AI’s Growing Role in Defense: A Look at Meta and Palantir

Investors are paying more attention to the potential of artificial intelligence (AI) in various sectors. However, much of the conversation around AI has felt repetitive.

While software companies highlight how AI can boost workplace productivity, the hardware and infrastructure sectors control essential components like data centers and semiconductor chips critical for AI development.

Recently, I’ve discovered a new dimension to AI’s application: the military sector. I knew that Palantir Technologies (NYSE: PLTR) played a significant role in AI and public projects, but a recent announcement from Meta Platforms (NASDAQ: META) has expanded my perspective on AI in defense.

This article will explain the significance of Meta’s partnership with Palantir while evaluating which stock offers the best investment opportunity as the military embraces AI technology.

Meta’s Support for Military Advancements

A major shift within AI technology has been the introduction of large language models (LLMs). You might be familiar with OpenAI’s ChatGPT, one of the leading LLMs available today.

Personally, I’ve found using ChatGPT to be quite useful, whether for answering questions or assisting in coding for personal projects.

What I didn’t realize is that LLMs extend far beyond just productivity enhancements. According to a press release from Meta, their Llama AI model will be used to aid the U.S. government and related private sector contractors.

This initiative includes using LLMs to speed up defense research, identify security risks, and facilitate better communications across different systems.

The operational challenges faced by the military often mirror those in the private sector. However, the military’s main priority isn’t just efficiency; safety is paramount. Research from Mordor Intelligence estimates that the market for AI analytics and robotic services in defense could surpass $60 billion within the next five years.

Meta’s partnership with Palantir marks a significant step in deploying Llama within the public sector. Here, I’ll examine valuation trends and key points about both companies to determine which stock presents a more attractive investment right now.

Image source: Getty Images.

Assessing Meta Stock: A Cautious Optimism

Meta’s approach to AI is clear. The company oversees influential social media platforms like Facebook, Instagram, and WhatsApp. Additionally, it is expanding in virtual reality, gaming, and the metaverse.

As Meta digs deeper into AI, it stands to enhance its understanding of user behavior. This advantage could refine its advertising strategies, leading to improved engagement. Furthermore, the array of virtual reality and gaming offerings diversifies its revenue sources beyond just advertising.

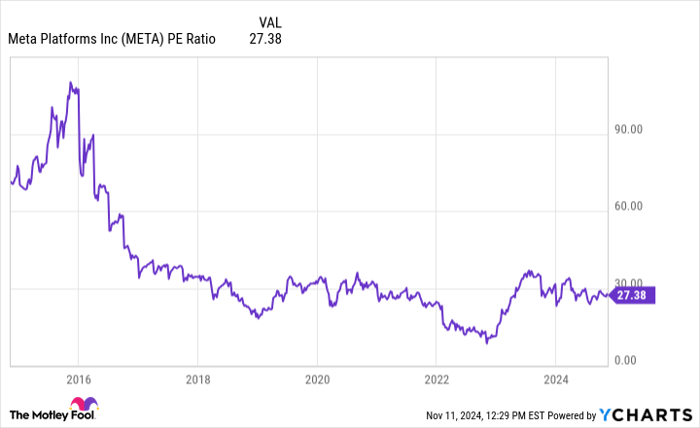

META PE Ratio data by YCharts

Meta’s entry into the defense sector and expansion of its public sector AI capabilities is a strategic move that could shape its long-term growth. Despite these promising developments, the company’s price-to-earnings (P/E) ratio stands at 27, which is relatively low historically. This suggests that investors might be missing out on significant growth drivers, making now a potential buying opportunity for Meta.

Evaluating Palantir Stock: A Pause for Reflection

Palantir has emerged as an influential force in AI, especially after launching the Palantir Artificial Intelligence Platform (AIP) in April 2023. This development has led to rapid customer growth, increasing revenues, and consistent profits.

Palantir’s advancements are noteworthy. The company recently formed partnerships with cloud services leader Oracle and Microsoft, integrating AIP with Microsoft’s Azure cloud for use by U.S. defense agencies.

Such progress has significantly affected Palantir’s stock performance, with shares appreciating over 240% this year, making it the second-best performer in the S&P 500.

With a market cap around $140 billion and a price-to-sales (P/S) ratio of 53, Palantir’s valuation appears stretched. While I maintain a positive outlook on its future and plan to remain a shareholder, the current momentum and valuation make me hesitant to recommend buying right now. I suggest investors keep an eye out for potential price corrections to consider purchasing shares at a better price.

Timing Your Investment for Maximum Returns

Have you ever felt you missed out on investing in successful companies? If so, this might be a critical moment for you.

Occasionally, our team of analysts offers a “Double Down” recommendation for stocks they believe are on the verge of significant gains. If you think you’ve missed your chance, now could be the ideal time to invest before new opportunities arise in the market.

- Amazon: If you had invested $1,000 when we issued our recommendation in 2010, you’d now have $23,818!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $43,221!*

- Netflix: Investing $1,000 in 2004 would have grown to $451,527!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Meta Platforms, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.