CPS Technologies Corporation (CPSH) encountered challenges in the third quarter of 2024, marked by contract completions and increased operational costs. As customer demands shifted and strategic adjustments were made, both revenues and profits were negatively impacted. Despite these hurdles, CPS Technologies has fully activated its third production shift and secured new contracts in key sectors, setting the stage for a potential recovery. Management remains optimistic, aiming to capitalize on developments in government contracts and the semiconductor industry to foster growth.

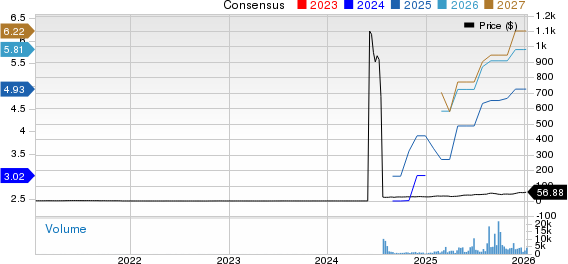

CPS Technologies Corp. Performance Overview

CPS Technologies Corp. performance chart | CPS Technologies Corp. Quote

Third Quarter Results

In Q3 2024, CPS Technologies reported a loss of 7 cents per diluted share, a steep decline of 800% compared to earnings of 1 cent per diluted share from the same period last year.

Quarterly revenues totaled $4.2 million, a significant drop of 33.3% from last year’s $6.3 million. This revenue decline primarily stemmed from the conclusion of the HybridTech Armor contract with Kinetic Protection for the U.S. Navy and reduced orders from another major customer due to inventory surplus.

Profitability Insights

CPS Technologies’ gross margin turned negative, presenting a gross loss of $0.5 million, compared to a gross profit of $1.2 million in Q3 2023. This margin decline arose from lower manufacturing efficiency and expenses related to staffing and training for the new third production shift. This shift, which began operations in late August, increased the cost of goods sold without generating corresponding revenues during the quarter.

The company faced an operating loss of $1.5 million in Q3 2024, starkly contrasting with an operating profit of $0.1 million reported in the previous year. This decrease in operating income reflects the cumulative effects of lower revenue and escalating production costs.

CPS Technologies reported a net loss of $1 million, compared to a net income of $0.2 million for the same quarter in 2023. This loss reflects challenges tied to contract completions and higher labor costs incurred during the quarter.

Cost Challenges

In Q3 2024, CPS Technologies experienced heightened costs, primarily due to staffing and training for the newly launched third production shift. These costs were incurred without corresponding revenue increases, causing a decline in the gross margin. Additionally, manufacturing inefficiencies intensified the company’s cost pressures.

Management Outlook

Looking forward, CPS Technologies remains hopeful about recovery in Q4 and the following quarters, as the third shift becomes fully operational. Management expects that higher deliveries in upcoming periods will positively impact revenues. The company reports a favorable book-to-bill ratio of 1.22, suggesting an increase in demand for its offerings.

Recent Developments

During the quarter, CPSH announced several significant contracts. They secured a $1.1-million contract from the U.S. Department of Energy for “Modular Radiation Shielding for Transportation and Use of Microreactors.” Additionally, a $200,000 contract from the U.S. Naval Air Systems Command was awarded to develop metal matrix composite solutions for specialized applications. Notably, CPS Technologies also received approximately $12 million from a long-term global semiconductor client to provide power module components and related solutions.

Summary

CPS Technologies faced considerable revenue declines and operational challenges in Q3 2024, primarily due to the end of a key contract and rising labor costs. Nevertheless, the company’s new contract wins indicate strong growth potential, particularly in government contracting and the semiconductor market.

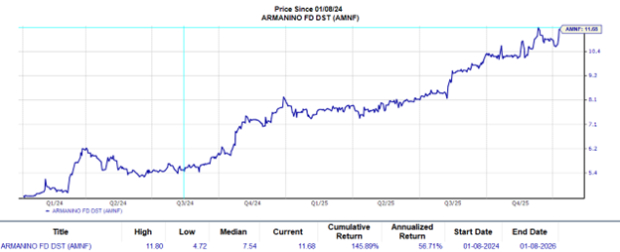

Research Chief Names “Single Best Pick to Double”

Out of thousands of stocks, five Zacks experts have each chosen a favorite poised to skyrocket +100% or more in the upcoming months. From this group, Director of Research Sheraz Mian has identified one stock as having the greatest potential upside.

This company targets millennial and Gen Z consumers, achieving nearly $1 billion in revenue last quarter alone. A recent pullback presents an ideal entry point. While not all of our elite picks have been winners, this one has the chance to significantly outperform earlier Zacks picks like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.