AppFolio’s Growth and Challenges: Navigating the Property Management Sector

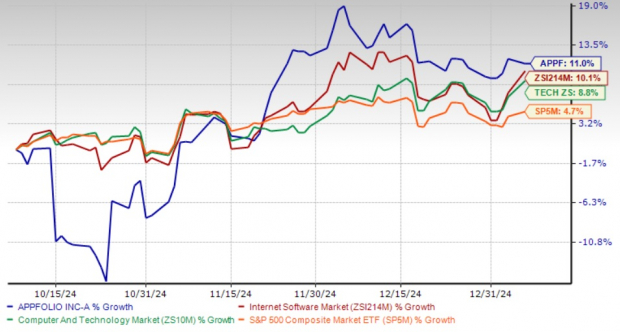

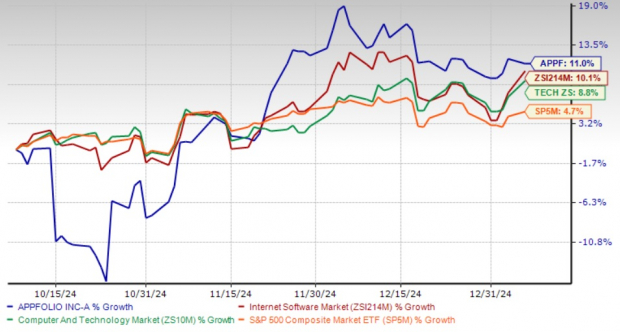

AppFolio (APPF) shares have increased by 11% over the past three months, surpassing the Zacks Computer Technology sector, the Zacks Internet Software industry, and the S&P 500, which reported returns of 8.8%, 10.1%, and 4.7%, respectively. This outperformance highlights investor confidence in AppFolio’s innovative platform and diverse product offerings.

With an impressive Growth Score of A, AppFolio successfully consolidates key metrics from its financial statements, revealing the strength and sustainability of its growth trajectory.

Earnings forecasts suggest a significant improvement, with expectations of 28.3% and 21.9% growth in 2025 and 2026, respectively. Revenue for these years is anticipated to rise by 18.2% and 17.5%.

Innovative Solutions Driving AppFolio Forward

AppFolio is transforming the property management industry by leveraging artificial intelligence (AI) within its platform. This integration aims to streamline the often cumbersome customer onboarding process, which traditionally deterred property managers, landlords, and housing associations from adopting new software. By automating much of this process, AppFolio enhances efficiency through AI-driven workflows.

AppFolio Price Performance Chart

Image Source: Zacks Investment Research

Among its recent enhancements is the introduction of generative AI, which allows clients to input financial and operational data as needed. Additionally, Realm-X, an AI conversational assistant, minimizes repetitive tasks, answers questions, and helps maintain smooth operations. Such innovations place AppFolio in a prominent position in the U.S. property management software market, as emphasized in a 6sense report.

Collaborations with established names like DocuSign (DOCU), AvidXchange (AVDX), and Amazon (AMZN) have also strengthened AppFolio’s service offerings. The DocuSign partnership eases contract management through e-signatures, while AvidXchange enhances invoice and payment processing.

Further integration with Amazon Apartment Locker automates package management, demonstrating AppFolio’s commitment to comprehensive service solutions. These strategic partnerships contribute to steady growth, with the company reporting a customer base of 20,403 in the third quarter of 2024, marking a year-over-year increase of 5.1%.

Valuation Concerns for AppFolio

While AppFolio has enjoyed exceptional performance recently, its stock valuation has reached a high level. Currently, shares trade at a forward 12-month price-to-earnings (P/E) ratio of 44.2X, significantly above the industry average of 35.79X. This premium pricing may limit potential short-term gains for APPF stock.

Additionally, AppFolio holds a Zacks Value Style Score of F, indicating its present valuation appears stretched.

Investment Outlook: Hold APPF Stock

Given AppFolio’s strong product line, rising customer base, and impressive growth projections, investors may find it beneficial to hold onto the stock. Nonetheless, the elevated valuation suggests limited growth potential in the short term.

In light of these insights, it is wise to maintain a Zacks Rank #3 (Hold) status for this stock presently. You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each of these stocks has been selected by a Zacks expert as the top pick to gain +100% or more in 2024. While not all choices can succeed, previous recommendations have seen gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks in this report are off Wall Street’s radar, presenting an excellent opportunity to get in early.

Discover These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

AppFolio, Inc. (APPF): Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX): Free Stock Analysis Report

DocuSign Inc. (DOCU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.