Cloudflare Achieves Impressive Growth Amid AI Innovations

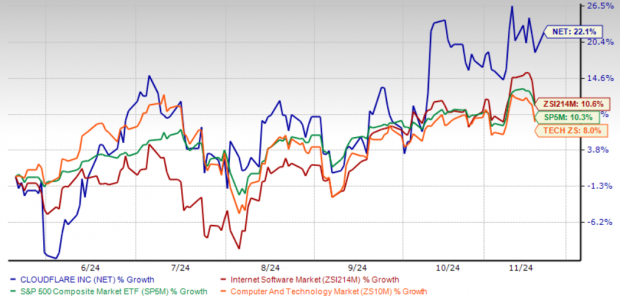

In just six months, Cloudflare’s NET shares have surged by 22.1%. This rise significantly outpaces the Zacks Computer Technology sector’s return of 8%, Zacks Internet Software industry’s 10.6%, and the S&P 500’s 10.3%. This growth indicates a strong investor confidence in Cloudflare’s advancements in artificial intelligence (AI) and its expected positive impact on revenue.

Recently, the company enhanced its serverless AI platform, Workers AI, by upgrading its graphics processing capabilities. Additionally, Cloudflare launched various security products, including AI Audit, Firewall for AI, and Defensive AI, reinforcing its stance as a leader in AI-focused security solutions. The company also collaborates with industry giants to boost its AI capabilities.

Strategic Partnerships Fuel Cloudflare’s AI Growth

Cloudflare’s partnerships play a crucial role in its AI expansion. Collaborations with Hugging Face Hub, CrowdStrike CRWD, Microsoft MSFT, and NVIDIA NVDA have strengthened its offerings. For instance, the partnership with Hugging Face enables developers to deploy AI applications seamlessly on Cloudflare’s global network.

Teaming up with CrowdStrike integrates NET’s Zero Trust protection with CRWD’s AI-powered cybersecurity, offering robust protection against widespread breaches. Cloudflare aims to further its capabilities by partnering with additional industry leaders throughout 2024.

The alliance with Microsoft focuses on enabling enterprise customers to deploy AI models across various platforms by utilizing the ONNX runtime. In 2023, Cloudflare announced its intention to employ NVDA’s GPUs and Ethernet switches to enhance its global network’s AI capabilities.

These innovations and alliances are expected to boost NET’s revenues. For 2024, Cloudflare anticipates revenues between $1.661 billion and $1.662 billion. The Zacks Consensus Estimate suggests expected revenue of $1.66 billion, indicating a substantial 28% growth year-over-year.

Additionally, Cloudflare projects its non-GAAP earnings per share for 2024 to be 74 cents, with the Zacks Consensus Estimate aligning at the same value, indicating year-over-year growth of 51%.

Cloudflare’s Strong Six-Month Performance

Image Source: Zacks Investment Research

Cloudflare’s Competitive Landscape

Despite its growth, NET faces stiff competition from established players like Palo Alto, Check Point, F5, and Fortinet, all of which boast significant resources and infrastructure. The cybersecurity sector is also witnessing emerging companies eager to meet the increasing demand for security solutions amid rapid technological advancements.

To maintain its position, Cloudflare has invested heavily in enhancing its sales and marketing strategies while expanding its international presence, a move that has impacted its operating margins.

Investor Guidance

Overall, Cloudflare’s strong market position and its foray into the AI domain are promising. However, the stock’s high valuation raises some caution. Currently, it holds a Zacks Value Style Score of F, indicating a potentially inflated valuation.

Given these factors, investors should consider holding onto this Zacks Rank #3 (Hold) stock for now. For those interested, you can check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stocks to Watch in the Next Month

Experts have identified 7 elite stocks from a current list of 220 Zacks Rank #1 Strong Buys, anticipating significant early price movements.

Since 1988, this curated list has outperformed the market, averaging a yearly gain of +23.7%. Be sure to pay attention to these selected stocks.

See them now >>

Looking for the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

Cloudflare, Inc. (NET): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.