Nvidia vs. Broadcom: The AI Chip Battle Heats Up for 2025

In the realm of artificial intelligence (AI) infrastructure, Nvidia (NASDAQ: NVDA) stands tall in 2024, but Broadcom (NASDAQ: AVGO) aims to compete fiercely in 2025.

Both companies have seen substantial stock growth this year, with Nvidia’s shares soaring over 170% and Broadcom climbing about 107%. This article explores which semiconductor company may be the smarter investment heading into 2025.

Start Your Mornings Smarter! Stay informed with Breakfast News delivered straight to your inbox each market day. Sign Up For Free »

Nvidia’s Dominance in AI Infrastructure

Nvidia has emerged as the chief beneficiary of the ongoing AI boom. As a leading manufacturer of graphics processing units (GPUs), the company’s chips are the foundation for AI infrastructure. Large language models (LLMs) and AI inference demand immense computing power, and GPUs excel at delivering high performance through parallel processing.

Nvidia’s success can be attributed to its CUDA software platform, which was designed to enable developers to use its GPUs for a wider array of tasks beyond gaming. Since its introduction, CUDA has become essential for training GPUs, establishing Nvidia’s stronghold with approximately 90% of the GPU market.

The synergy between Nvidia’s advanced GPUs and the competitive advantage provided by CUDA has resulted in breathtaking growth. For instance, in the first nine months of its fiscal 2025, ending January 2025, Nvidia reported a revenue increase of 135% to $91.2 billion, and its most recent quarter saw a 94% jump to $35.1 billion.

As AI models demand even more computing resources, Nvidia’s growth outlook remains bright. Recent developments in models from Alphabet‘s Llama and xAI’s Grok require up to 10 times the GPU power compared to earlier iterations. Nvidia’s hyperscale customers, who operate massive data centers, anticipate boosting their AI infrastructure investments, viewing AI as a once-in-a-generation opportunity. Analysts are optimistic, projecting revenue growth of over 50% for Nvidia next year.

Image source: Getty Images.

While Nvidia leads the AI chip landscape, Broadcom is making strides by offering custom AI chip solutions. The company’s application-specific integrated circuits (ASICs) are tailored to meet specific client needs, enhancing performance and energy efficiency.

Broadcom attracted attention from Alphabet, the first to utilize its technology for creating a bespoke AI chip. This tensor-processing unit (TPU), named Trillium, is optimized for work within Google’s TensorFlow, a prominent software library for AI and machine learning. According to Alphabet, these TPUs feature distinctive elements such as a matrix multiply unit (MXU) and unique interconnect design that set them apart from standard GPUs.

Despite initial rumors of Alphabet potentially pursuing an independent approach, Broadcom secured the contract for the next generation of Alphabet’s TPUs. The company has also gained traction with four additional custom AI chip clients this year. Customers include Meta Platforms and ByteDance, with speculation surrounding more recent partnerships with OpenAI and Apple.

In its latest earnings call, Broadcom emphasized that its three largest custom AI chip clients represent a market opportunity worth $60 to $90 billion by fiscal 2027. These clients plan to deploy 1 million of Broadcom’s custom AI chips by this target date, with the potential for newer customers to further expand that number. For context, Alphabet took 15 months to develop and implement its custom TPUs within its facilities.

Though Broadcom’s AI prospects are substantial, there’s a distinction between potential market size and actual revenue. The company operates in various semiconductor and software sectors outside of AI, which do not see the same rapid growth. Broadcom’s organic revenue grew only 11% in the last quarter when excluding its acquisition of VMware. Analysts predict an 18% revenue increase for the current fiscal year ending October 31, 2025, followed by a 14% rise the following year.

Comparing Valuations and Future Outlooks

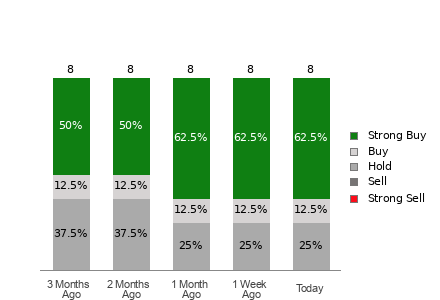

Nvidia currently enjoys a more favorable valuation than Broadcom, with a forward price-to-earnings (P/E) ratio of around 30, compared to Broadcom’s over 33. Additionally, Nvidia’s revenue growth is significantly outpacing Broadcom’s and is expected to continue its upward trajectory into 2025. Nvidia also holds a strong financial position with approximately $30 billion in net cash, while Broadcom carries $48.3 billion in net debt.

NVDA PE Ratio (Forward 1y) data by YCharts.

Broadcom has generated considerable excitement with its remarks regarding its AI addressable market, which recently fueled its stock price rise. Conversely, Nvidia faced challenges toward the end of the year. Although Broadcom has gained momentum, Nvidia now presents greater value and is anticipated to maintain superior short-term growth.

Questions remain about Broadcom’s capacity to emerge as the dominant force in AI chips. However, both companies have the potential to thrive in 2025. Investors might want to consider Nvidia for its current growth and attractive valuation.

Don’t Miss Out on Another Investment Opportunity

Wishing you’d invested in successful stocks earlier? Here’s your chance to join in.

From time to time, our analysts recommend a “Double Down” stock – a company poised for significant gains. If you’re concerned that you missed the opportunity, now might be the best moment to invest before it’s too late. Here’s a quick look at past recommendations:

- Nvidia: if you invested $1,000 when recommended in 2009, you’d have $338,103!*

- Apple: if invested $1,000 when recommended in 2008, you’d have $48,005!*

- Netflix: if invested $1,000 when recommended in 2004, you’d have $495,679!*

Currently, we’re issuing alerts for three promising “Double Down” stocks, and you won’t want to miss your chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook, and sister to Meta Platforms CEO Mark Zuckerberg, is also on The Motley Fool’s board. Geoffrey Seiler has positions in Alphabet. The Motley Fool holds positions in and recommends Alphabet, Apple, Meta Platforms, and Nvidia, while also recommending Broadcom. The Motley Fool has a disclosure policy.

The views expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.