577K shares, indicating an increase of 89.85%. However, the fund decreased its portfolio allocation in MS51 by 28.92% during the last quarter.

Meanwhile, the Vanguard 500 Index Fund (VFINX) has 13,633K shares, representing 2.30% ownership. This is an increase from the 1,319K shares reported previously, reflecting a growth of 90.33%. Similarly, VFINX decreased its MS51 allocation by 28.42% over the past quarter.

Geode Capital Management holds 12,847K shares, translating to 2.16% ownership of the company.

Additionally, the Vanguard Mid-Cap Index Fund (VIMSX) maintains 10,693K shares, which equates to 1.80% ownership. The previous filing showed ownership of 1,054K shares, leading to an increase of 90.14%. The fund decreased its allocation in MS51 by 26.29% in the last quarter.

Lastly, Coatue Management possesses 8,867K shares, representing 1.49% ownership of Super Micro Computer.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.