Understanding Market Winners: The Rare Gems of the S&P 500

You might assume that about half of the stocks in the S&P 500 outperform the market each year. However, the reality is different. In most cases, only about 20% of these stocks are true winners. This makes identifying a successful investment particularly valuable.

Stay Informed: Get Daily Market Insights! Subscribe to Breakfast news to receive financial updates directly in your inbox every market day. Sign Up For Free »

Top Performers from the Last Decade

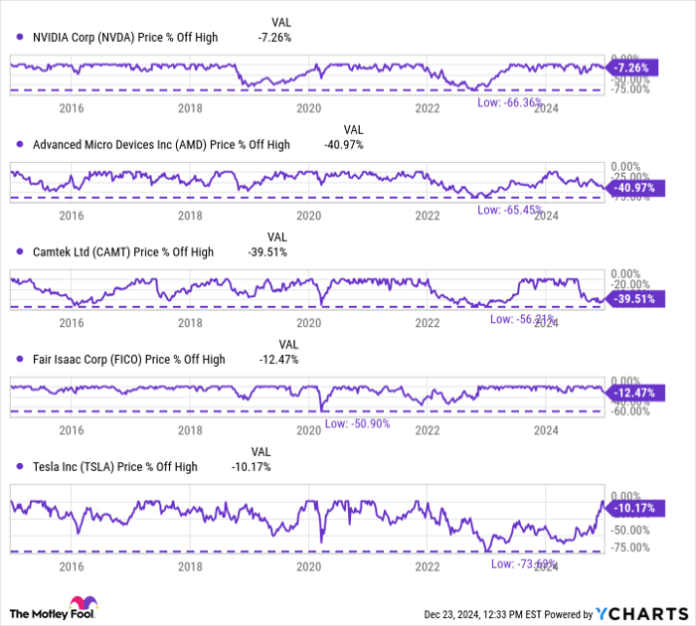

According to MacroTrends, the top five stocks from the past ten years are Nvidia (NASDAQ: NVDA), AMD (NASDAQ: AMD), Camtek (NASDAQ: CAMT), Fair Isaac (NYSE: FICO), and Tesla (NASDAQ: TSLA). These stocks have seen impressive compound annual growth rates ranging from 40% to 75%. For instance, a $10,000 investment in Tesla 10 years ago would now be worth $290,000, while an investment in Nvidia could be nearly $2.7 million today.

The Importance of Holding on to Winners

The Motley Fool’s investment philosophy encourages investors to “let your portfolio’s winners keep winning.” Since true winners are rare, selling a strong stock too early can lead to replacing it with a poor performer, usually about 80% of the time.

Seems straightforward, right? Just buy the strong stocks and hold on to them. However, each of the top five stocks has faced significant challenges over the past decade.

Common Traits of the Top Five Stocks

Remarkably, all five stocks have experienced drops of 50% or more at least once in the last ten years. For instance, Tesla’s value plummeted more than 70% during this period. Nvidia also suffered a 66% drop as recently as 2022.

In fact, Nvidia has fallen 50% or more on two occasions, while Tesla has experienced such declines three times. AMD has similarly faced significant downturns, currently sitting about 40% lower than its peak earlier this year.

NVDA data by YCharts.

Such sharp declines often lead to negative news and fears, prompting investors to consider selling. It can be distressing to see a profitable investment halve in value, raising concerns about whether to sell or hold.

Advice for Investors

Renowned investor Charlie Munger remarked, “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder.” His advice, while direct, contains valuable wisdom.

Investors must first accept that fluctuations of 50% or more are part of the investing landscape. If you aim to make money, prepare for these declines.

Moreover, such drops do not indicate when to buy or sell. It’s interesting to note that the best-performing stocks over the last decade all dipped significantly at least once without being selling opportunities.

Conversely, many stocks not included in this elite group have also seen declines but never rebounded. Therefore, having a strong investment thesis is crucial. This guiding principle should clarify the conditions that will ensure sustained shareholder value.

As market changes occur, if a company continues meeting the expectations outlined in your thesis, it’s often best to hold your position long-term, even during turbulent times.

Considering an Investment in Nvidia

Before investing in Nvidia, consider the following:

The Motley Fool Stock Advisor analyst team recently identified their picks for the 10 best stocks to buy right now, and Nvidia was not included. The selected stocks have potential for impressive returns in the coming years.

If you had invested $1,000 in Nvidia when it was on their list on April 15, 2005, it would now be worth $859,342!

Stock Advisor offers a user-friendly approach to investing, providing guidance on portfolio building and two new stock picks each month. Since 2002, this service has significantly outperformed the S&P 500.

Explore the 10 stock picks »

*Stock Advisor returns are accurate as of December 23, 2024

Jon Quast has no positions in any of the mentioned stocks. The Motley Fool holds positions in and recommends Advanced Micro Devices, Nvidia, and Tesla, as well as Fair Isaac. The Motley Fool has a disclosure policy.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.