Cloudflare Anticipates Q1 2025 Results with Strong Revenue Growth

Cloudflare (NET) is set to report its first-quarter 2025 results on May 8, 2025.

Revenue Projections and Earnings Expectations

Cloudflare forecasts revenues between $468 million and $469 million for Q1 2025. According to the Zacks Consensus Estimate, NET’s first-quarter revenues are estimated at $468.7 million, suggesting a year-over-year growth of 23.8%.

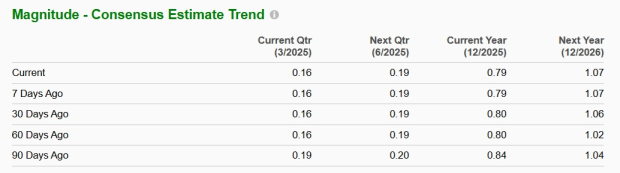

The company also expects non-GAAP earnings of 16 cents per share, matching the Zacks Consensus Estimate, which reflects no change from last year’s quarter. This earnings consensus has remained steady for the past 60 days.

Image Source: Zacks Investment Research

Recent Earnings Performance

Cloudflare has surpassed the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 20.7%.

Outlook for Cloudflare’s Q1 2025

Currently, our model does not conclusively predict an earnings beat for Cloudflare. While a positive earnings ESP and a Zacks Rank of #1 (Strong Buy) or #2 (Buy) typically signal higher chances of a beat, NET currently holds a Zacks Rank #3 (Hold) and an earnings ESP of -1.54%.

Factors Impacting Q1 Results

Cloudflare’s performance in the first quarter likely benefited from an industry shift towards zero-trust cybersecurity solutions. The ongoing hybrid work trend has also heightened the need for robust security that extends beyond traditional on-premises setups.

Revenue is anticipated to rise from accelerated global expansion, with roughly 50% of the company’s 2024 revenues generated outside the U.S. Cloudflare’s diverse clientele has further contributed to revenue growth, with approximately 16,174 new paying customers added in Q4 2024, totaling around 237,714.

Additionally, the addition of 232 new large clients (annual billings over $100,000) brought the total to 3,497 by the end of Q4. This expanding customer base has been consistent for the past 14 quarters and is likely to have continued in Q1 2025 due to rising demand for Cloudflare’s offerings amid ongoing digitalization.

However, geopolitical and macroeconomic challenges have made it difficult for Cloudflare to close sizable deals. This has impacted revenue recognition as clients have become cautiously selective in their IT spending and vendor choices, following recent U.S. policy changes. These factors are expected to exert downward pressure on top-line growth in the upcoming quarter.

Stock Performance and Valuation

In the past year, shares of NET have increased by 67.8%. This growth, however, falls short compared to the Zacks Internet – Software industry, the Zacks Computer and Technology sector, and the S&P 500 index, which rose by 22.7%, 8%, and 10%, respectively.

Current Valuation Metrics

Image Source: Zacks Investment Research

At present, NET is trading at a forward 12-month price-to-sales (P/S) ratio of 18.86X, significantly higher than the industry average of 5.12X, indicating a stretched valuation.

Investment Considerations for Cloudflare

Cloudflare competes in a highly competitive web infrastructure and security market, contending with established players like Akamai Technologies, Inc. (AKAM), Fastly, Inc. (FSLY), and Amazon Web Services (AWS).

Akamai provides a range of solutions including Content Delivery Network services and security features. Similarly, Fastly offers compute solutions and has a comprehensive security portfolio. AWS also equips businesses with various cloud services and security solutions.

Despite fierce competition, Cloudflare is focusing on artificial intelligence and expanding zero-trust security offerings, which position it for potential long-term growth. The company’s Workers AI and AI Gateway platforms are gaining traction, which could drive growth as AI adoption accelerates.

Moreover, improvements in the company’s go-to-market strategy have bolstered sales execution, setting the stage for future growth opportunities.

“`html

Cloudflare’s Growth Promises Strong Future Despite Current Overvaluation

Cloudflare has displayed significant growth in customer conversions over recent quarters, primarily focusing its sales efforts on enterprise clients. This strategic shift is expected to result in larger deal wins as we approach 2025.

Conclusion: Advising on Cloudflare Stock

Despite Cloudflare’s robust growth potential, its current overvaluation may concern investors. The company’s expanding base of enterprise clients, along with strong financial performance and innovations in AI, position it for continued growth. Therefore, maintaining a hold on Cloudflare stock appears prudent for the time being.

Zacks’ Research Chief Highlights Potential Doubling Stock

Recently, our research team identified five stocks likely to gain +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian identifies one stock poised for the highest gains.

This standout is recognized as one of the most innovative financial firms. With a rapidly expanding customer base of over 50 million and a diverse range of advanced solutions, this stock has the potential for significant increases. While not all selections guarantee success, this one could significantly outperform earlier high-fliers from Zacks, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Additionally, you can explore more about our top stock and four other runner-ups. Interested in the latest recommendations? Today, you can download our report on the 7 Best Stocks for the Next 30 Days.

Further analysis is available on notable companies such as Amazon.com, Inc. (AMZN), Akamai Technologies, Inc. (AKAM), Fastly, Inc. (FSLY), and Cloudflare, Inc. (NET).

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`