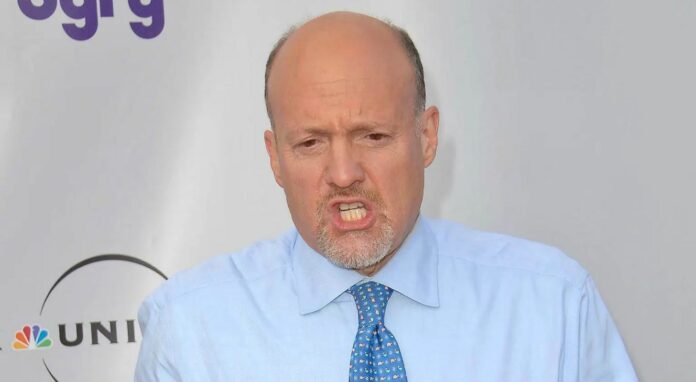

If there’s one colossus on Wall Street whose opinions are wrapped in a tempest, it must be Jim Cramer. On a recent episode of “Mad Money Lightning Round” on CNBC, the financial pundit spared no praise for Woodward, Inc. WWD.

Woodward recently trumpeted its first-quarter financial results, and they are nothing if not impressive. Boasting adjusted earnings of $1.45 per share, the company surged past the market estimate of $1.10 per share. Meanwhile, quarterly sales rang in at $787.00 million, comfortably eclipsing forecasts pegged at $748.29 million, as reported by Benzinga Pro.

Starwood Property Trust, Inc. STWD, on the other hand, has been at the center of a storm brewing on the real estate front. Cramer, however, vehemently opposed the ‘dire’ outlook put forth by none other than the billionaire CEO Barry Sternlicht.

Sternlicht’s recent prophecy prognosticating $1 trillion in office real estate losses appears to have ruffled the feathers of the Mad Money host, as Starwood Property Trust gears up to unveil its fourth-quarter and full-year 2023 financial results come February 22, 2024.

Cramer, the oracle of Wall Street, then turned his attention to the tried-and-true Simpson Manufacturing Co., Inc. SSD, dubbing it a “good, classic stock to own.” The company eagerly awaits its fourth-quarter financial results on Feb. 5, 2024.

Meanwhile, the enigma that is Super Group (SGHC) Limited SGHC has left Cramer befuddled. However, he didn’t hold back on his endorsement of DraftKings Inc. DKNG, exuding confidence in the company. Super Group, which saw its third-quarter revenue soar 16% to €356.9 million in November, seems to be a conundrum for Cramer.

Devon Energy Corporation DVN also caught his eye. With a resolute tone, he declared, “It’s too low,” tacitly advising investors to “buy Devon.” Recent commentaries from Raymond James and Piper Sandler also cast a ray of positivity on Devon Energy, despite the stock slipping to close at $42.02 on Wednesday.

Price Action:

- Devon Energy witnessed a 3% dip, closing at $42.02 on Wednesday.

- Super Group shares took a hit, sliding down 2.5% to $3.13 on Wednesday.

- Simpson Manufacturing saw its shares plummet by 3.9%, settling at $180.99 during Wednesday’s session.

- Starwood Property Trust wasn’t spared either, with its shares falling 3.2% to close at $20.33 on Wednesday.

- Woodward shares felt the tremors, dipping 2.6% to settle at $137.77.

Image: Shutterstock

Now Read This: Top 5 Energy Stocks That May Crash This Quarter