Semiconductor Sector Surges: Nvidia and Micron Shine in AI Revolution

The semiconductor industry is forecasted to produce $611 billion in revenue this year, according to World Semiconductor Trade Statistics (WSTS). This marks a robust 16% increase from last year, and growth is anticipated to persist into 2025, with projections pointing to an additional 12.5% rise in revenue.

Artificial intelligence (AI) has significantly contributed to this impressive growth. The surge in AI technology has led to increased demand for various types of chips, including application-specific integrated circuits (ASICs), processors, and memory components.

Key players like Nvidia (NASDAQ: NVDA) and Micron Technology (NASDAQ: MU) have capitalized on the AI-driven demand for semiconductors. Nvidia, with its stronghold in AI graphics processing units (GPUs), has seen extraordinary growth in revenue and earnings, with its stock soaring by 193% this year. Meanwhile, Micron has also gained momentum, with its shares rising by 27%. This article assesses the potential and valuation of both companies to determine which is the better investment in the AI sector.

Nvidia’s Strong Market Position

In recent years, demand for data center GPUs has skyrocketed as companies scramble to deploy AI models. Nvidia has emerged as the primary provider of data center GPUs, commanding an estimated 98% market share in 2023. The company sold approximately 3.76 million data center GPUs last year, reflecting a 42% increase from the previous year.

For Nvidia investors, the outlook remains positive, with the demand for AI GPUs continuing to grow. Global Market Insights estimates that the data center GPU market could see an annual growth rate of 28% through 2032. This positions Nvidia well for higher GPU shipments in 2025.

Market research firm TrendForce projects a staggering 55% increase in shipments of Nvidia’s high-end GPUs next year, spurred by the new Blackwell chips. This could lead to potential data center revenue of $200 billion in 2025, nearly double from the current fiscal year’s $98 billion run rate (with Nvidia reporting $49 billion in data center revenue in the first half of this fiscal year).

If these predictions hold true, Nvidia could significantly surpass Wall Street revenue forecasts for the next fiscal year, expected to finish with nearly $126 billion in total revenue—more than double the $60.9 billion achieved in the prior year.

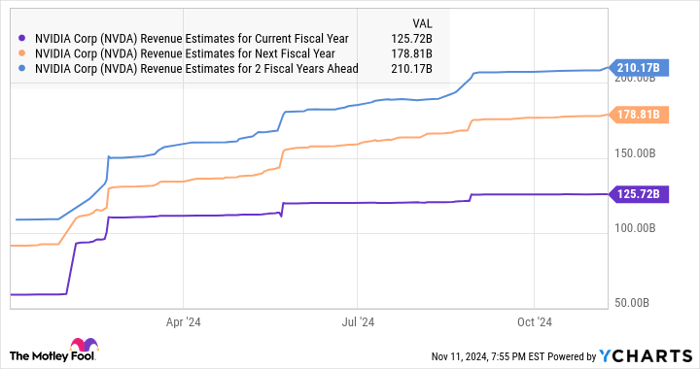

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

As shown in the chart above, analysts predict Nvidia’s revenue will increase by 42% in the next fiscal year, followed by a 17% gain in fiscal 2027. However, there’s potential for Nvidia to exceed these estimates, benefiting from expanding into fast-growing sectors such as data center networking and enterprise AI software.

Micron Technology’s Growing Demand

Micron Technology has also reaped the benefits of growing demand for memory chips used in AI GPUs, greatly improving its financial outlook. The company closed fiscal 2024 (ending August 29) with a 61% revenue spike to $25.1 billion, reporting a profit of $1.30 per share compared to a loss of $4.45 per share during the same quarter last year.

In its latest earnings call, Micron’s management highlighted that strong AI demand has driven robust growth in its data center DRAM products and high-bandwidth memory. This positive trajectory is expected to continue into 2025, with TrendForce forecasting a 51% revenue increase for the dynamic random access memory (DRAM) market, reaching $136.5 billion, largely due to the growing demand for high-bandwidth memory in AI chips.

Considering that DRAM accounted for 70% of Micron’s total revenue last year, favorable market prospects are advantageous for the company. Additionally, the NAND flash storage market, which makes up the remainder of Micron’s revenue, is projected to grow by 29% in 2025, generating $87 billion in revenue.

