Costco’s Stock Surges Past $1,000: Key Factors Behind the Rise

Retail giant Costco Wholesale (NASDAQ: COST) continues to make headlines, having recently seen its stock cross the $1,000 mark for the first time. To put this achievement into perspective, 10 years ago, the stock was trading around $100 per share.

Costco’s stock performance largely reflects the company’s strong business fundamentals. In the fiscal first quarter of 2025, which ended on November 24, net sales rose 7.5% year over year. While this percentage may seem modest, it translates to a significant increase given Costco’s annual revenue of over $250 billion.

One appealing aspect of Costco stock is its long-term resilience, attributed to its unique membership-based business model. Customers pay an annual membership fee, which accounts for less than 2% of total revenue but is essential to maintaining low product prices. This structure fosters a sense of value among members, who tend to be quite loyal due to their investment in membership.

Interestingly, Costco has been attracting a younger demographic recently. During fiscal 2024, about half of its new members were under 40 years old, indicating a potential for sustained growth in the coming decades.

Additionally, investors should note Costco’s impressive e-commerce growth. In Q1, e-commerce sales climbed 13% year over year, a sign that the company is tapping into a vital revenue stream that could be crucial for future success.

The Importance of Costco’s E-commerce Growth

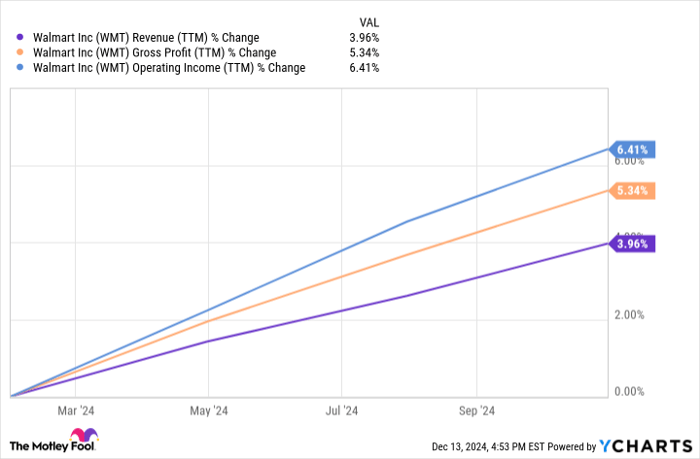

To contextualize this growth, we can look at recent developments at Walmart. Over the past year, Walmart has reported strong revenue increases, with gross profit rising even more significantly. For example, in its fiscal third quarter of 2025, which concluded in October, global advertising revenue surged 28% year over year.

WMT Revenue (TTM) data by YCharts

Walmart’s ability to enhance its profit margins has been largely fueled by its advertising initiatives. The company is developing a retail media platform that leverages shopping data to offer advertising opportunities, showcasing the connection between a strong e-commerce presence and higher-margin revenue streams.

Walmart’s robust e-commerce business, generating over $100 billion in annual sales, has been pivotal in this regard, allowing its profits to outpace revenue growth.

Turning back to Costco, CFO Gary Millerchip noted in the Q1 2025 earnings call that the company is still in the early stages of developing its own retail media opportunities. This suggests a potential for growth ahead.

Despite its significant size, Costco has relatively modest profits, with trailing-12-month operating profits of $9.3 billion. Consequently, even a small growth in e-commerce sales can make a substantial impact. The 13% growth in e-commerce is more than just a number; it represents an avenue to unlock further growth opportunities through retail media.

While substantial changes may take time, Costco’s story is not fully written, and investors should pay attention to the unfolding chapters.

Don’t Miss This New Opportunity

Have you ever felt like you missed out on investing in successful companies? If so, you’re not alone.

Our team of expert analysts sometimes identifies “Double Down” stock recommendations for companies poised to grow significantly. If you’ve been waiting for the right moment to invest, now could be the time before the opportunity passes. The numbers tell a compelling story:

- Nvidia: If you had invested $1,000 during our recommendation in 2009, your investment would be worth $348,112!*

- Apple: A $1,000 investment when we recommended it in 2008 would now be $46,992!*

- Netflix: Investing $1,000 in our 2004 recommendation would yield $495,539!*

Currently, we’re issuing “Double Down” alerts for three promising companies. This may be one of the last chances to seize such an opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.