Citigroup Recommends Buy on Kaspi.kz with Strong Future Outlook

On November 4, 2024, Citigroup began coverage of Joint Stock Company Kaspi.kz – Depositary Receipt (NasdaqGS:KSPI) with a Buy recommendation.

Analyst Predicts 33% Price Increase

The average one-year price target for Joint Stock Company Kaspi.kz – Depositary Receipt, set on October 22, 2024, is $146.88 per share. Current estimates vary from a low of $111.10 to a high of $168.00. This target reflects a potential upside of 33.39% compared to its recent closing price of $110.11 per share.

To see more companies with large price target increases, check our leaderboard.

Strong Fund Sentiment for Kaspi.kz

As of now, 265 funds or institutions hold shares of Joint Stock Company Kaspi.kz – Depositary Receipt. This marks an increase of 43 holders, or 19.37%, from the previous quarter. The average portfolio weight allocated to KSPI across these funds is 1.23%, up by 0.06%. Institutional ownership rose by 3.61% in the last three months, totaling 46,838K shares.

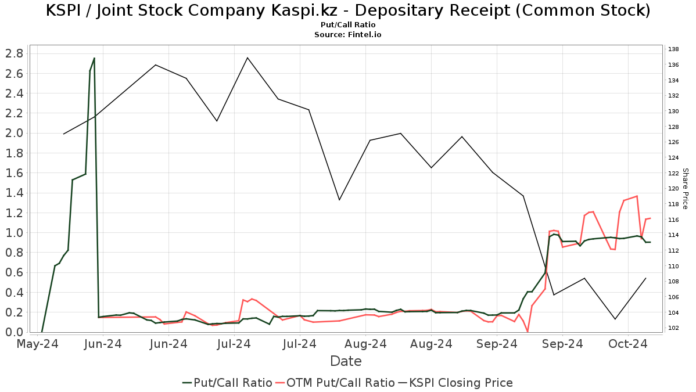

The current put/call ratio stands at 0.95, indicating a bullish market sentiment.

FIL owns 3,950K shares but has decreased its holdings from 4,153K shares, reflecting a 5.16% decline in share count and a 4.89% drop in portfolio allocation over the last quarter.

In contrast, Baillie Gifford has increased its stake significantly, owning 3,344K shares compared to only 1,147K previously, marking a rise of 65.69% and a massive 192.77% increase in portfolio allocation.

GQG Partners retains 1,968K shares, slightly reducing its position by 0.09% over the last quarter, while Standard Life Aberdeen has sharply decreased its holdings from 2,385K to 1,653K shares, representing a 44.25% drop in ownership.

Sands Capital Management also reduced its investment, holding 1,520K shares, a decrease of 8.41% since the last filing.

Fintel offers comprehensive investment research to individual investors, traders, and financial professionals, providing vital data such as fundamentals, analyst insights, ownership statistics, and more.

For further information, click here.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.