SoundHound AI (NASDAQ: SOUN) has garnered attention as an AI stock with immense potential.

- Trading at around $5, SoundHound is within reach for many investors.

- Nvidia (NASDAQ: NVDA) has shown interest by investing in the company.

- With a modest market capitalization of $1.6 billion, SoundHound has ample room to evolve into a larger entity.

Could SoundHound AI emulate Nvidia’s remarkable stock performance? While the comparison is based on financial success, it’s crucial to note the different products and services offered by the two entities.

So, is SoundHound poised for significant growth? Let’s delve into the details.

Revolutionizing Audio and AI Integration

SoundHound is at the forefront of merging audio technology with AI solutions. This integration presents innovative possibilities in areas like drive-thru and mobile ordering, enabling businesses to leverage AI for operational efficiency while enhancing customer satisfaction. Recent successes include enhancing Jersey Mike’s phone ordering system and streamlining White Castle’s drive-thru operations.

Moreover, SoundHound is making waves in the automotive sector by enhancing voice assistant capabilities in vehicles. Collaborating with Stellantis to integrate ChatGPT into its DS brand and partnering with Nvidia for software integration mark significant strides in offering seamless AI-driven experiences without the constraints of a stable internet connection.

The dawn of AI’s transformative impact on our lives is upon us, with companies like SoundHound trailblazing this evolution. The allure of such future prospects tantalizes investors, sparking optimism that SoundHound could replicate Nvidia’s success.

A Promising Future Awaits

Despite its modest revenue generation, SoundHound boasts rapid growth potential. In the last quarter, the company witnessed an 80% year-over-year revenue surge, reaching $17.1 million. While operational expenses stood at $29.5 million, the company’s relative size dictates such financial dynamics.

Of particular interest to investors is SoundHound’s substantial order backlog, indicative of future revenues from committed long-term agreements. The company’s backlog, standing at $661 million as of Q4, reflects a twofold increase from the previous quarter. This robust and burgeoning backlog serves as a compelling reason for investors to maintain faith in SoundHound amid market fluctuations.

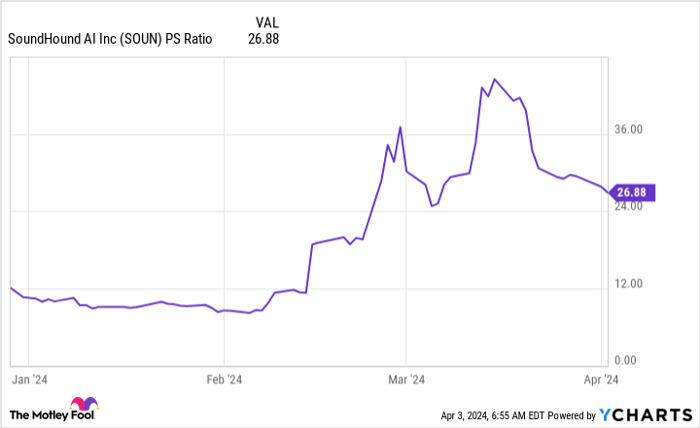

Although recent volatility followed Nvidia’s investment announcement in SoundHound, the stock currently trading at around 27 times sales may appear steep. However, realizing a sizable portion of the backlog into tangible revenues could justify this valuation.

SOUN PS Ratio data by YCharts.

SoundHound emerges as a compelling small-cap investment opportunity, offering the potential for substantial returns. Nevertheless, the inherent risks associated with product performance and competitive landscape underscore the need for prudent risk management through diversified portfolio allocation.

Optimal portfolio weighting, reflecting risk and growth prospects, positions SoundHound as a high-risk, high-reward asset earmarked for a nominal 1% portfolio allocation.

While the prospect of SoundHound becoming the next Nvidia looms large, the flip side of potential failure necessitates a balanced approach. Setting realistic expectations can uncover the promise hidden within SoundHound’s stock.

Considering an Investment in SoundHound AI

Before delving into SoundHound AI stock, a crucial contemplation looms:

The Motley Fool Stock Advisor analyst team recently highlighted what they perceive as the 10 top stocks poised for substantial returns, with SoundHound AI notably absent from the list. The selected stocks hold the promise of significant growth in the foreseeable future.

Stock Advisor offers a roadmap to investment success, furnishing insights on portfolio construction, analyst updates, and bimonthly stock recommendations. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500 index*.

Discover the 10 stocks

*Stock Advisor returns as of April 4, 2024

Keithen Drury holds no positions in the mentioned stocks. The Motley Fool has interests in and endorses Nvidia. The Motley Fool recommends Stellantis. The Motley Fool abides by a disclosure policy.

The opinions expressed herein represent the views of the author and may not align with those of Nasdaq, Inc.