“`html

Constellation Energy (CEG) experienced a significant 25% increase on Friday, reaching all-time highs following its announcement to acquire the natural gas and geothermal powerhouse Calpine.

This acquisition establishes the largest clean energy company in the United States, reinforcing Constellation Energy’s position as a top long-term investment in both the energy sector and artificial intelligence.

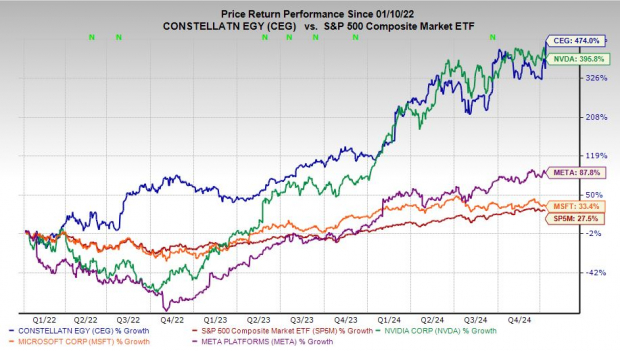

With a Zacks Rank of #2 (Buy), CEG has outperformed several prominent AI tech stocks in recent years, including Nvidia, and indications suggest it’s poised for further gains as 2025 approaches.

Reasons to Consider Constellation Energy as a Top Investment

As the largest operator of nuclear power plants in the U.S., Constellation runs over 20 reactors at multiple sites across the Midwest, Mid-Atlantic, and Northeast. Over the past three years, CEG stock has surged by 475%, outperforming even Nvidia.

The investment community is increasingly turning to Constellation, as nuclear energy is expected to play a vital role in powering the growing demand from the AI sector, particularly as coal plants are phased out.

Support from the U.S. government is boosting Constellation’s prospects, with plans to increase nuclear energy capacity threefold by 2050. This form of energy is seen as a reliable source, offering baseload power that is 2.5 to 3.5 times more dependable than alternatives like wind and solar.

In 2024, nuclear energy dominated the U.S. clean energy landscape and has consistently provided roughly 20% of the country’s electricity since 1990. Countries such as China and India are also investing heavily in nuclear energy to ensure their economic growth and energy independence.

Image Source: Zacks Investment Research

With the government’s backing, Constellation raised its dividend by 25% in 2024, exceeding its goal of 10% annual growth, showcasing its robust financial health.

The company is also retrofitting its existing nuclear plants to extend their operating life, reopening decommissioned facilities, and exploring advanced technologies.

In November, Constellation projected visible long-term growth with an expected earnings increase of 66% in 2024 and 10% in 2025, bolstered by the Nuclear Production Tax Credit.

For the past few years, Constellation has reassured investors of its commitment to acquisitions and returning value to shareholders.

Calpine: A Strategic Acquisition in the Energy Landscape

Notably, generative AI platforms require ten times more energy than a simple Google search, with some AI data centers consuming as much electricity as mid-sized cities.

Projected capital expenditures for big tech are set to reach $250 billion by 2025, and Microsoft plans to invest $80 billion this year exclusively on AI data centers. In September, CEG made headlines by securing a 20-year power purchase agreement with Microsoft (MSFT), while other tech giants also engaged in nuclear power contracts in 2024.

