The E.W. Scripps Company (SSP) and TEGNA (TGNA) are navigating different paths in the local media industry. As of Q1 2025, SSP reported revenues of $325 million with a segment profit of $35 million, while TEGNA faced challenges, including a total debt of $3.08 billion and flat distribution revenues.

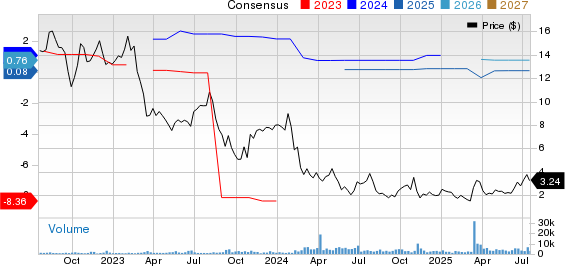

SSP’s recent acquisition of KKTV in Colorado Springs is expected to enhance its presence in the Western U.S. market. Conversely, TEGNA’s advertising and marketing sectors have struggled due to macroeconomic conditions, leading to a Zacks Consensus Estimate of $1.61 per share for 2025, down 47.56% year-over-year. In comparison, SSP’s earnings estimate of 8 cents per share suggests a 92.59% decline.

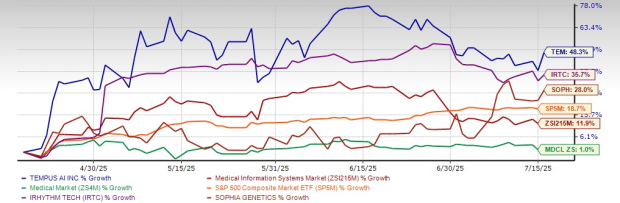

Year-to-date, SSP shares have gained 41.2%, while TGNA shares have lost 8.6%. Concerns over TEGNA’s high debt and stagnant growth signal potential risks, whereas SSP’s strategic growth initiatives position it for future gains.