Shopify’s Strong Earnings Signal a Potential Turnaround Amid Amazon’s Dominance

Shopify (NYSE: SHOP) might finally be on the path to recovery. Its solid third-quarter earnings report on Nov. 12 propelled the stock to its highest level since early 2022. Despite still being 38% below its 2021 peak, the 21% rally in trading following the announcement indicates a shift in investor sentiment.

Shopify is one of the most significant e-commerce stocks in North America, second only to Amazon (NASDAQ: AMZN). While Amazon holds a market cap exceeding $2.2 trillion, Shopify’s stands at about $140 billion. The vast difference in size highlights the competitive landscape.

Understanding the Competitive Landscape: Shopify vs. Amazon

It’s important to note that Shopify and Amazon primarily serve different roles in e-commerce. Shopify provides an e-commerce platform, enabling merchants to operate their online stores independently, while Amazon focuses on selling goods directly and managing an extensive logistics operation.

Shopify once considered entering the logistics sector but retreated after determining it was not a profitable venture, reaffirming its commitment to being a software provider.

Amazon’s third-party seller services parallel Shopify’s offerings, allowing vendors to sell on Amazon’s platform for a fee. However, the costs associated with selling on Amazon can push merchants toward independent platforms like Shopify.

Despite Shopify’s advantages, the larger scale of Amazon alters the competitive dynamics. Shopify reported $6.1 billion in revenue during the first nine months of 2024, marking a 23% increase from the previous year. Conversely, Amazon’s revenue totaled $371 billion over the same period, with only a 10% growth rate.

Furthermore, Shopify’s operating margin stands around 10%, while Amazon operates its two segments with margins below 5% due to its high fixed costs, suggesting a financial edge for Shopify.

Amazon’s Key Strengths in the Market

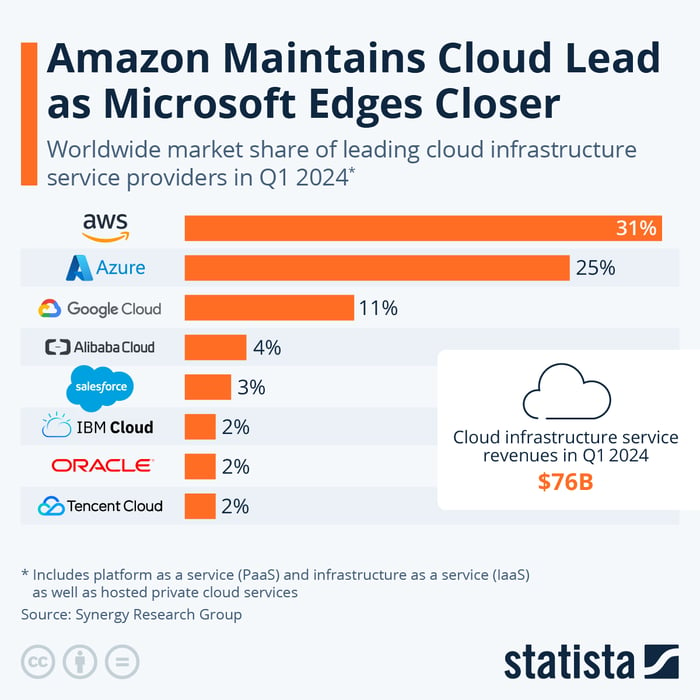

When comparing both companies, investors should not overlook Amazon’s AWS, its cloud computing division. AWS has been pivotal in transforming the tech landscape and continues to hold a significant market share despite emerging competition from firms like Microsoft and Alphabet.

Image source: Statista.

The rise of artificial intelligence (AI) further boosts AWS’s significance. Though Amazon invests heavily in AI, AWS runs AI-driven workloads, solidifying its status in an evolving sector. During the first nine months of 2024, AWS generated nearly $79 billion in revenue, with an impressive operating margin of 38%. This contributed significantly to Amazon’s overall operating income.

When factoring in operating margins, Amazon holds an 11% margin, slightly ahead of Shopify’s 10%, demonstrating that Amazon’s size does not inhibit its growth capabilities despite its need for larger operational output.

Shopify’s Long-Term Challenges in Surpassing Amazon

While Shopify’s growth is remarkable, it may not reach Amazon’s market cap by 2035. Smaller companies like Shopify usually grow faster, and it might outpace Amazon in terms of growth rate and stock price increases over the coming years.

However, given that Amazon is nearly 16 times larger than Shopify by market cap and has a robust AWS segment expanding rapidly, it’s unlikely Shopify will surpass Amazon anytime soon.

Stay Alert for Investment Opportunities

Do you worry about missing out on top-performing stocks? Here’s a chance to reassess your options.

Occasionally, our team identifies “Double Down” stocks believed to be on the verge of significant growth. If you think you’ve missed out, investing now might be wise. Recent examples include:

- Nvidia: Investing $1,000 in 2009 would yield $381,173!

- Apple: A $1,000 investment in 2008 would have grown to $43,232!

- Netflix: A $1,000 investment in 2004 would have turned into $469,895!

Currently, we are issuing “Double Down” alerts for three promising companies, and this opportunity might not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has positions in Shopify. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Shopify. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.