CoreWeave Emerges as Major Player in AI Cloud Computing

Overview of CoreWeave’s Services

CoreWeave (CRWV), rated Zacks Rank #3 (Hold), is an AI cloud-computing firm that operates a vast computer rental platform. This platform offers extensive capabilities for artificial intelligence tasks, among other resource-demanding functions. The rapid growth of AI applications was underscored by the late 2022 launch of OpenAI’s ChatGPT, which became the fastest-growing consumer application in history. In response, major tech companies, part of the “Magnificent 7,” including Meta Platforms (META) and Alphabet (GOOGL), have invested significantly—hundreds of billions of dollars—into data centers and GPUs necessary for developing large language models (LLMs) such as ChatGPT and Google’s Gemini.

Founded in 2017, CoreWeave started by catering to Bitcoin miners. However, a downturn in cryptocurrency prices in 2018 prompted management to pivot toward AI. This strategic shift has paid off, resulting in significant growth for the company.

CoreWeave’s Historic IPO

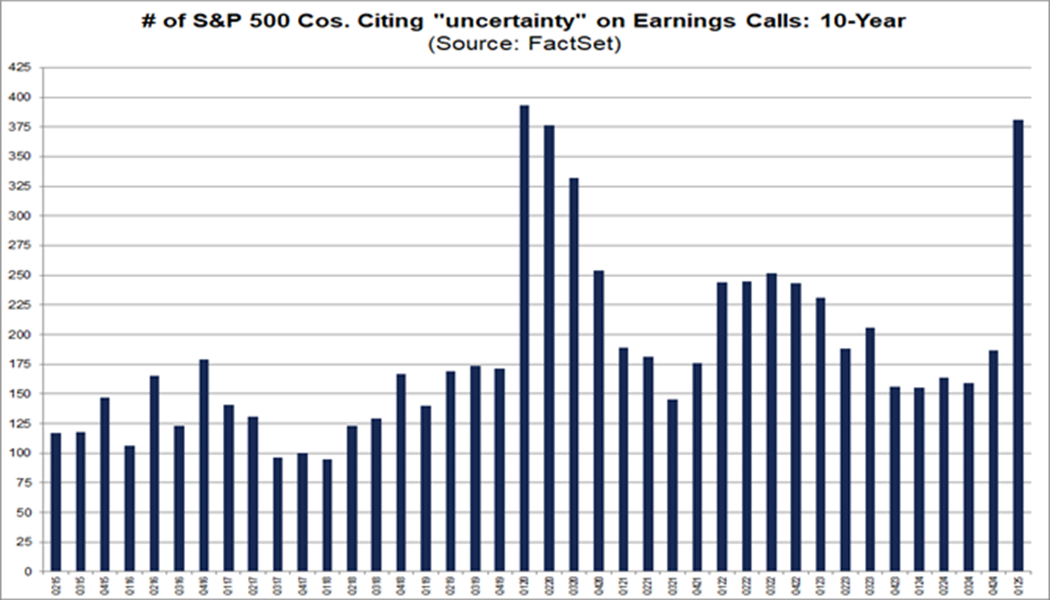

In March, CoreWeave launched its IPO, raising $1.5 billion. Although this amount fell short of expectations, it’s important to consider the context. At the time, global market conditions were challenging, with a trade war escalating between the U.S. and China. Typically, many tech companies would delay their IPOs under such circumstances. Compounding this, China had launched its DeepSeek large language model, claiming capabilities similar to ChatGPT but with significantly lower computational requirements.

Despite these hurdles, CEO Mike Intrator noted that demand had actually increased following the DeepSeek launch, and Wall Street analysts later disputed DeepSeek’s claims. CoreWeave proceeded with the IPO, making it the largest tech offering in years.

Historical Parallels: CoreWeave and Google

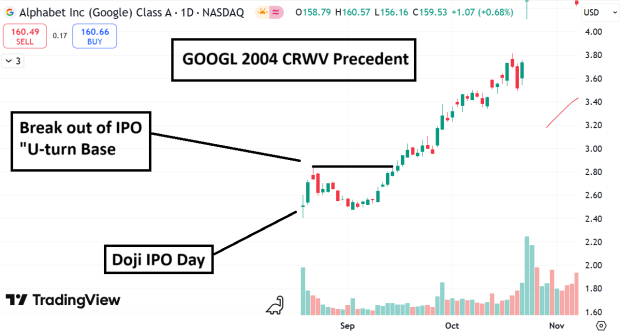

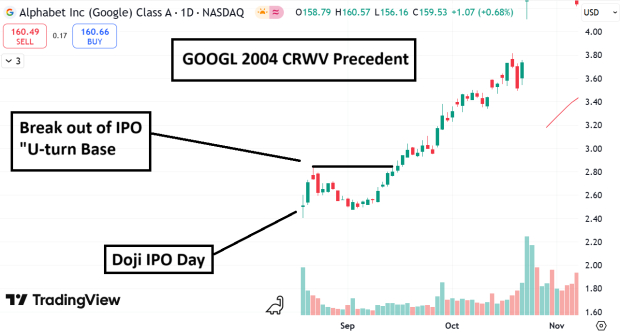

Investor Jesse Livermore famously stated that “there is nothing new on Wall Street.” Historically, patterns often repeat, and the 2004 IPO of Google (GOOGL) offers a relevant comparison. Following its IPO, Google shares tripled within a year and have since shown consistent growth. CoreWeave shares display similar traits, suggesting potential for similar success.

