Understanding the Semiconductor Boom: Nvidia vs. TSMC

The past two years have seen semiconductor stocks soar, with the PHLX Semiconductor Sector index increasing by 81%. This impressive rise can largely be attributed to the booming demand for artificial intelligence (AI) technology.

Nvidia (NASDAQ: NVDA) has emerged as a significant winner during this period, achieving a remarkable 702% gain as various sectors scramble to acquire its AI chips. In contrast, its primary manufacturing partner, Taiwan Semiconductor Manufacturing (NYSE: TSM), often referred to as TSMC, has seen a more modest increase of 142% in the same timeframe.

As the largest semiconductor foundry in the world, TSMC plays a crucial role in the industry. While fabless design companies like Nvidia rely on TSMC’s facilities to produce their chips, TSMC’s influence spans a wider range of products. This article will delve into the outlook and valuations of both companies to determine which semiconductor stock might be the better investment following their impressive gains.

Why Nvidia is Compelling

Nvidia’s standout position in the AI chip market is its primary selling point. Estimates indicate that it controls over 90% of the AI chip market. This level of dominance helps explain why Nvidia’s competitors lag far behind in sales.

For instance, Nvidia sold $27.6 billion worth of data center compute chips in the third quarter of fiscal 2025, which marks an impressive 132% increase compared to the same quarter last year. In comparison, Advanced Micro Devices anticipates selling only $5 billion worth of data center GPUs in 2024.

Nvidia’s revenue from AI GPU sales exceeds five times what AMD expects to earn from this segment throughout the year. Meanwhile, Intel reported $3.3 billion in combined data center and AI revenue last quarter, representing a modest 9% year-over-year increase. Clearly, Nvidia is outpacing its competitors in the AI chip sphere.

This competitive edge is bolstered by Nvidia’s successful acquisition of a significant portion of TSMC’s advanced chip-packaging facilities. According to Taiwan-based DigiTimes, Nvidia secured 60% of TSMC’s Chip on Wafer on Substrate (CoWoS) packaging capacity for 2025. TSMC also plans to more than double its CoWoS capacity in the coming year.

With TSMC expanding production capacity, Nvidia is well-positioned for another year of substantial growth in 2025. Reports suggest that its Blackwell supply may already be sold out for nearly all of that year, making TSMC’s increased capacity especially crucial.

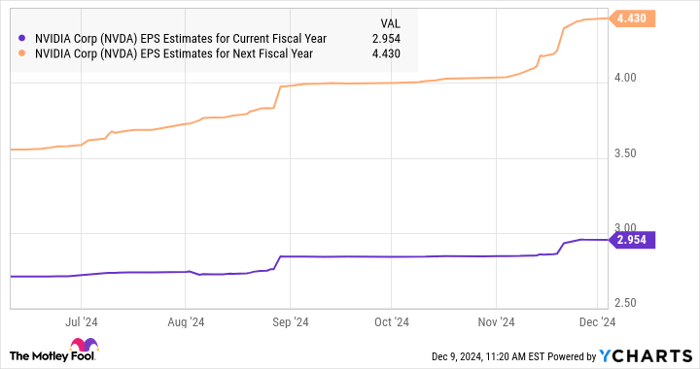

Although Nvidia is currently pushing to ramp up production of its Blackwell processors, this effort may temporarily constrain profit margins. However, as indicated in the following chart, Nvidia is on track for a substantial uptick in its bottom line in the next fiscal year, starting in late January 2025.

NVDA Earnings-Per-Share (EPS) Estimates for Current Fiscal Year data by YCharts.

With production of its new processors ramping up and margin concerns easing, Nvidia’s earnings estimates could continue to rise, suggesting robust performance ahead.

Why TSMC is Attractive

Although TSMC’s market performance lags behind Nvidia’s, its diversified business model offers stability. As a key manufacturer for numerous fabless chipmakers, TSMC occupies a vital role in the AI chip market.

In addition to serving companies like Nvidia, TSMC manufactures custom chips for major players such as Broadcom and Marvell Technology, smartphone chips for Qualcomm and Apple, and CPUs and GPUs for AMD. This positions TSMC favorably to benefit from various growth opportunities within the semiconductor landscape.

For example, demand for specialized AI chips, or application-specific integrated circuits (ASICs), is expected to rise at an annual rate of 32% over the next six years. Both Broadcom and Marvell have reportedly increased orders with TSMC to meet rising demand.

Besides, the increasing need for generative AI-enabled smartphones and computers will underpin demand for Qualcomm, Apple, and AMD products. Recently, Qualcomm saw a boost in smartphone processor sales, and it is expected to maintain its strong position in the generative AI market. Similarly, Apple’s smartphone sales are predicted to grow further next year.

As TSMC’s largest customer, Apple’s success in the smartphone sector is a significant advantage for the foundry, allowing it to capitalize on the emerging generative AI market. Consequently, analysts expect TSMC’s earnings to grow by 36% this year, with additional solid growth forecasted in the following years.

TSM EPS Estimates for Current Fiscal Year data by YCharts.

Final Thoughts

While TSMC may appear more diversified, it is evident that Nvidia is experiencing rapid growth. However, this growth comes at a higher price, as seen in the following chart:

NVDA P/E Ratio data by YCharts.

Those willing to accept higher risk might find Nvidia a compelling buy, as it seems on track to justify its current valuation. Conversely, investors looking for a more affordable yet steadily growing semiconductor company might consider TSMC, as its critical role in the industry positions it for sustained growth.

Explore This Potential Investment Opportunity

Ever feel like you’ve missed out on top-performing stocks? You’re not alone.

On special occasions, our expert analysts issue a “Double Down” stock recommendation for companies they believe are on the verge of significant gains. If you’re concerned you’ve missed your chance to invest, now may be the optimal moment to act before it’s too late. Consider these compelling numbers:

- Nvidia: Investing $1,000 when we recommended it in 2009 would now be worth $359,936!*

- Apple: An investment of $1,000 from 2008 would have grown to $46,730!*

- Netflix: If you invested $1,000 when we recommended it in 2004, you’d hold $492,745!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Marvell Technology and makes the following options recommendations: short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.