Walmart to Reveal Consumer Trends in Upcoming Q4 Earnings Report

Scheduled for release on Thursday, February 20, Walmart’s WMT Q4 earnings report aims to shed light on current shopping habits. Amid a backdrop of easing inflation seen after recent rate cuts in 2024, Walmart retains an edge over Target TGT by leading in low-cost alternatives. The retailer’s growth in e-commerce also strengthens its competition against Amazon AMZN.

What to Expect from Walmart’s Q4 Earnings

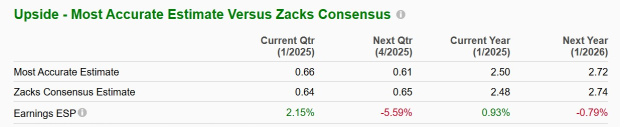

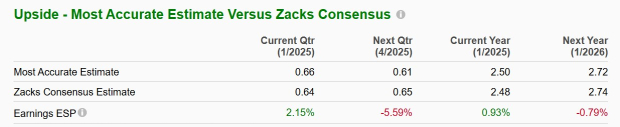

Walmart’s Q4 sales are projected to rise 3% from last year, reaching approximately $179.18 billion. In terms of earnings per share (EPS), predictions suggest a 6% increase, estimating it at $0.64. The Zacks Expected Surprise Prediction (ESP) indicates Walmart may outpace earnings forecasts, with the latest revision suggesting a higher EPS of $0.66—2% more than the current Zacks Consensus.

Image Source: Zacks Investment Research

Walmart has successfully met or surpassed earnings predictions for the past ten quarters, averaging a surprising EPS uptick of 9.25% during its last four quarterly evaluations.

Image Source: Zacks Investment Research

Walmart’s Future Projections

For fiscal year 2025, Walmart anticipates a total sales increase of 5%, reaching $678.56 billion compared to $648.13 billion the previous year. Zacks estimates also suggest a further sales growth of 4% in fiscal year 2026, with total sales potentially hitting $704.61 billion.

In terms of earnings, Walmart’s annual EPS is expected to rise by 12% to $2.48, up from $2.22 in fiscal year 2024. Further growth is anticipated, with EPS projected to increase an additional 11% in fiscal year 2026 to $2.74.

Image Source: Zacks Investment Research

Walmart’s Stock Performance and Valuation Analysis

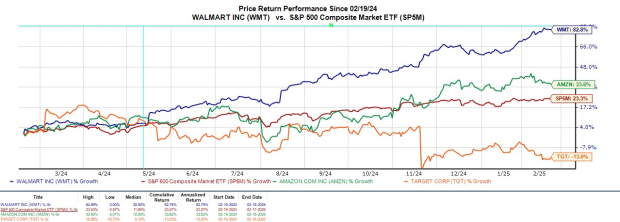

With Walmart’s stock price up over 70% since its three-for-one stock split last February, the question remains whether investors should consider buying now. Compared to the broader market and Amazon’s 33% growth, Walmart has shown substantial outperformance, especially against Target’s notable drop of 13%.

Image Source: Zacks Investment Research

Currently trading around $103, Walmart’s stock is valued at a forward earnings multiple of 37.9, significantly higher than the S&P 500’s 23. Meanwhile, it is also above Target’s 13.7 but close to Amazon’s 36.2.

Image Source: Zacks Investment Research

Conclusion

As Walmart approaches its Q4 earnings announcement, the stock holds a Zacks Rank #2 (Buy). The company’s EPS growth trajectory is beginning to substantiate its higher price-to-earnings ratio compared to the overall market, particularly since Zacks ESP indicates a potential upside in quarterly earnings.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.