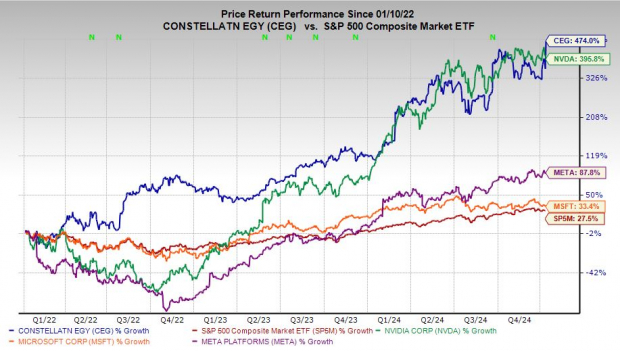

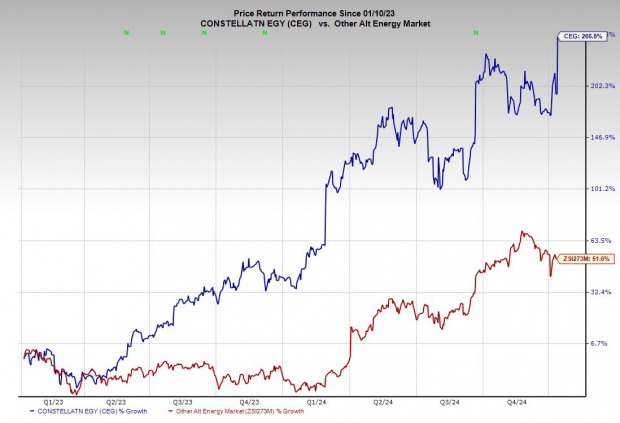

Image Source: Zacks Investment Research

Forecasts suggest that capital expenditures in energy utilities will reach all-time highs between 2025 and 2027 to meet rising demand.

On January 2, Constellation announced it had secured over $1 billion in contracts from the U.S. General Services Administration, aimed at supplying power to more than 13 government agencies.

In a landmark announcement on Friday, Constellation detailed its plans for a $26.6 billion cash and stock acquisition of Calpine, merging two of America’s largest electricity providers.

Calpine is recognized as one of the foremost generators of electricity from natural gas and geothermal sources in the U.S., with a capacity to generate roughly 27,000 MW—enough to power around 27 million homes.

The role of natural gas will remain critical as the U.S. works to phase out coal and ensure reliable energy supply.

Calpine further extends CEG’s reach into energy-demanding states like Texas and California.

“Both companies are dedicated to leading the path to cleaner, safer, and more reliable energy. Our shared goals will guide future investments into emerging clean technologies to meet soaring demand,” stated Constellation CEO Joe Dominguez during the announcement.

Constellation’s…

“`

Constellation Energy Soars: Will CEG Stock Continue to Rise in 2025?

Constellation’s Impressive Stock Performance

In the last three years, Constellation Energy Corporation (CEG) stock has skyrocketed by 475%, surpassing the growth of notable companies like Nvidia (NVDA), which increased by 390%, Meta Platforms Inc. (META), at 85%, and Microsoft (MSFT), which experienced a 33% rise. This year alone, CEG gained 170%, with a notable 25% jump occurring on Friday.

Recent Stock Surges

Constellation Energy’s stock price has recently broken through its early October highs. This upward trend resembles the spike seen in September after their deal with Microsoft, which pushed the stock past its May levels. Such strong performances have led some investors to consider waiting for a potential pullback before purchasing CEG, as its recent surge may indicate an overheated market. However, CEG maintains a price-to-earnings-to-growth (PEG) ratio of 1.5, which is lower than both the S&P 500 at 1.8 and its industry average of 1.6, signaling potential undervaluation.

Image Source: Zacks Investment Research

A Promising Future for Constellation

CEG’s solid earnings growth has earned it a Zacks Rank #2 (Buy). The recent deal positions Constellation as a key player among the largest electricity suppliers, crucial for tech giants like Microsoft, Amazon, and Meta, who are racing to secure energy sources necessary to support their massive AI investments projected to cost trillions. This positions Constellation not only as a strong investment choice today but also as a significant contender in the future of energy and artificial intelligence.

Stock Recommendations for Immediate Attention

Experts have released a new list of seven stocks they believe represent the best investment opportunities over the next 30 days. These contenders are highlighted for their potential for early price gains and have historically outperformed the market, averaging +24.1% growth annually since 1988. Investing in these recommendations could be worthwhile.

Interested in the latest stock recommendations from Zacks Investment Research? You can download the report on the 7 Best Stocks for the Next 30 Days for free. Click to see the selections.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Constellation Energy Corporation (CEG): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.