Analyst Predictions Signal Potential Growth for Vanguard Russell 1000 Value ETF

Our analysis at ETF Channel provides insights into the potential upside for the Vanguard Russell 1000 Value ETF (Symbol: VONV). After examining its underlying holdings, we discovered that the average implied analyst target price for the ETF is $94.01 per unit.

Current Trading Performance and Analyst Insights

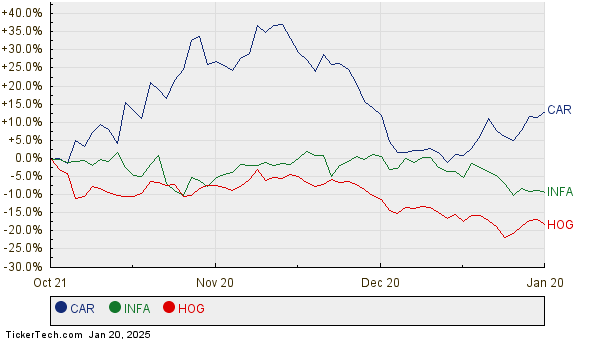

As VONV trades at approximately $84.06 per unit, analysts anticipate an 11.84% increase based on these target prices. Among VONV’s holdings, Avis Budget Group Inc (Symbol: CAR), Informatica Inc (Symbol: INFA), and Harley-Davidson Inc (Symbol: HOG) stand out due to their significant upside potential. CAR’s recent price is $90.19 per share, while the average target is 36.94% higher at $123.50 per share. INFA, trading at $24.38, shows a 36.72% upside to its target price of $33.33. HOG is expected to rise to $38.50, reflecting a 32.58% increase from its recent trading price of $29.04. Below, a chart displays their price trends over the past year:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Value ETF | VONV | $84.06 | $94.01 | 11.84% |

| Avis Budget Group Inc | CAR | $90.19 | $123.50 | 36.94% |

| Informatica Inc | INFA | $24.38 | $33.33 | 36.72% |

| Harley-Davidson Inc | HOG | $29.04 | $38.50 | 32.58% |

The Road Ahead: Analyst Justifications or Overoptimism?

Are analysts’ targets reasonable or overly optimistic for these companies? Evaluating whether analysts have valid reasons for their expectations is crucial for investors. While high price targets may indicate confidence in the future, they could also signal possible downgrades if based on outdated information. Investors should conduct their research to gauge the potential of these stocks effectively.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• APTV DMA

• ED shares outstanding history

• FIF Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.