Citigroup Gives Cytokinetics a Boost with a Buy Recommendation

On February 7, 2025, Citigroup announced it is initiating coverage of Cytokinetics (NasdaqGS:CYTK) and has issued a Buy recommendation for the company’s stock.

Analysts Predict Significant Price Increase

As of January 29, 2025, analysts project an average one-year price target for Cytokinetics at $84.12 per share. This forecast ranges from a low of $60.60 to a high of $126.00. Notably, this average price target indicates a potential increase of 96.73% from its most recent closing price of $42.76 per share.

For more insights, check our leaderboard of companies with the highest price target upside.

Strong Revenue Projections

Cytokinetics is expected to generate an annual revenue of $354 million, showing an impressive increase of 10,895.34%. However, the projected annual non-GAAP EPS stands at -3.99.

Market Sentiment towards Cytokinetics

A total of 792 funds or institutions have reported positions in Cytokinetics, marking a decline of 19 owners, or 2.34%, over the past quarter. The average portfolio allocation of all funds dedicated to CYTK is 0.33%, reflecting an increase of 14.39%. Additionally, institutional ownership rose by 6.46% in the last three months, resulting in 158,769K shares owned.

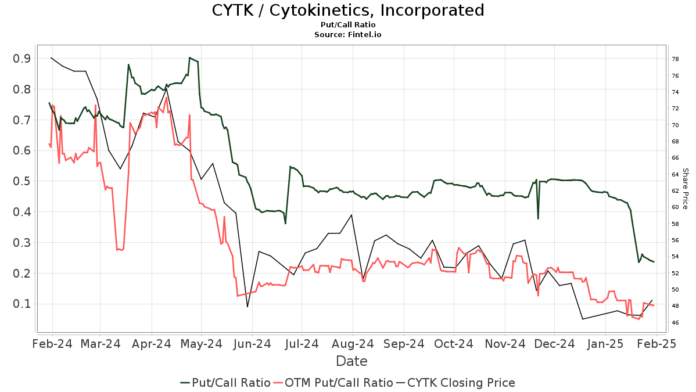

The put/call ratio for CYTK is 0.23, suggesting a bullish market sentiment regarding the stock.

T. Rowe Price Investment Management holds 9,690K shares, accounting for 8.21% of the company. This is an increase from their previous holding of 8,139K shares, representing an uptick of 16.01%. The firm also boosted its allocation in Cytokinetics by 10.86% in the last quarter.

Wellington Management Group LLP owns 7,775K shares, which is 6.59% of the company. This reflects a rise from 7,510K shares, an increase of 3.41%. However, the firm cut its allocation in CYTK by 86.12% over the same period.

Bank of America has increased its stake to 4,829K shares, now representing 4.09% ownership, up from 4,381K shares or a 9.29% increase. Their portfolio allocation in CYTK rose modestly by 0.93% in the past quarter.

Vanguard Health Care Fund Investor Shares hold 4,068K shares, maintaining a 3.45% stake with no recent changes. Meanwhile, Vanguard Total Stock Market Index Fund Investor Shares owns 3,752K shares, making up 3.18% of ownership. This was an increase from 3,620K shares, though the firm reduced its allocation in CYTK by 5.13% over the last quarter.

Cytokinetics’ Company Overview

(This description is provided by the company.)

Cytokinetics, Inc. is a publicly traded biopharmaceutical firm based in South San Francisco, California. It specializes in developing muscle activators and inhibitors aimed at treating diseases associated with impaired or declining muscle function.

Fintel serves as a leading research platform for investors, traders, and financial advisors, providing comprehensive data including fundamentals, ownership insights, and fund sentiment analysis.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.