Contrasting Paths: AMD Faces Challenges While Marvell Soars in 2024 (NASDAQ: AMD) (NASDAQ: MRVL)

In 2024, Advanced Micro Devices has experienced a 13% drop in stock value, while Marvell Technology has achieved a remarkable 76% increase. Both companies are impacted by the growing need for chips that support artificial intelligence (AI) technology. The pivotal question remains: Can AMD bounce back in 2025, or will Marvell maintain its lead as the preferable AI investment?

Let’s explore each company’s position.

Analyzing AMD’s Potential

While AMD struggles to keep pace with Nvidia in the AI graphics processing unit (GPU) market, it has made significant strides in its data center operations. A notable highlight is that in the third quarter of 2024, AMD’s data center revenue surged by 122% year-over-year, reaching a landmark $3.5 billion.

This growth stems from robust demand for AMD’s data center GPUs and central processing units (CPUs). The company anticipates ending the year with an impressive $5 billion in data center GPU revenue, a stark rise from $400 million in the final quarter of 2023.

Throughout the year, AMD has consistently raised its GPU revenue projections, starting from an original forecast of $2 billion.

AMD also thrives in adjacent markets, particularly with AI-enabled personal computers (PCs). This contributed to a noteworthy 29% rise in CPU sales for desktops and notebooks, totaling $1.9 billion in the third quarter. Collectively, data center and client segment revenues accounted for 80% of AMD’s overall sales for that quarter, mitigating losses from gaming and embedded chips.

Overall, AMD’s revenue climbed 18% from the previous year to $6.8 billion, with adjusted earnings rising 31% to $0.92 per share. The company projects top-line growth to accelerate by 22% in the fourth quarter. Analysts predict a 13% rise in AMD’s revenue, reaching $25.6 billion, and a 25% gain in earnings, hitting $3.32 per share, by the end of 2024.

Looking ahead, 2025 is expected to be even stronger, with projected revenue growth of nearly 27% and earnings forecasted to rise by 54%.

This optimism is buoyed by expected shipments of AI-enabled PCs, projected to rise 165% in 2025, up from 100% in 2024, according to Gartner. AMD is well-positioned to tap into this expansion, with expectations from PC manufacturers like HP and Lenovo to significantly increase their Ryzen AI Pro products.

A potential boost could come from its manufacturing partner, TSMC, which anticipates doubling production of AI GPUs in 2025. TSMC’s Arizona fab is set to support AMD’s new AI accelerators, suggesting promising prospects for AMD’s market performance in the coming year.

Marvell Technology’s Growth Story

Marvell Technology stands out in the market for AI-focused application-specific integrated circuits (ASICs). The company is poised for growth, with an increasing demand for its optical equipment that enhances data center connectivity. This trend has considerably bolstered Marvell’s data center business.

In the third quarter of its fiscal year 2025, Marvell’s data center revenue soared by 98% year-over-year, totaling $1.1 billion. Impressively, this segment constituted 73% of the company’s overall revenue, a sharp increase from 39% in the same period last year. This data center growth helped offset declines in its other areas, leading to a 7% rise in total revenue year-over-year.

Management indicates that demand for its AI-specific products is robust, surpassing its full-year AI revenue target of $1.5 billion, with forecasts now reaching $2.5 billion for the next fiscal year.

Further growth may stem from expanding collaborations with major cloud providers like Amazon, enhancing the potential for rising AI revenues.

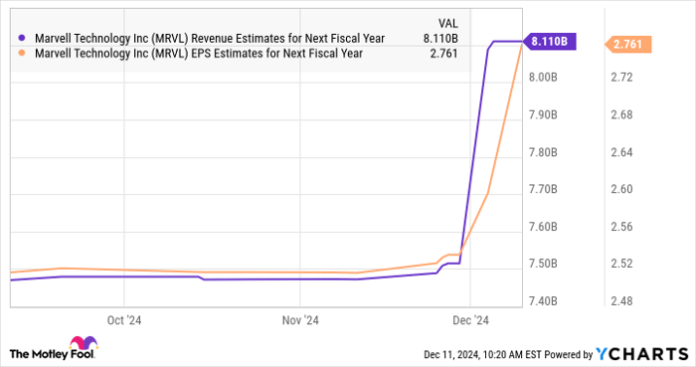

Analysts project Marvell’s top line to jump 41% next year to $8.1 billion and a 77% increase in earnings to $2.76 per share. For context, Marvell expects a modest 4% revenue growth in the current fiscal year along with increases in earnings per share.

MRVL revenue estimates for next fiscal year; data by YCharts.

Given these dynamics, Marvell stock seems likely to continue its impressive ascent into 2025.

Final Thoughts

Both AMD and Marvell are on track for substantial growth in the upcoming year. However, Marvell is expected to outpace AMD. Despite this, there are reasons why AMD may still present a better opportunity for investors.

For starters, AMD’s stock currently appears to be the more affordable option compared to Marvell when evaluating sales and forward earnings ratios.

AMD PE ratio (forward), data by YCharts; PS = price to sales. PE= price to earnings.

Additionally, AMD boasts a broader AI portfolio, supplying both CPUs and GPUs across data centers and personal computers. This could give AMD a larger share of the AI market compared to Marvell.

Investors may find AMD appealing as a balanced choice between growth and value, despite this year’s stock struggles.

Is Advanced Micro Devices Worth a $1,000 Investment Right Now?

Before committing to AMD stocks, consider this advice:

The Motley Fool Stock Advisor team has highlighted what they believe to be the 10 best stocks to invest in currently, and AMD is absent from this list. The selected stocks are positioned for potentially significant returns in the coming years.

For instance, Nvidia made this list on April 15, 2005. If you had invested $1,000 then, it would be worth $822,755.

Stock Advisor provides a strategic guide for investors, offering portfolio-building advice, regular updates, and two new stock recommendations each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002.*

Check out the 10 top stocks »

*Returns as recorded on December 9, 2024

Harsh Chauhan has no stake in any mentioned stocks. The Motley Fool holds positions in Advanced Micro Devices, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing, and recommends Marvell Technology and Gartner. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.