Dividend Declaration and Historical Context

Cross Timbers Royalty Trust announced on February 16, 2024, that its board of directors authorized a routine monthly dividend of $0.11 per share ($1.37 annually), a slight dip from the prior $0.12 per share payout. At the current share price of $17.52, the stock’s dividend yield stands at an enticing 7.82%.

Comparative Dividend Performance

Reflecting on the past five years, with a diligent eye tracking weekly dividends, the average yield hovers at an impressive 10.54%, encapsulating the trust’s consistent profitability. The lowest recorded yield was a respectable 6.23%, whereas the peak soared to a remarkable 22.92%. Statistical mavens would note that the standard deviation of yields clocks in at 2.71 (n=196), with the current yield modestly positioned at 1.00 standard deviations below the esteemed historical mean.

Financial Health and Strategic Vision

An essential metric, the company’s dividend payout ratio surfaces at a sturdy 0.87, indicating a responsible disbursement of earnings towards shareholders. Ideally situated below one, this ratio signifies a prudent balance between rewarding investors and retaining capital for growth initiatives, a hallmark of a stable and forward-thinking enterprise. Moreover, the trust’s 3-Year dividend growth rate of 1.45% underscores its commitment to enhancing shareholder value over time.

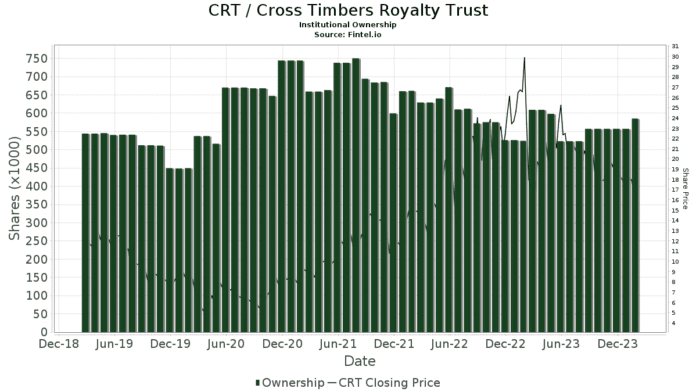

Ownership Insight and Investor Sentiment

The winds of change in investment sentiment are discernible as 28 funds or institutions are now vested in Cross Timbers Royalty Trust, marking a notable 12.00% growth in ownership during the preceding quarter. On a broader scale, the yardstick of average portfolio weight, intently watched, demonstrates an upward swing, catapulting by a staggering 92.03%. Institutions, in a vote of confidence, have seen their collective shares rise by an impressive 4.98% to a total of 585K shares.

Captrust Financial Advisors maintains a robust position, holding 266K shares, translating to 4.43% ownership, steadfast in their commitment. Meanwhile, Beacon Pointe Advisors and Mraz, Amerine & Associates exhibit unwavering support, each owning 71K (1.19%) and 58K (0.97%) shares, respectively. Notably, Mraz, Amerine & Associates displayed a modest retreat, reducing its ownership by 49.27% in the latest filing, but their loyalty to the trust remains evident.

GWM Advisors and Significant Wealth Partners, despite minor adjustments, continue to show a stalwart stance, holding 24K (0.40%) and 49K (0.82%) shares, respectively, portraying an enduring faith in the trust’s strategic direction and financial stewardship.

Understanding the Trust’s Foundations

Cross Timbers Royalty Trust operates with a clear mandate, overseeing oil and natural gas properties across Texas, Oklahoma, and New Mexico. Encapsulating the essence of its existence, the trust was founded to garner and distribute monthly net income to its valued unitholders, a testament to its enduring commitment to shareholder prosperity and sustainable growth.

For further insights and enriched perspectives, the curious minds can delve deeper into this financial realm with Fintel, a beacon of light in the sphere of investing research, empowering individual investors, financial advisors, and entities to uncover a trove of data, enabling informed decisions and propelling financial futures towards success.

Embark on this enlightening journey and unearth the myriad possibilities awaiting. The chapter on Cross Timbers Royalty Trust is merely a prelude to a vast landscape of opportunity and innovation.

Embrace the narrative, for within lies the tapestry of financial wisdom and prosperity.