Exploring the Unique Landscape of BigBear.ai

As investors tread the ever-evolving terrain of artificial intelligence (AI) stocks, the shadows of giants like Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI) loom large. Established players in the AI arena, these companies have long dominated the landscape, heralding the era of AI technology. Yet, amidst these titans stands a lesser-known contender – BigBear.ai (NYSE: BBAI).

Veteran investors appreciate the allure of emerging companies like BigBear.ai, recognizing the potential of “getting in on the ground floor.”

BigBear.ai: A Blend of Familiarity and Novelty

BigBear.ai shares the same AI-centric DNA as its larger competitors but distinguishes itself in key aspects. Despite mirroring the core mission of aiding organizations in harnessing data for actionable insights, BigBear.ai stands out due to its modest scale. With a revenue of $155 million in the previous year, it pales in comparison to Palantir’s $2.2 billion and C3.ai’s nearly $300 million over four quarters. Moreover, while market behemoths like Palantir boast market caps in the billions, BigBear.ai hovers around a humble $500 million.

However, being small confers distinct advantages. Agility and adaptability are hallmarks of leaner enterprises, enabling them to pivot swiftly and cater to niche market demands. For instance, BigBear.ai’s recent forays into enhancing AutoCAD through innovative technology signify its nimbleness in meeting evolving customer needs.

Although agility is a virtue, it carries inherent risks, notably in the realm of scale. BigBear.ai’s narrow focus on specific sectors like government/defense, manufacturing, and healthcare solutions may limit its appeal beyond these realms. The recent acquisition of Pangiam, a specialist in vision AI, highlights the company’s strategic shift to broaden its offerings. Yet, larger competitors may possess advantages in scalability and cost efficiency, potentially posing a challenge to BigBear.ai’s market penetration.

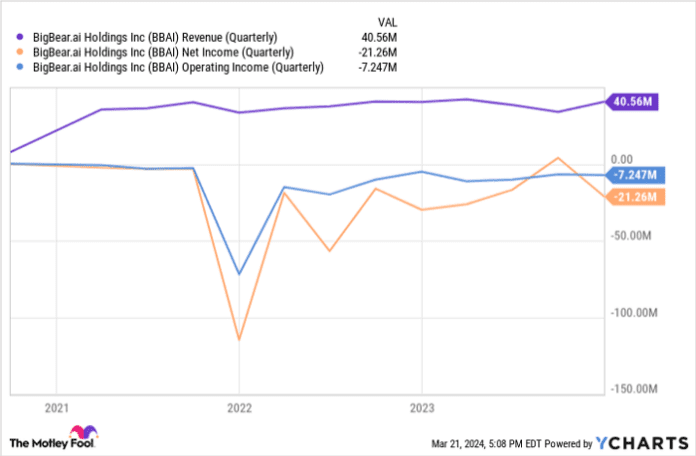

Moreover, the company’s inconsistent revenue growth presents a conundrum for investors, with projections indicating a slowdown in the coming year. This volatility could deter shareholders seeking stable returns, raising concerns about the company’s long-term trajectory.

Nonetheless, amid these challenges, prospects for BigBear.ai appear cautiously optimistic.

Assessing the Prospects: Balancing Risks and Rewards

The burgeoning landscape of AI harbors immense growth potential, with industry forecasts suggesting robust expansion in the coming decade. BigBear.ai, nestled within the software segment of the AI market, stands to capitalize on this upward trajectory. Should its specialized solutions resonate with clientele seeking tailored AI services, the company could carve a lucrative niche in the competitive landscape.

Yet, the notion of transforming a $20,000 investment in BigBear.ai into a million-dollar windfall remains a lofty ambition. Success stories of transformative investments, akin to Apple and Amazon, underscore the rarity of such astronomical returns in the AI domain. These tech juggernauts, operating in boundless markets, epitomize sustained growth trajectories that overshadow the more constrained AI industry.

In essence, while BigBear.ai presents an appealing opportunity for astute investors willing to navigate risks, prudence dictates a measured approach in light of the company’s competitive dynamics.

If you’re considering allocating funds to this budding player in the AI realm, exercising caution amidst optimism could pave the way for informed investment decisions.

*John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.*

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.