Key characteristics shared between CRWV and GOOGL include:

1. IPO U-turn Base:

After its initial surge, Google stock experienced a decline before establishing a rounded “U-turn” base. CRWV’s current pattern mirrors this IPO dynamic, making it a noteworthy benchmark for investors.

Image Source: TradingView

2. Explosive Revenue Growth:

In its pre-IPO year, Google saw revenue soar from $961.90 million to $2.7 billion. In the same timeframe, CoreWeave’s revenue surged by 725%, indicative of strong growth potential.

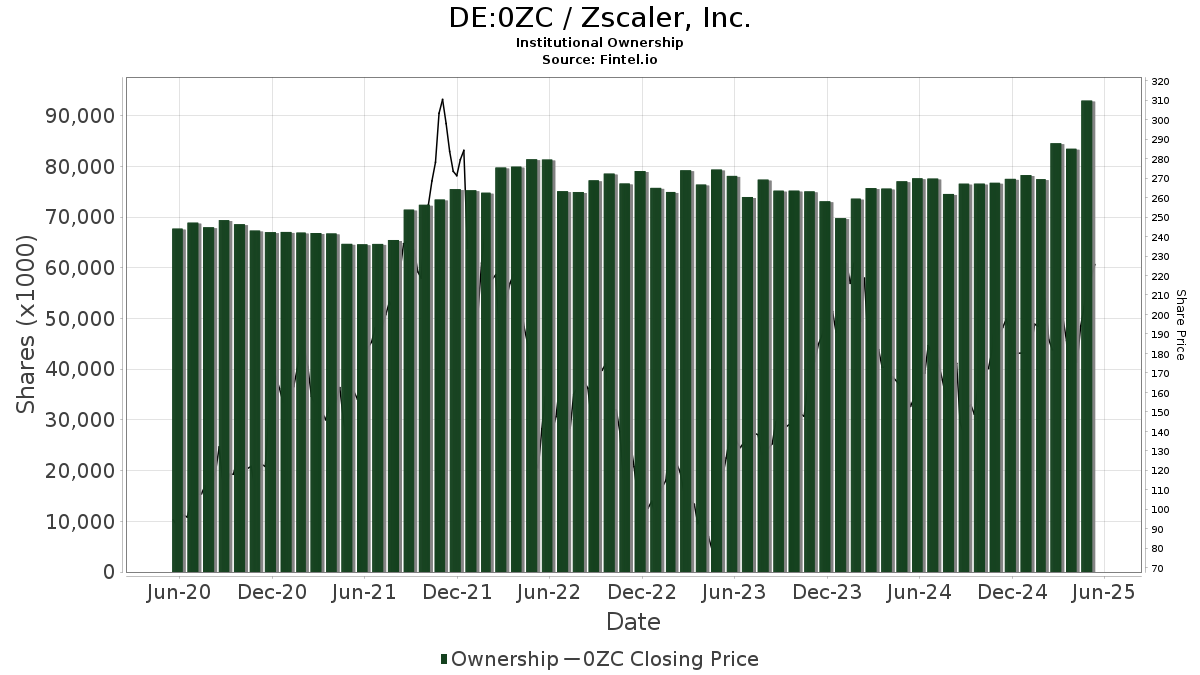

3. Institutional Sponsorship:

Institutional investors played a crucial role in Google’s rise, a trend mirrored by CoreWeave. Notably, Nvidia (NVDA), a leader in AI technology, holds a 6% stake in CRWV. Additionally, BlackRock (BLK) has acquired 250,000 shares, while Fidelity recently announced a 9% ownership interest.

4. Riding the New Technology Wave:

As Google capitalized on the internet boom, CRWV is positioned to benefit from the rapidly expanding field of artificial intelligence, which is poised for significant growth.

Upcoming Earnings Report

CoreWeave will report earnings after the market closes today, May 14th. A strong performance could result in much higher Fibonacci targets for the stock.

Image Source: TradingView

# CoreWeave Poised for Growth Amid Positive Market Sentiment

Bottom Line

As CoreWeave gets ready to release its earnings report, the optimistic landscape shaped by Google’s historic IPO and solid institutional support suggests a bright future for this AI cloud-computing pioneer.

Research Chief Highlights High-Growth Stock Opportunity

Recently, a team of experts identified five stocks that are likely to achieve a +100% increase in the upcoming months. Among these, Director of Research Sheraz Mian has singled out one Stock expected to lead the pack.

This leading choice is recognized for its innovation within the financial sector. With a rapidly expanding customer base of over 50 million and a wide array of advanced solutions, this Stock is well-positioned for significant growth. While not every stock listed will succeed, this particular pick shows strong potential, especially when compared to previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged +129.6% in just over nine months.

For details on this top pick and four other contenders, interested parties can see our analysis.

Market watchers can also look forward to the latest recommendations from Zacks Investment Research, including insights on the 7 Best Stocks for the Next 30 Days. Click here for more information.

Additional free stock analysis reports are available for:

- Microsoft Corporation (MSFT)

- BlackRock (BLK)

- NVIDIA Corporation (NVDA)

- Alphabet Inc. (GOOGL)

- Meta Platforms, Inc. (META)

- CoreWeave Inc. (CRWV)

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.