Given these developments, Micron is projecting $8.7 billion in revenue for the first quarter of fiscal 2025, alongside adjusted earnings of $1.74 per share—an 84% rise compared to the same period last year. Consensus estimates expect Micron’s revenue to increase 52% for the current fiscal year, reaching $38.2 billion, and a further 20% rise to $45.7 billion in fiscal 2026.

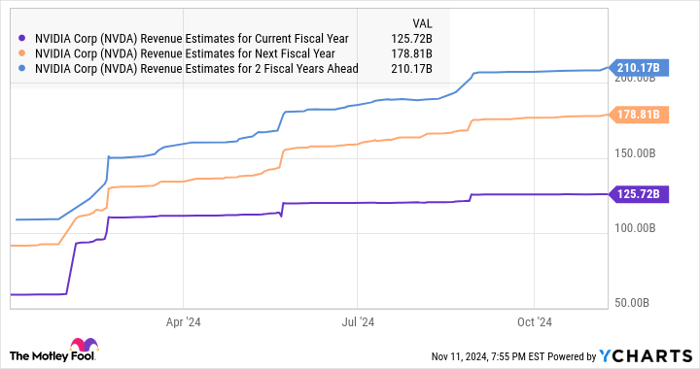

MU EPS Estimates for Current Fiscal Year data by YCharts

Both companies appear to be solid candidates in the AI stock market. But if one must choose between the two, a deeper examination of their valuations is essential.

Investment Outlook: Nvidia vs. Micron

The previous analysis indicates that both Micron and Nvidia are poised for notable growth due to AI-induced demand for their products. However, a close examination of their valuations facilitates the decision-making process for investors.

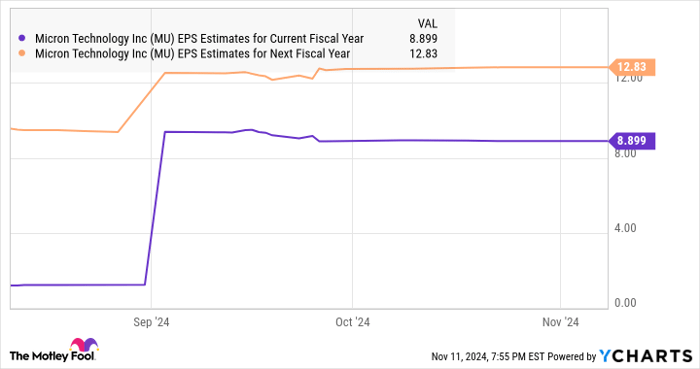

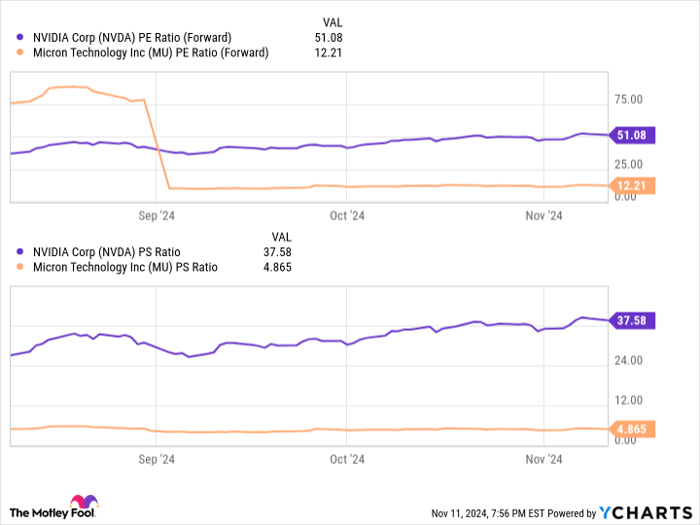

As illustrated below, Micron is notably cheaper relative to Nvidia.

NVDA PE Ratio (Forward) data by YCharts

While Nvidia is justified in commanding a premium valuation due to its leadership in the AI chip market, Micron’s rapid growth also deserves attention. Investors in search of a balanced combination of value and growth may find Micron Technology appealing due to its strong earnings forecasts that could sustain its upward trend.

Future Considerations for Investors

Before investing in Nvidia, consider the following:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in right now… and Nvidia isn’t one of them. The stocks on this list are expected to deliver significant returns in the future.

Reflect on this: had you invested $1,000 in Nvidia following their recommendation on April 15, 2005, it would now be worth $899,361!*

Stock Advisor offers a straightforward approach for investors, featuring guidance on portfolio building, regular analyst updates, and two new stock recommendations every month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.