We perused the Global 100 list of most sustainable corporations by Corporate Knights and stumbled upon a surprise – SMA Solar Technology AG (OTCPK:SMTGF) (OTCPK:SMTGY). This European renewable energy player, often overshadowed by the likes of Enphase Energy (NASDAQ:ENPH) and SolarEdge (SEDG), had quietly made its mark.

We were taken aback by SMA Solar’s impressive progression and astoundingly reasonable valuation, offering exposure to markets similar to Enphase and SolarEdge. Encouraged by this, we kick-started our investment journey with a small stake in the company.

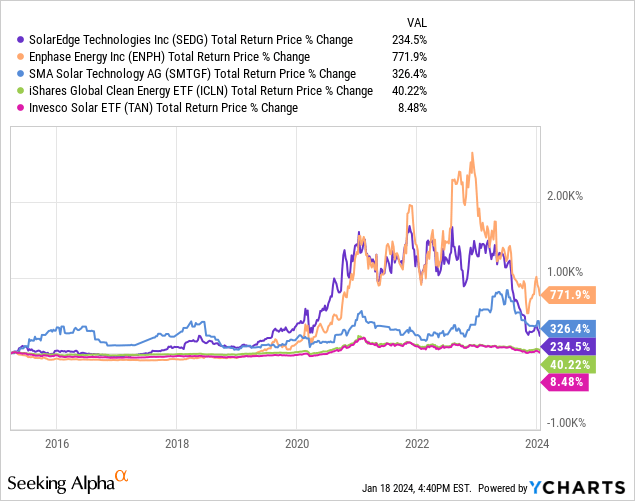

Strangely, SMA is not extolled as it deserves, even though its ten-year total return performance has been solid. It has lagged behind Enphase but outperformed SolarEdge and major clean energy ETFs.

Unearthing SMA’s Potential

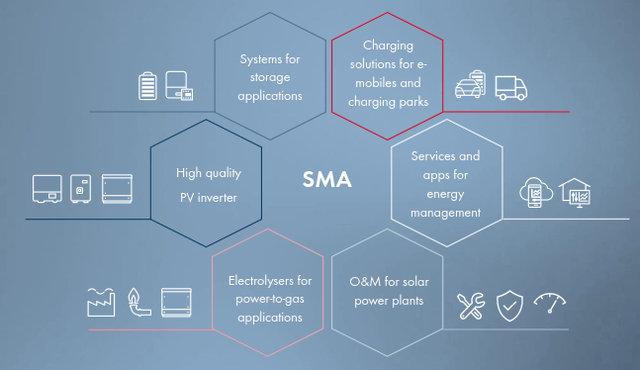

SMA defines itself as an “energy transition” company, offering a plethora of clean energy products and services. While primarily known for its solar inverters, it has been diversifying its portfolio to include energy management, boasting an installed base of over 120 GW of solar inverters across 190 countries.

The company’s strategic expansion includes ventures into electric vehicle charging solutions, hydrogen projects, and the integration of battery energy storage systems, a move that has fortified its competitive position. Moreover, SMA anticipates rapid growth across its business segments, with an average 21% CAGR through 2026.

Financial Fortitude

Although SMA’s financial results have notably improved, sustaining this upsurge remains uncertain. Yet, it’s compelling that profitability surged to 180 million Euros in the first nine months of 2023 from a meager 11 million Euros in the same period of 2022. Additionally, the company managed to reverse its free cash flow to 79 million Euros despite increased CapEx.

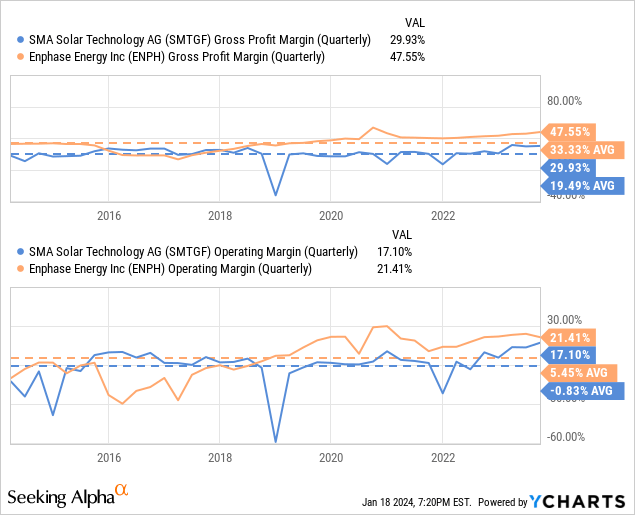

SMA’s gross margin, while showing improvement, still trails Enphase. The ascent to a gross margin 10% above its decade-long average is commendable, but it needs further progress to close the gap with its peer.

Revival and Rivalry

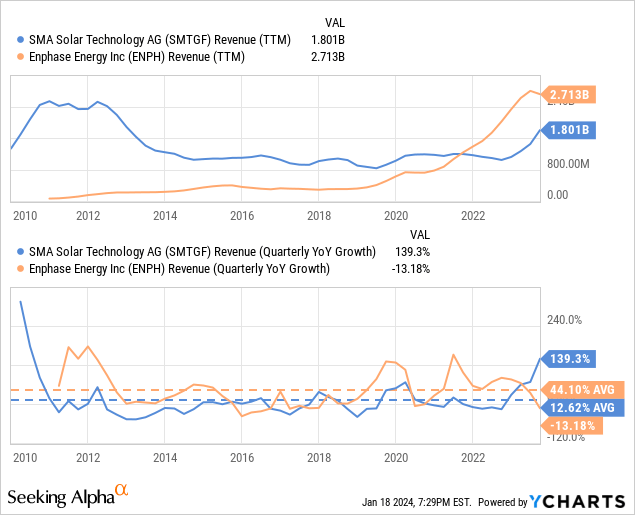

Enphase’s revenue growth has been staggering in recent years, but SMA has now begun to exhibit rapid growth, coinciding with Enphase’s struggle to maintain its previous momentum. This resurgence might signal SMA’s reclamation of lost market share.

Financial Foundation

Both companies exhibit robust balance sheets, with SMA carrying virtually no long-term debt and boasting a net cash position of approximately $300 million. In contrast, Enphase holds about $1.8 billion in debt, with a significant chunk offset by cash and short-term investments of nearly $1.3 billion, rendering the net debt eminently manageable given Enphase’s current EBITDA of almost $700 million.