Following a tumultuous period for initial public offerings (IPOs), a glimmer of hope shines on the horizon. The recent public debut of Reddit on March 21 serves as a litmus test to gauge market sentiment towards new issuers.

Klarna, the European buy now, pay later fintech behemoth, has its sights set on a 2024 IPO, with ambitions of becoming the “artificial intelligence (AI) bank” and targeting a hefty $20 billion valuation upon going public. Here are the key aspects investors should be aware of regarding Klarna.

Image source: Getty Images.

Klarna’s Expansion in the U.S.

Established in 2005, Klarna, a Swedish financial institution, has skyrocketed in popularity by offering flexible payment solutions under the buy now, pay later (BNPL) model. With a massive user base of 150 million customers globally, Klarna processes a staggering 2.5 million transactions daily.

While partnering with 250,000 merchants across 25 countries, Klarna’s overarching objective transcends merely being a checkout alternative on e-commerce platforms. Instead, the company aspires to become a pivotal player in the realms of payments, retail, and banking.

In a strategic move, Klarna has intensified its focus on the U.S. market, emerging as its primary revenue generator since penetrating the market in 2015. Notably, the fintech powerhouse achieved its first-ever gross profit in the U.S. last year, showcasing remarkable operational streamlining despite the challenges faced in recent times.

Revolutionizing Costs Through AI

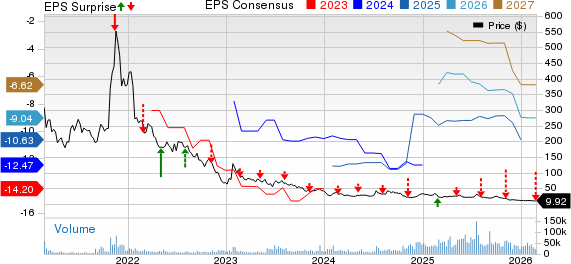

The BNPL sector faced formidable economic headwinds over the past years, with surging inflation and escalating interest rates exerting immense pressure on emerging companies. As interest rates began climbing in 2022, Klarna witnessed a spike in borrowing costs to unprecedented levels.

Not only did borrowing expenses soar, but BNPL enterprises experienced staggering valuation markdowns. Amidst the turmoil of 2023, Klarna witnessed a sharp decline in its estimated valuation, plummeting from $45.6 billion to a mere $6.7 billion, as economic uncertainties and rising costs cast a shadow on firms of all sizes.

One of the key challenges faced by Klarna pertained to escalating costs. In response, the fintech stalwart embarked on a quest to enhance operational efficiency and credit standards. Leveraging cutting-edge AI technology, Klarna swiftly integrated AI tools, such as ChatGPT, to automate repetitive tasks and boost employee productivity.

Image source: Getty Images.

In a noteworthy revelation, Klarna hailed its digital assistant’s remarkable prowess, attributing it to the workload equivalent of 700 full-time customer service agents. Furthermore, the digital assistant yielded a 25% decline in recurring inquiries, significantly slashed response times, and obviated the necessity for excessive manpower recruitment. Such AI integration stands as a stellar illustration of how burgeoning enterprises leverage technology to scale operations without incurring exorbitant expenses concurrently.

The adoption of AI heralded notable outcomes for Klarna. Despite processing a monumental 981 billion Swedish kronor ($93 billion) in gross merchandise volume last year, representing a 17% surge from the previous year, the company managed to curtail operating expenditures by 16%. Notably, substantial reductions in sales, marketing, and customer service overheads led to a colossal improvement in the operating loss, plummeting from 10.5 billion kronor in the prior year to a mere 3.2 billion kronor.

Future IPO Prospects

According to data from Caplight, Klarna’s recent fundraising endeavors hinted at a valuation nearing $9.5 billion. As the company shores up its financials, the IPO landscape appears more amiable towards prospective offerings.

Bolstered by positive market sentiments, Klarna has engaged in discussions with investment banks regarding its impending public debut, slated tentatively for the third quarter. Reports from Bloomberg suggest that Klarna eyes a lofty $20 billion valuation, with the current surge in BNPL adoption and favorable market conditions accentuating the allure of Klarna’s IPO for discerning investors.

Where to invest $1,000 right now

When our analyst team has a stock tip, heeding their advice can prove lucrative. Indeed, the acclaimed newsletter Motley Fool Stock Advisor has consistently outperformed the market over the past decade.* They’ve recently highlighted what they deem the 10 best stocks for investors to consider right now…

See the 10 stocks

*Stock Advisor returns as of March 21, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.