The Electric Vehicle Showdown: Tesla vs. Rivian

As electric vehicles gain popularity, Tesla Inc TSLA and Rivian Automotive Inc RIVN are at the forefront of the U.S. market.

While Tesla enjoys a robust profit model, Rivian has struggled with significant cash losses, depending on partners like Volkswagen AG VLKAF to sustain operations.

The critical question remains: who holds the advantage in the race for electric vehicles, and can Rivian’s adventurous brand and collaborative efforts help it catch up?

Profitability: Tesla’s Earnings vs. Rivian’s Losses

Tesla has established itself as a leader in profitability, proving that electric vehicles can thrive in a crowded marketplace.

In stark contrast, Rivian faced a $1.46 billion loss in the second quarter, which translates to about $33,000 in losses for every vehicle sold. Despite the company’s initial excitement and a record-setting IPO, it faces significant hurdles in achieving profitability.

Branding and Product Offerings: Tesla’s Technology vs. Rivian’s Adventure Appeal

Tesla’s focus on technology and efficiency keeps it dominant in urban and suburban environments, with the highly anticipated Cybertruck drawing interest even from skeptics.

Read Also: Tesla Engineer Denies Prioritizing ‘Affluent’ Cybertruck Owners For Lightbar Installation

On the other hand, Rivian’s rugged R1T and R1S vehicles appeal to adventure seekers, although ongoing reliability challenges could threaten its niche market position.

Upcoming mid-size offerings like the R2 and R3 might enhance Rivian’s appeal if the company can streamline production processes.

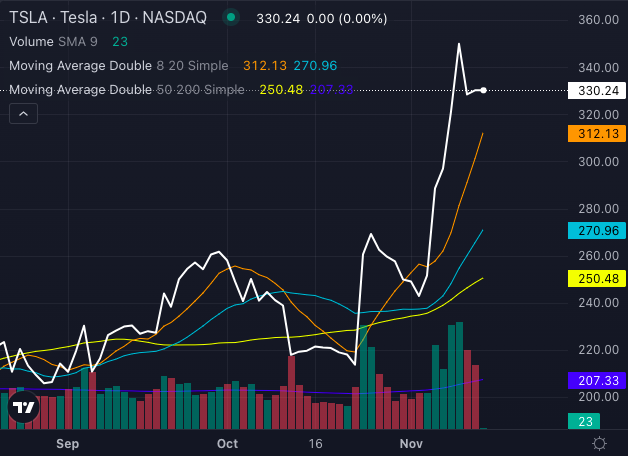

Market Performance: Tesla’s Steady Gains vs. Rivian’s Volatile Stock

Chart created using Benzinga Pro

Tesla’s stock has shown strong growth, consistently surpassing key moving averages, which signals investor confidence.

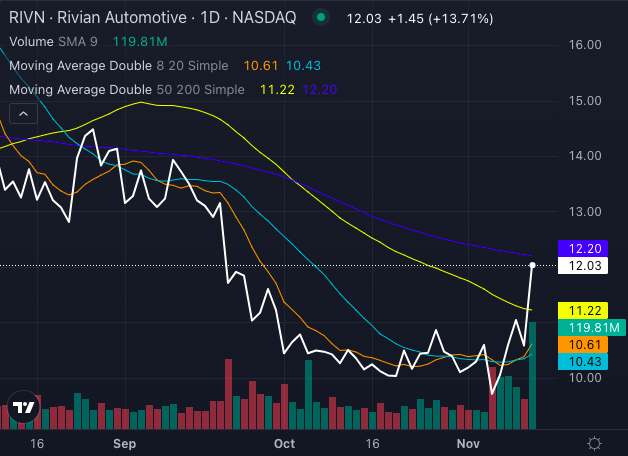

Chart created using Benzinga Pro

In contrast, despite receiving a lift from its partnership with Volkswagen, Rivian’s stock has been unstable. With indicators showing mixed results, investor sentiment appears to be cautious regarding Rivian’s future potential.

Read Next:

Rivian vs Tesla. Photos via Shutterstock

Market News and Data brought to you by Benzinga APIs