Maximize Your Investment: The Race Between Nvidia and Palantir

With cash building up in your savings or leftover bonuses waiting to be invested, deciding where to put your money can be challenging. The S&P 500 has been on fire, gaining more than 20% over the past two years, making it daunting to jump into the market now.

However, declining interest rates in savings accounts may prompt you to consider a more aggressive investment strategy. If you’re young or have other conservative investments, this might be the perfect moment to take the plunge.

Palantir’s Rising Influence

The booming artificial intelligence (AI) sector is a smart option. Companies like Nvidia (NASDAQ: NVDA) and Palantir Technologies (NASDAQ: PLTR) show significant potential, even after their impressive stock performances. Nvidia has dominated the headlines recently, but it may surprise you to learn that Palantir has outperformed Nvidia in stock returns.

Over the last three years, Palantir’s stock price soared a staggering 750%. This growth stems from its innovative AI software platforms designed for data management and security, expanding from military applications to commercial markets.

Nvidia, meanwhile, also realized a remarkable growth of 425% during this time, aided by its advanced AI hardware and software. Recently, Palantir has been the centerpiece, with most of its gains happening in just the past year.

Driving this momentum is Palantir’s rapid sales growth, especially as U.S. government and financial agencies focus on optimizing efficiencies and solving complex problems—both key aspects of Palantir’s offerings.

Fast Growth from Two Giants

Both Palantir and Nvidia are on a growth trajectory. Palantir’s sales grew by 29% year-over-year in 2024, with a predicted 31% growth for 2025. Notably, it has an operating profit margin of 39% for the same year.

On the other hand, Nvidia is experiencing even faster growth. With a market capitalization of nearly $3.2 trillion, compared to Palantir’s $250 billion, Nvidia is set to report a phenomenal growth rate of about 110% year-over-year for the fiscal year ending in January 2025.

Understanding Stock Valuations

When it comes to stock value, Nvidia has shown steady revenue growth, with high-teens percentages over the past half-year. In contrast, Palantir’s quarter-over-quarter growth has accelerated to 14% recently.

Despite Palantir’s impressive growth, it faces high valuation metrics, such as a forward price-to-earnings (P/E) ratio of 200, and a price-to-sales (P/S) ratio of 67. In contrast, Nvidia’s metrics stand at approximately 30 and 16, making it appear more appealing based on traditional valuation measures.

Nvidia: A Bright Future Ahead

Nvidia’s sales forecast looks strong, largely driven by its cutting-edge AI chips and an ecosystem that keeps demand high. Even if growth slows, its stock might still present better value than Palantir due to lower valuations.

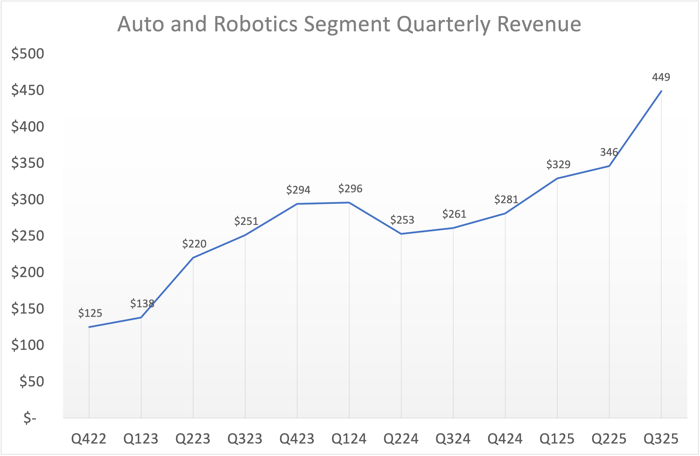

Additionally, Nvidia’s technology stands to benefit from advancements in self-driving automobiles and robotics, which could emerge as significant growth areas in the future.

Data source: Nvidia. Chart by author.

Though Palantir offers potential as both a business and an investment, it might be wise for investors who can handle risk to consider this AI company gradually.

Nonetheless, Nvidia appears to possess more immediate growth prospects and better value, making it an attractive AI stock to buy right now.

Is $1,000 in Nvidia a Smart Move Today?

Before committing your money to Nvidia, consider that the Motley Fool Stock Advisor analyst team has identified other top stocks that might outperform—including ten that are currently recommended.

If you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would now hold an impressive $813,868!

The Stock Advisor program offers a straightforward guide to investment strategies, monthly new stock recommendations, and ongoing analyst updates. Since its inception, Stock Advisor has significantly outperformed the S&P 500, achieving returns more than four times higher since 2002.

Learn more »

*Stock Advisor returns as of February 7, 2025

Howard Smith holds shares in Nvidia. The Motley Fool recommends Nvidia and Palantir Technologies. For more details on the disclosure policy, please visit their site.

The views expressed in this article reflect those of the author and may not necessarily represent those of Nasdaq, Inc.