Exploring the Potential of Recursion Pharmaceuticals: A Biotech Investment Opportunity

Veteran investors know that trading biotech stocks can be challenging. The rewards can be significant, but the risks are equally high. Many biotech companies unfortunately fail. However, choosing the right one could lead to substantial financial gain. In this context, let’s examine Recursion Pharmaceuticals (NASDAQ: RXRX), a firm that presents both risks and the potential for high rewards.

Understanding Recursion Pharmaceuticals

Not familiar with Recursion Pharmaceuticals? You’re not alone. With a market cap of $2 billion, it doesn’t catch widespread attention. Consistent losses alongside minimal revenue don’t help much, either.

Despite this, biotech stocks are often valued based on their research and development (R&D) prospects. Recursion stands out in this area.

Leading its pipeline is REC-994, designed to treat cerebral cavernous malformation. This orphan drug has shown promise during late-phase 2 testing and gained confirmation of safety and tolerability in September. A meeting with the Food and Drug Administration (FDA) to discuss its next steps is forthcoming.

While REC-994 is ahead, Recursion is also developing four other drugs that are progressing swiftly. Two additional treatments are in the early stages of research. Nevertheless, the most compelling aspect of Recursion may not be the specific drugs but rather its innovative approach to drug development.

Recursion’s primary focus is its drug-development software platform, Recursion OS, which aims to streamline how drugs are developed—reducing reliance on costly clinical trials.

Why the Bullish Outlook for Recursion Pharmaceuticals?

The pharmaceutical industry has long sought ways to minimize early R&D efforts, ideally transferring these tasks to computers. Historically, that has been unfeasible until recently, with advancements in artificial intelligence (AI) and high-performance computing now making it a reality.

Recursion OS allows developers to digitally simulate drug creation and predict how effective these drugs may be for treating various conditions. The company claims to have identified nearly 4 trillion potential links between chemical and biological functions, accumulating over 50 petabytes of data valuable for new drug development.

The demand for such innovations is critical. According to the Congressional Budget Office, developing a new therapy can cost between $1 billion and $2 billion, with some exceeding $4 billion. Compounding this issue, 90% of drugs that enter clinical trials fail, often due to ineffectiveness or safety concerns, making the development process expensive and punishingly inefficient. Recursion’s AI-powered platform may help companies focus their resources on the most promising drug candidates.

This is not just a current trend; the AI-assisted drug development sector is projected to grow at an annual rate of 21.5% through 2033, as indicated by Precedence Research.

Balancing Risk and Reward in Recursion Pharmaceuticals

While there’s potential, risks remain significant, particularly uncertainty and skepticism toward new technology. Many pharmaceutical companies may be reluctant to abandon traditional methods for this novel approach, preferring their established practices.

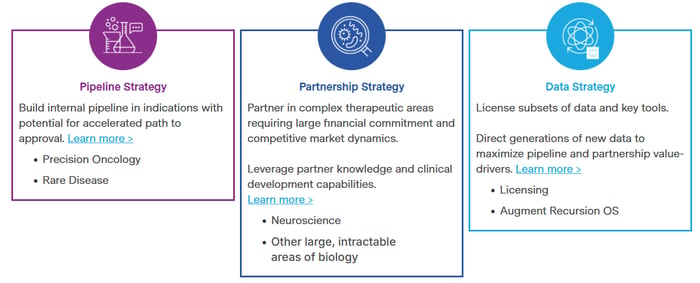

Recursion has a robust strategy, offering access to its software, selling data sets, and co-developing its therapies. This tripartite approach positions the company to capitalize on a variety of revenue streams.

Image source: Recursion Pharmaceuticals.

If everything aligns favorably, Recursion could potentially yield significant returns for investors. Analysts set a one-year price target of $10.14, representing over a 50% upside from its current price—a positive indicator for prospective shareholders.

However, it is vital to note that Recursion remains a high-risk biotech investment. While its narrative is compelling, it largely hinges on future results, which could still lead to substantial losses. Investors should consider their risk tolerance carefully before investing.

Seize the Opportunity: Invest in Potential

Worried that you may have missed previous investment opportunities? It’s not too late.

Our team has identified certain stocks they believe will see considerable growth. If you think you’ve already overlooked your chance to invest in high-performing companies, now might be the optimal moment.

- Amazon: If you had invested $1,000 when we suggested it in 2010, you’d now have $22,292!*

- Apple: A $1,000 investment following our 2008 recommendation would now be worth $42,169!*

- Netflix: If you invested $1,000 as we recommended in 2004, your investment would have soared to $407,758!*

We currently have “Double Down” alerts for three outstanding companies, and the window for this opportunity is narrowing.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.