Upstart vs. Pagaya: A Comparative Look at Two AI-Driven Fintech Stocks

Upstart Holdings (NASDAQ: UPST) and Pagaya Technologies (NASDAQ: PGY) both utilize artificial intelligence (AI) to evaluate consumer credit risk more efficiently than traditional models. After recently releasing positive earnings reports, both companies saw a rise in stock prices. This article compares their performances to help investors determine which stock may be the better choice today.

Upstart: A History of Peaks and Valleys

Upstart quickly became popular following its public debut, experiencing a significant stock price increase. However, as growth slowed, its stock took a downturn. After a challenging few years, signs suggest that the company is regaining momentum, much to the delight of investors.

The fourth quarter of 2024 showed remarkable improvement for Upstart. Revenue soared by 56% year over year, reaching $219 million, while transaction volume increased 68% to $2.1 billion. Notably, the net loss dropped to $2.8 million from $42.4 million the previous year. Chief Executive Officer Dave Girouard expressed optimism, projecting that the company could at least break even by 2025.

When Upstart went public in late 2020, favorable interest rates allowed it to approve more loans and post solid profits. If the company can replicate that success, it may once again reward its investors.

Transitioning to an AI-based platform appears irreversible. While banks have been slow to adopt new technologies, AI is becoming more prevalent across industries, including loan approvals. Currently, 91% of Upstart’s loans are fully automated, and 93% of these loans receive immediate funding. The company has secured $1.3 billion in commitments for new loans, which is essential for operational success.

Pagaya: Thriving Despite Challenges

Pagaya entered the public market when Upstart was facing struggles, yet it has displayed consistent performance. In the fourth quarter, network volume reached $2.6 billion, representing a 9% year-over-year increase, which, while modest, marked continued annual growth. Its revenue rose 28% to $279 million, slightly surpassing Upstart’s figures. However, Pagaya reported a net loss of $238 million for the quarter, primarily due to stock-based compensation and adjustments in fair value. Management anticipates a net loss between $20 million and break-even for the first quarter of 2025, with expectations for profitability by the second quarter.

Pagaya has considerably fewer lending partners than Upstart, with only 31 compared to over 100. However, it collaborates with notable clients, including U.S. Bank and SoFi Technologies, leading to greater business volume per partner.

A significant advantage for Pagaya lies in its funding capabilities. The company secured $6 billion in upfront loan commitments in 2024 from 130 different funding partners. Additionally, Pagaya was the leading issuer of asset-backed securities (ABSs) for personal loans in the U.S.

Examining the Investment Potential

Both Upstart and Pagaya present investment risks but in different contexts. Upstart has achieved profitability in the past, creating confidence that it can do so again despite its struggles in a rising interest rate environment since 2021. While many financial stocks are cyclic, established firms generally do not experience the sharp declines seen with Upstart, which recorded losses for several years. It appears poised for a turnaround, having gathered more data to face economic challenges, but this brings inherent risk. Furthermore, Upstart’s stock has experienced extreme volatility, offering a tumultuous journey for its investors.

Pagaya, on the other hand, poses risks due to its relative unfamiliarity. Its robust performance during difficult economic conditions demonstrates effective risk management, essential for a reliable investment. However, it has only recently started turning a profit and possesses a complex structure that can obscure understanding. Additionally, its stock issuance last summer raised eyebrows, adding an element of uncertainty.

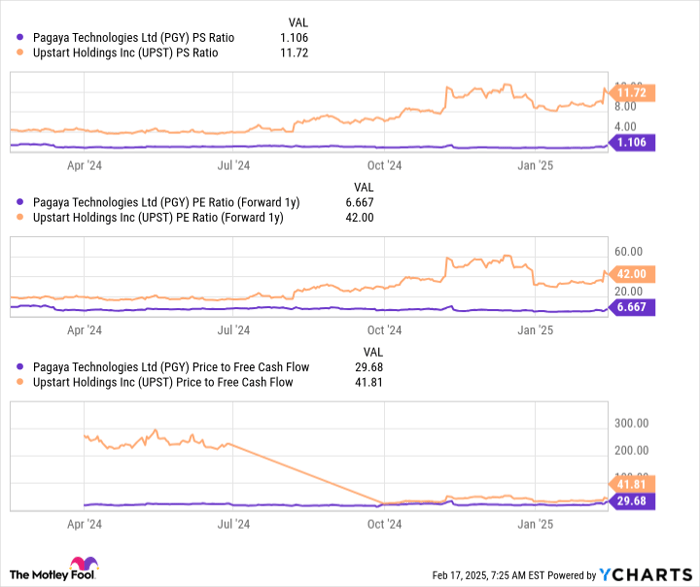

Shifting our focus to valuation, Pagaya is significantly cheaper across the board, which reflects the market’s view of its risks, despite its strong track record and near profitability.

I would advise against making a large investment in either stock due to their inherent risks. For those willing to embrace higher risk, Pagaya may be the more attractive option due to its affordability and upward trajectory. Conversely, if you prefer a stock with a more established history that appears less complicated, Upstart could be the preferable choice.

Is Upstart a Smart Investment Right Now?

Before considering an investment in Upstart, keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in currently, and Upstart does not appear on that list. The selected stocks have strong potential for significant returns in the coming years.

Take Nvidia, for example: If you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would now be worth approximately $854,317!*

The Stock Advisor service offers straightforward guidance for building a strong investment portfolio, including updates and two new stock picks each month. Since 2002, it has achieved returns that more than quadruple those of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has positions in and recommends U.S. Bancorp and Upstart. The Motley Fool recommends Pagaya Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.