Citigroup Boosts Chevron Rating: A Look at Institutional Investors

On November 26, 2024, Citigroup upgraded their outlook for Chevron (SNSE:CVXCL) from Neutral to Buy.

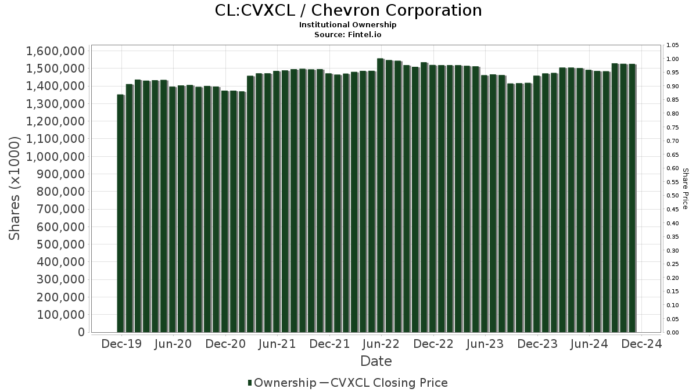

Institutional Sentiment Towards Chevron

Currently, 4,810 funds or institutions hold positions in Chevron, reflecting a decrease of 24 owners or 0.50% from the previous quarter. The average portfolio weight dedicated to CVXCL across all funds is 0.51%, which marks a substantial increase of 27.91%. Over the last three months, total shares held by institutions have seen a decline of 1.97%, now totaling 1,532,037K shares.

Key Institutional Stakeholders

BlackRock remains a significant player, holding 128,959K shares, which accounts for 7.18% of the company’s ownership. Similarly, Berkshire Hathaway retains 118,611K shares, representing 6.60% ownership, with no changes observed over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) reports owning 55,079K shares which signifies a 3.06% stake. This reflects a minor decrease of 0.65% from their previous holding of 55,435K shares, along with a 12.14% reduction in portfolio allocation over the last quarter.

Vanguard 500 Index Fund (VFINX) holds 44,549K shares, accounting for 2.48% ownership. This shows a slight increase of 1.26% from the prior total of 43,990K shares. The firm’s allocation in CVXCL, however, decreased by 12.26% during the last quarter.

The Energy Select Sector SPDR Fund (XLE) holds 37,372K shares, which represents 2.08%. In the prior filing, their shares amounted to 43,018K shares, indicating a noteworthy decrease of 15.11%. Their portfolio allocation in CVXCL also dropped by 12.66% during the last quarter.

Fintel is recognized as one of the most extensive investing research platforms, serving individual investors, financial professionals, and small hedge funds.

Our platform features a wide range of data, including fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, unusual options trades, and much more. Exclusive stock picks are generated using advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.